Dollar Weakness Boosted Safe-havens Demand; Gold Awaiting Breakout

The dollar index recorded a third consecutive daily losses on Thursday, falling 0.13% to 94.81 as rate hike optimism continued to be priced in by the market, dragging the dollar’s preference lower.

Yesterday’s Producer Price Index (PPI) data showed producers’ goods price increasing by only 0.2% in December, missing economists forecast of 0.4% while portraying cooling market conditions. The softer figures had prompted demand for safe-haven assets, with the Yen (JPY) gaining 0.4% against the dollar to a three-week high.

On the other hand, precious gold managed to claw back on its losses from last week, retesting a crucial resistance zone near $1,830 a troy ounce. Demand on the metal continues to be supported higher by rising global inflationary pressures, where investors typically retain their investment portfolios value through the latter.

Gold was previously ignored by investors despite surging goods prices, as the US dollar stole the safe-haven spotlight amid rising US Treasury yields. However, as talks on an earlier Fed rate hike eases, dollar fell alongside US yields while pushing gold prices higher.

Recent resurgence in global Covid-19 infections amid the Omicron variant also kept investors’ skepticism in place, as uncertainties surrounding the pandemic offset optimism for a robust global economic recovery. Demand for gold is expected to remain intact until the world is clear from the pandemic’s impact, with international borders fully reopened.

However, as gold garners its support from rising inflation levels, policy tightening actions from major central banks to control inflation might jeopardize the safe-haven demand.

——————————————————————————————————————-

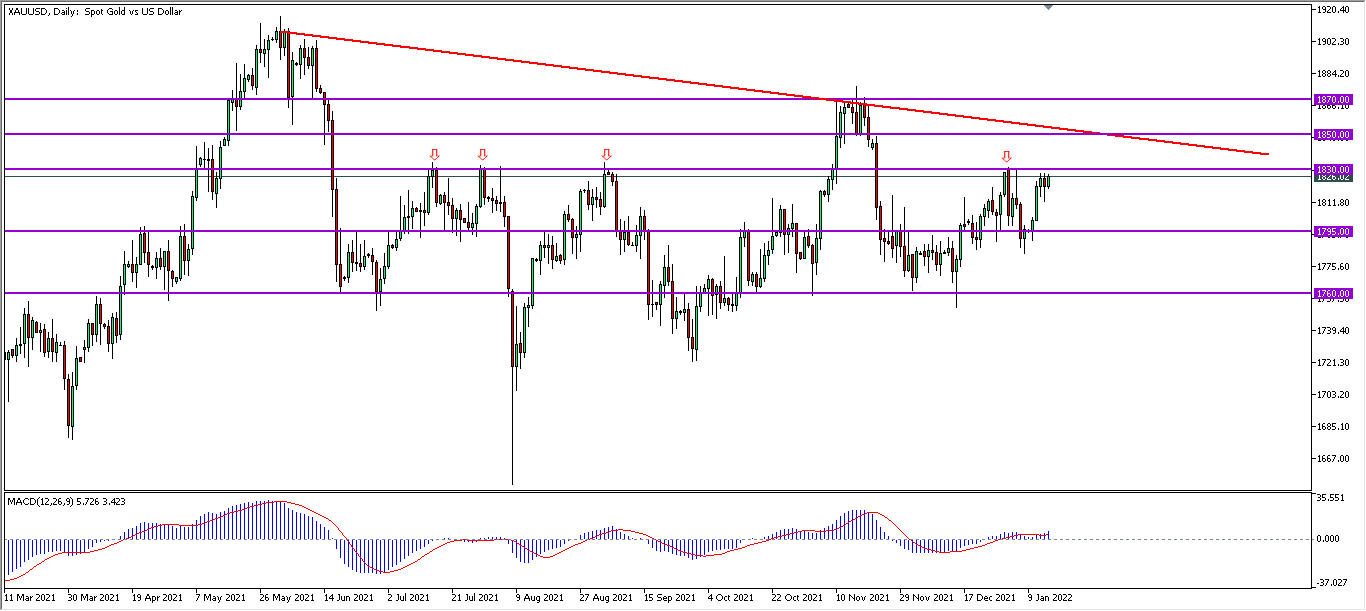

From the technical front, gold (XAUUSD) in its D1 timeframe rebounded from its 1,795 support zone to retest its crucial resistance zone at 1,830. MACD, showing a bullish momentum, suggests the gold to extend higher towards its downward trendline near 1,850 after a successful breakout above the 1,830 levels. However, another rejection from the major resistance zone suggests gold to continue its trading within a downtrend, where the lower bound support placed at 1,795 and 1,760.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022