Crude Oil Posted Largest Weekly Gains Since December

Crude oil extended its gains for a fourth consecutive week back above $83 per barrel, surging 7.03% while posting its largest weekly gains since December 6. The London-traded Brent (UKOIL) was up by 5.51% to $86.46, its highest level last seen since November 2014.

Crude oil continues to be supported by demand optimism, as the global economic recovery ramp up demand for the world’s widely used commodity. Despite rising new Covid-19 infections, major economies such as the US and Europe are not considering to reinforce lockdown measures, keeping economic activities and demand for the oil high.

Also supporting oil prices were supply constraints from the world’s largest oil producing group – OPEC and its allies (OPEC+). The cartel followed through with their production plan to boost output by 400K b.p.d in February, however, recent reports showed that some members failed to meet their production quota amid concerns over the pandemic and investment constrains.

Additionally, recent geopolitical tensions arising between Russia and Ukraine sparked concerns over potential supply disruptions. According to reports, Russia had massed 100K troops on Ukraine’s border, while signaling they’re readiness to attack should diplomacy in Ukraine fails.

Stronger demand, associated with tightening supplies had kept the crude oil market sentiment supported. Confidence were also reinforced after the release of US crude oil inventories report last week, where inventories fell by 4.6M barrels. Investors will continue to monitor upcoming inventories report to gauge oil price’s movement further.

———————————————————————————————————————

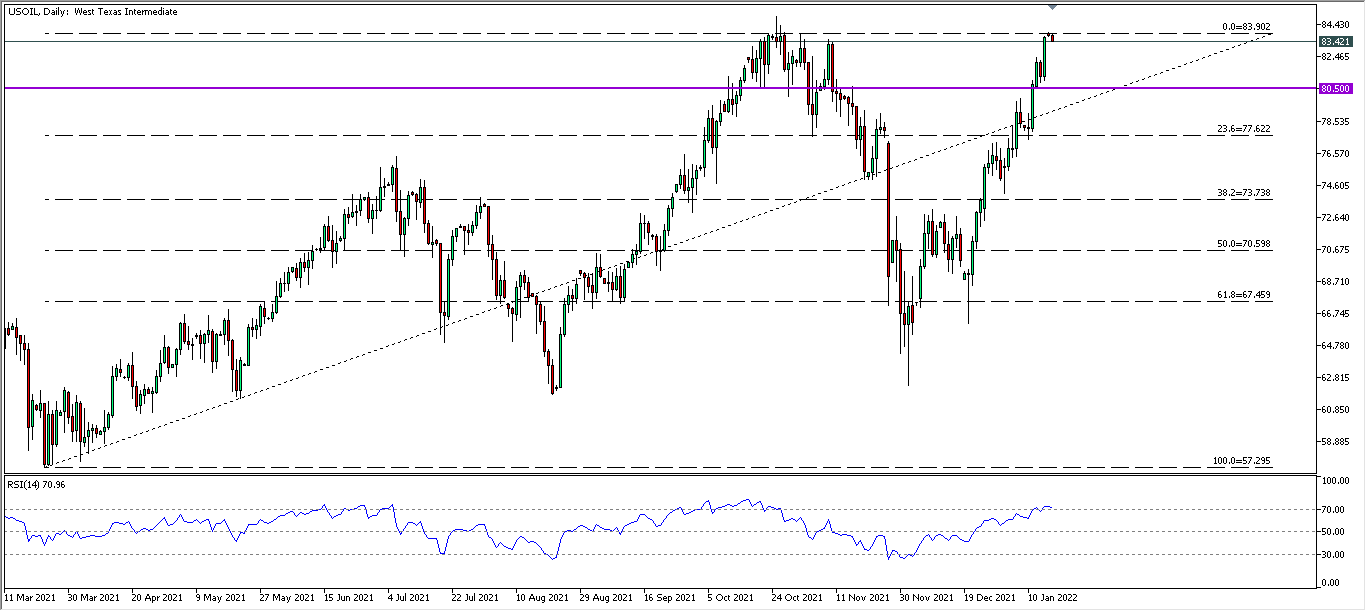

From the technical front, crude oil (USOIL) in its D1 timeframe extended gains back to its previous high near 83.90. Overall trend for oil remains bullish biased; however, RSI, signaling an overbought market conditions, suggests oil to experience a technical correction lower. The lower bound support is targeted at 80.50 and the 23.6 Fibonacci level at 77.60. Investors can consider long positions after a technical correction lower, or after a breakout above the previous high near 83.90.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022