Market Risk Appetite Kept Dollar Pressured

Dollar index ended last week lower back towards its 96 levels, erasing most of its gains from earlier this month. The global market is expected to experience thin trading this week heading into the new year, with most countries still celebrating Christmas and Boxing day.

The latest pressure on the dollar came despite encouraging inflation figures, where the Fed’s favored inflation tracking tool, Core PCE Price index rose to 0.5% in November, beating economists’ expectations of 0.4%. The upbeat inflation data was mostly offset by a weaker spending activity, after the US personal spending fell from 1.4% in October to 0.6% in November.

On a side note, optimism surrounding the possibility of an earlier rate hike by the Fed has also been fully digested by the market. The dollar’s rally fueled by the optimism was extended to its July 2021 highs; however, with the Fed falling behind the Reserve Bank of New Zealand (RBNZ) and the Bank of England (BOE) in terms of rate hike, preference towards the US dollar also fell.

Furthermore, recent evidence suggested that the Omicron variant carries a lower risk that leads to serious illness, calming market fears of further global economic slowdown ahead while boosting investors’ risk appetite. Commodity-backed currencies such as the Loonie (CAD) and Aussie (AUD) was supported higher against the dollar.

——————————————————————————————————————

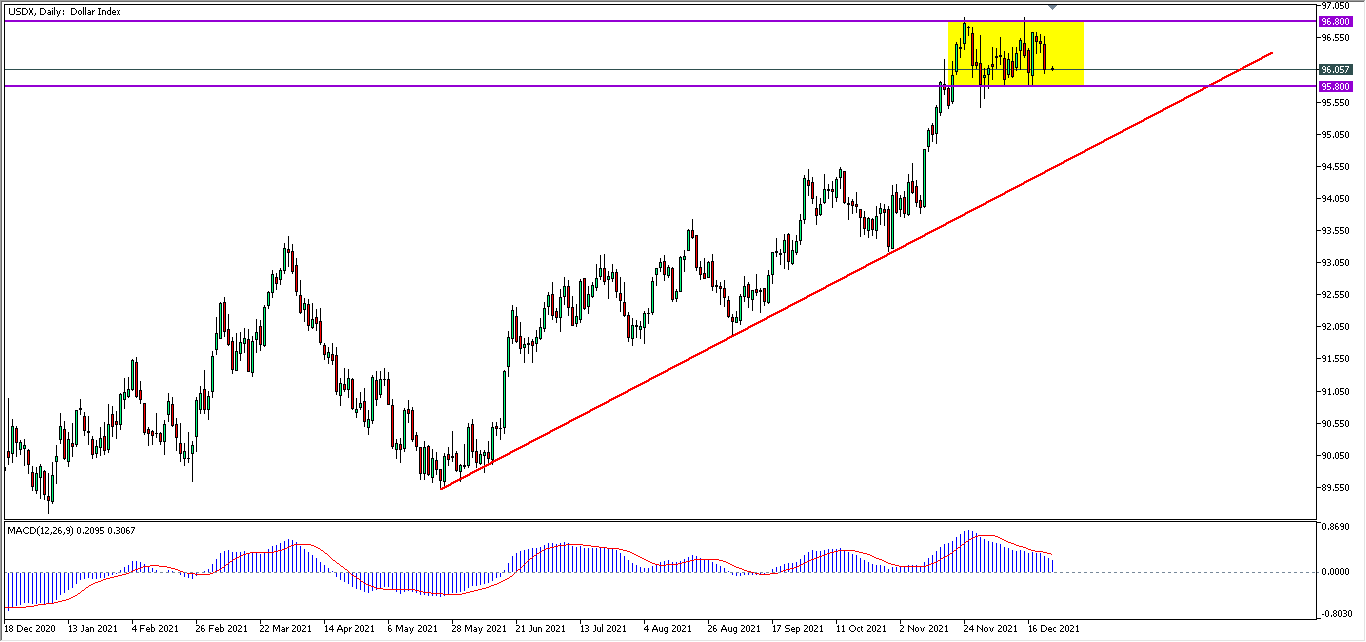

From the technical front, the dollar index in its D1 timeframe continues to be traded within a side-way channel between the 96.80 resistance and 95.80 support levels. MACD is currently showing a diminishing bullish momentum associated with a death cross formation, suggesting the dollar to extend lower back towards its upward trendline, after successfully breaking below its side-way channel.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022