Oil Limit Losses On Tighter Supply; Optimism Remains

Oil price recorded a second consecutive daily losses on Monday, with the West Texas Intermediate (WTI) sliding 0.55% lower to $78.07 per barrel, while the London-traded Brent fell nearly 1% to $80.54 per barrel.

Recent pressure in the oil market came after the world’s largest oil importer, China, tightens control over travel in one of its city across north, Tianjin after the region reported two cases of the Omicron, Covid-19 variant. Despite studies proving a lower Omicron severity compared to the Delta variant, and lax restriction across Europe and the US, China is still committed to pursue its zero-covid policy.

The swift move from China in fending against the Covid-19 virus could potentially threaten global demand, causing cautious investors to take-profit after a three-week rally in the oil price.

However, support in the oil market remains after OPEC and its allies (OPEC+) agreed to continue with its plan to add production by 400K b.p.d (barrels per day) in February, signaling strong demand optimism. Furthermore, members within the cartel was reported to have failed in meeting their production quota due to disruptions and lack of investment, limited the global supply overall.

As the crude oil continues to consolidate below its $80 levels, investors will focus on today’s Fed testimony that could bring significant impact onto the dollar, which in turn affecting the dollar-denominated commodity. Investors will also look into this week’s US crude inventories from the American Petroleum Institute (API) and Energy Information Administration (EIA) reports on Wednesday to gauge the overall market conditions.

——————————————————————————————————————-

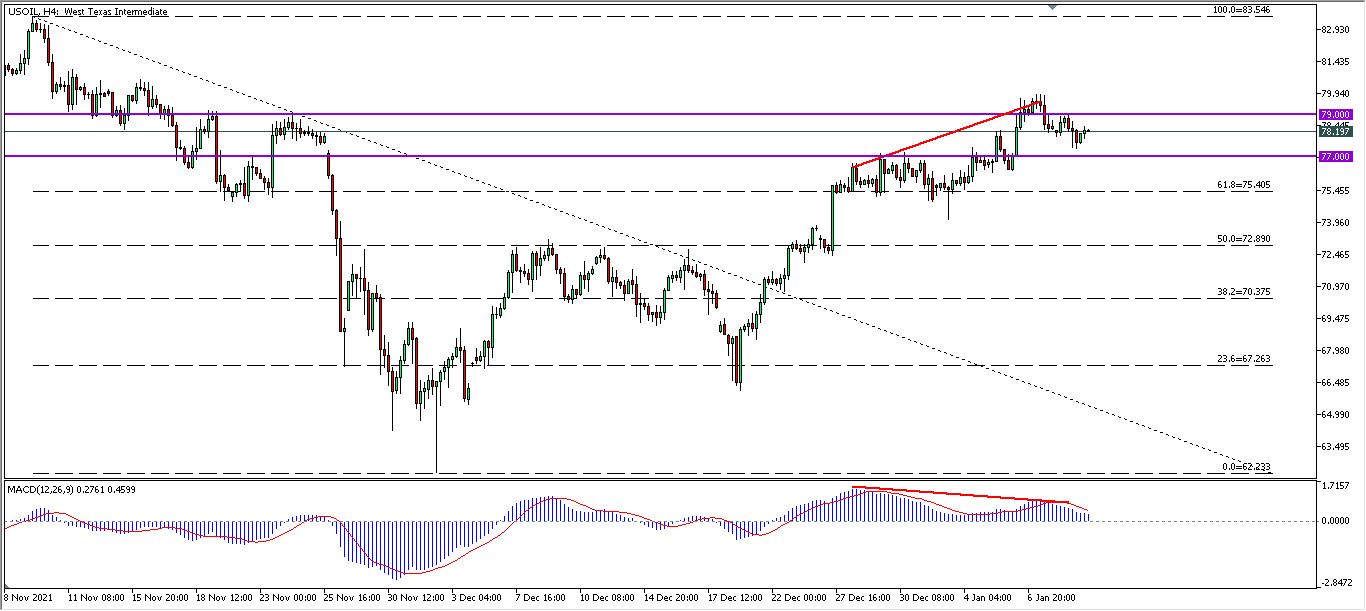

From the technical front, crude oil in its H4 timeframe remain pressured below its 79.00 psychological resistance. MACD, showing a negative divergence signal, suggests further potential pullback towards the 77.00 psychological support. Should prices break below its support level, further sell-off pressure can be expected towards the 61.8 Fibonacci support neat 75.40. Investors are advised to consider long positions after a technical correction lower, or after a breakout above the 79.00 resistance level.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022