Oil Pared Losses To 3-Weeks High; Loonie Supported Higher

West Texas Intermediate (WTI), the benchmark for US crude oil rose 2.44% back to $73 per barrel, recouping gains back to more than a three-week high. UK Brent oil was also up by 2.08% to $75 per barrel.

Crude oil’s rally was supported by another week of upbeat inventories report, where the Energy Information Administration reported a drawdown of 4.7M barrels throughout last week, exceeding expectations of only 2.4M drawdown.

Despite the large draw, distillates, which are refined into diesel and jet fuel, and gasoline inventories rose much higher than expected. The argument behind the buildup in petroleum inventories was due to new travel and movement restrictions to curb the spread of the Omicron variant.

The overall demand for crude oil continues to inch higher amid continuous manufacturing activity following the global economic recovery, keeping oil price supported above its $70 levels.

Benefiting from the oil’s rally was the Loonie (CAD), as Canada represents one of the top oil exporting countries and their economy is highly dependent on oil price. The CAD has been losing grounds against the dollar for 8 out of 9 weeks since October 17 to its highest level in more than a year near 1.2940. Yesterday’s rebound in oil price allowed the Loonie to rebound sharply by 0.63% against the dollar to 1.2850.

——————————————————————————————————————-

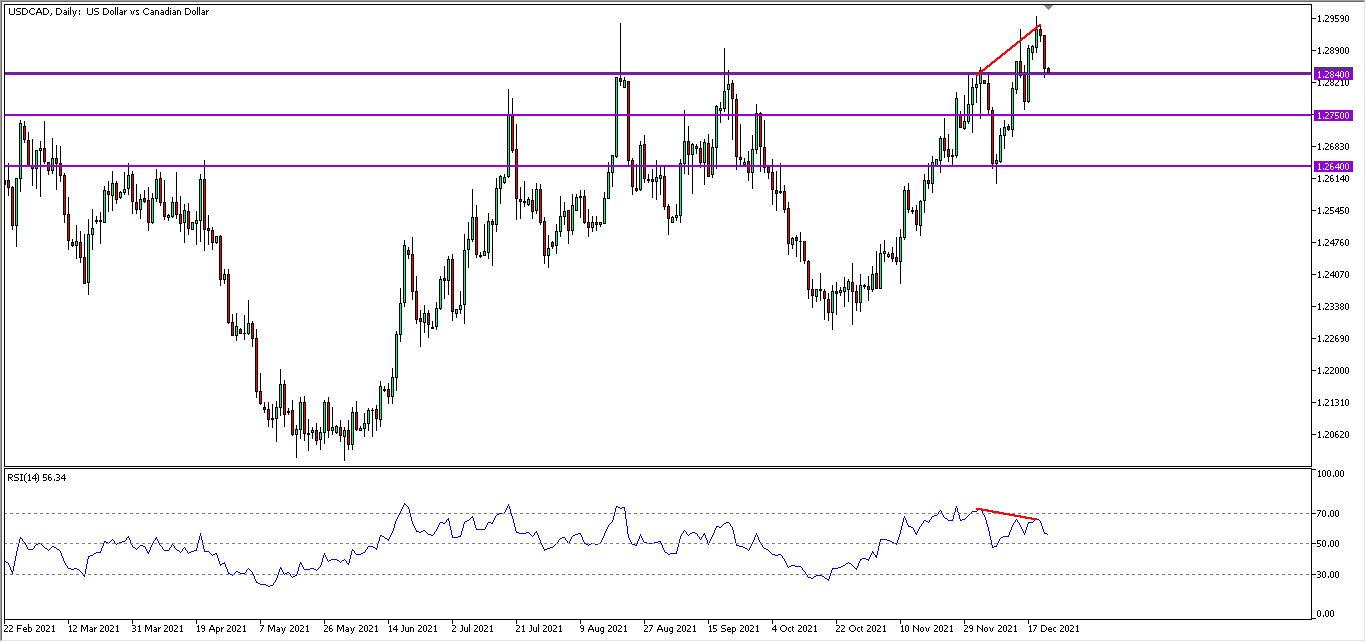

From the technical front, USDCAD in its D1 timeframe continues to be traded within an upward trend while currently testing its 1.2840 major support level. RSI, showing a negative divergence signal associated with a retrace from its overbought region, suggests the pair to experience further technical pullback after a successful breakout below the support level towards the next support zone near 1.2750. Should both support zone be broken, the pair could revisit its December 7 lows near 1.2640.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022