Upbeat US Inflation Data Failed To Sustain Dollar’s Rally

The dollar index extended its losses on Wednesday, closing the market 0.64% lower to 94.93. The sell-off came despite a better than expected inflation data.

The US Core Consumer Price Index (CPI) and CPI data grew by 0.6% and 0.5% in December, beating economists expectations of 0.5% and 0.4%. The year-on-year inflation grew 0.7%, its largest jump in three decades. However, the data alone failed to boost investors optimism for an earlier Fed rate hike.

The dollar’s rally had been previously supported by ongoing talks on a rate hike as early as March, after the Fed fully scale back on its bond buying program. However, as the latest Fed’s testimony failed to provide further signals and confirmation on March’s rate hike, confidence towards the dollar shrank.

According to Fed Chairman Jerome Powell, the current pace of policy tightening is sufficient to contain rising inflationary pressures, while yesterday’s CPI reading wasn’t convincing enough to cause a change in the Fed’s policy plan.

As talks on a sooner than expected Fed’s rate hike dies down, investors had since withdrew from their net long positions on the dollar, while entering into riskier assets such as the pound and crude oil. The Bank of England on the other hand had raise its rates in December, while talks on another rate hike is underway, giving the GBP a boost to more than a two-months high against the dollar.

In other news, the precious gold climbed higher against a weaker dollar, gaining 0.25% to $1825.32 a troy ounce. The inflation-hedging metal was previously traded off against a stronger dollar and rising US Treasury yields, despite inflationary levels building up.

However, as market preference shifts, demand for gold was restored. Until further policy tightening action takes place, rising inflation levels will continue to provide support for the safe-haven metal.

———————————————————————————————————————

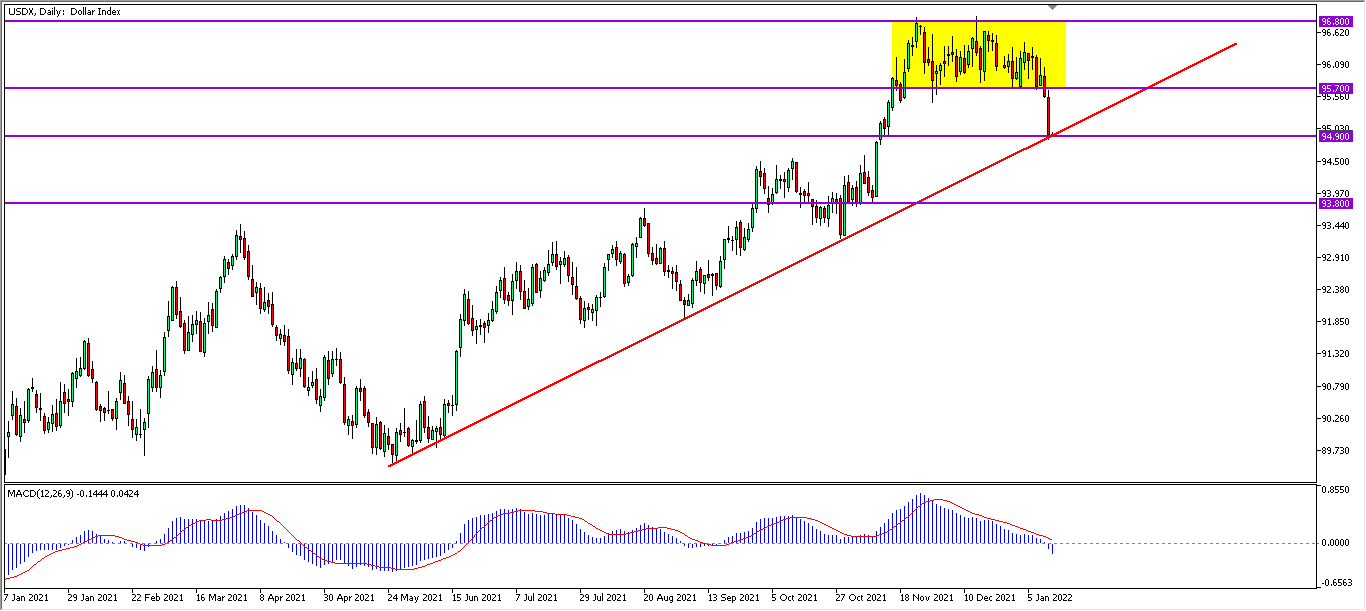

From the technical front, dollar index in its D1 timeframe exteded lower towards the 94.90 support level and its medium-term upward trendline. MACD, showing bearish momentum and the formation of a death cross, suggests the dollar to extend lower after successfully breaking its support level and trendline. A breakout further below would suggests a bearish reversal for the dollar, where the first target support would be near the 93.80 levels.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022