Intermediate – STOCHASTIC OSCILLATOR (Stochastic)

STOCHASTIC OSCILLATOR (Stochastic)

![]()

(A) Introduction

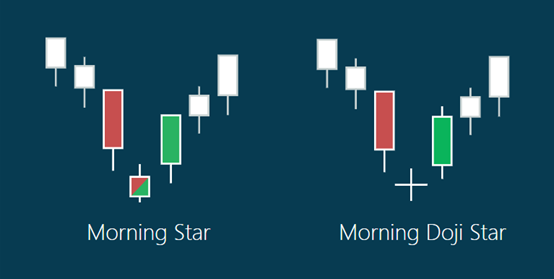

▸A momentum indicator used to

identify when an instrument is currently overbought

or oversold

▸It is easy & simple to

understand with a high degree of accuracy in signaling when to enter the market.

▸It is used to measure the

degree of change between an instrument’s closing price and its price range over a period of time.

▸Displayed as an oscillator

(line graph), scaled from 0 to 100.

1) 80-100 : Indicates an overbought

market

2) 0-20 : Indicates an

oversold market

![]()

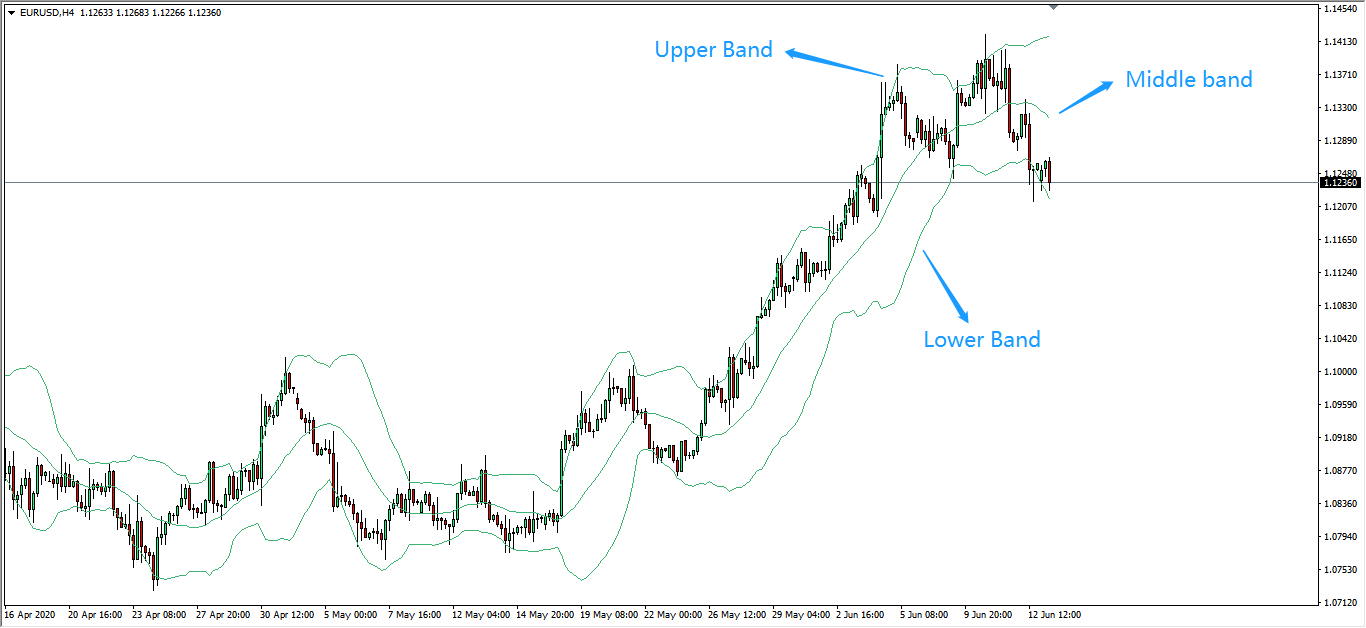

(B) Overview

![]()

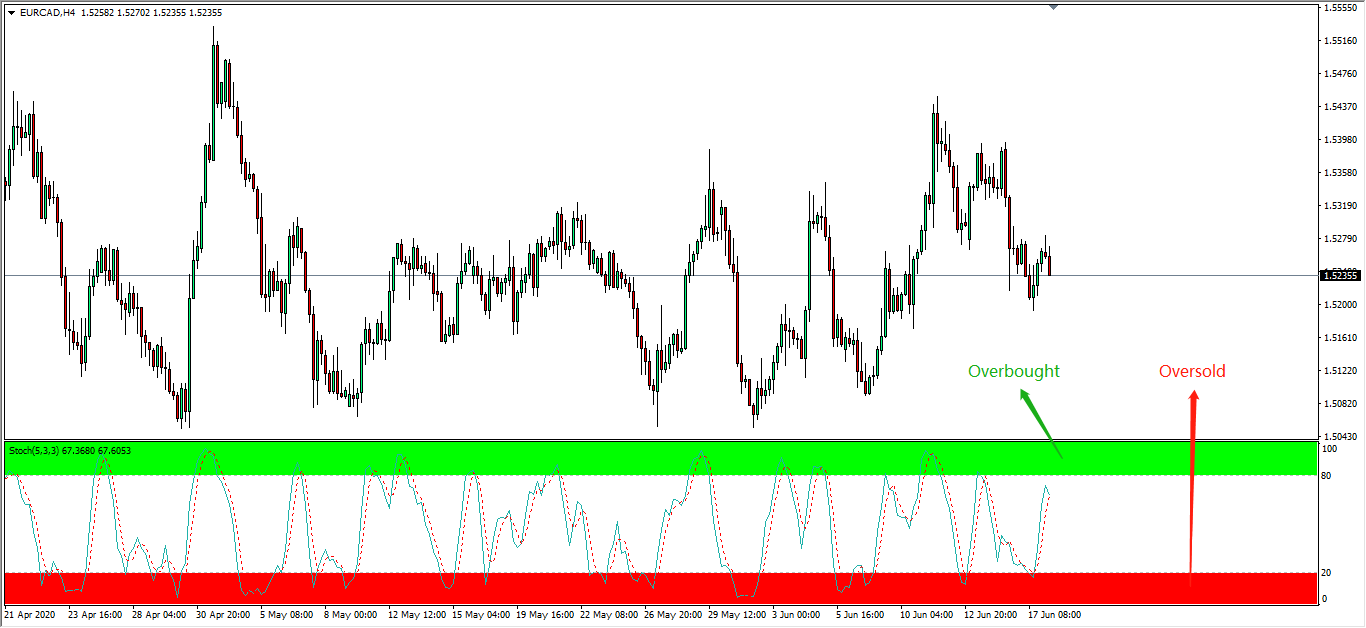

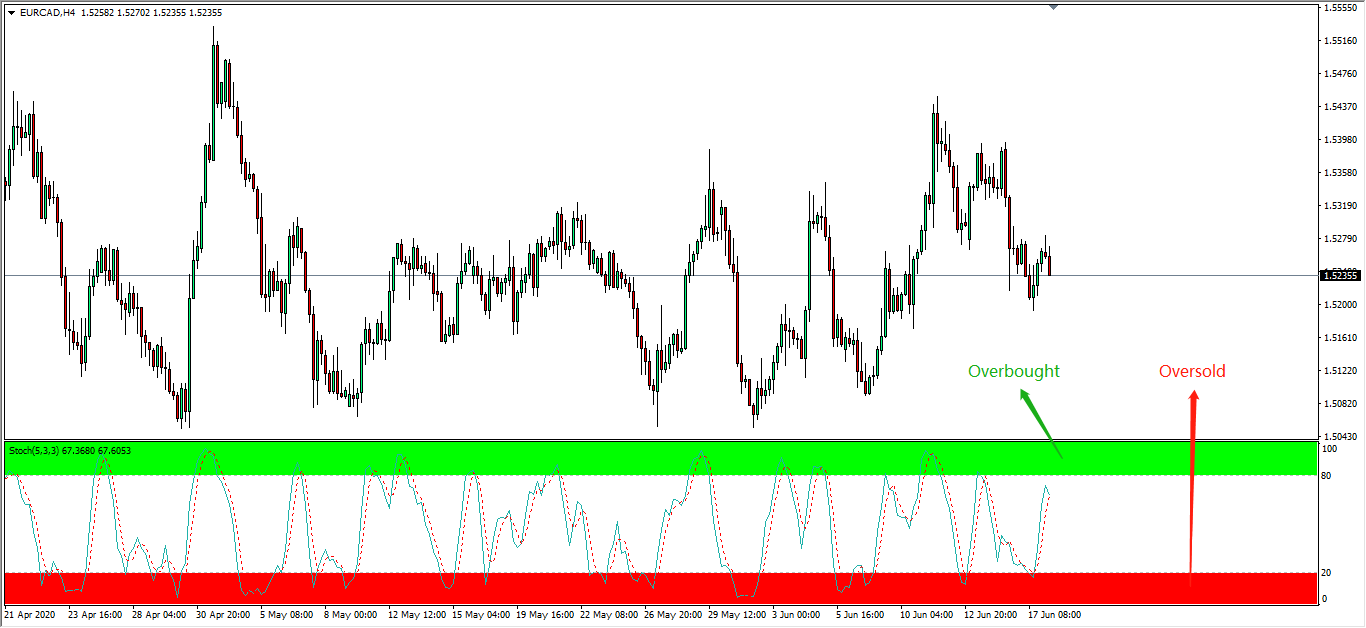

(C) Application Of Stochastic

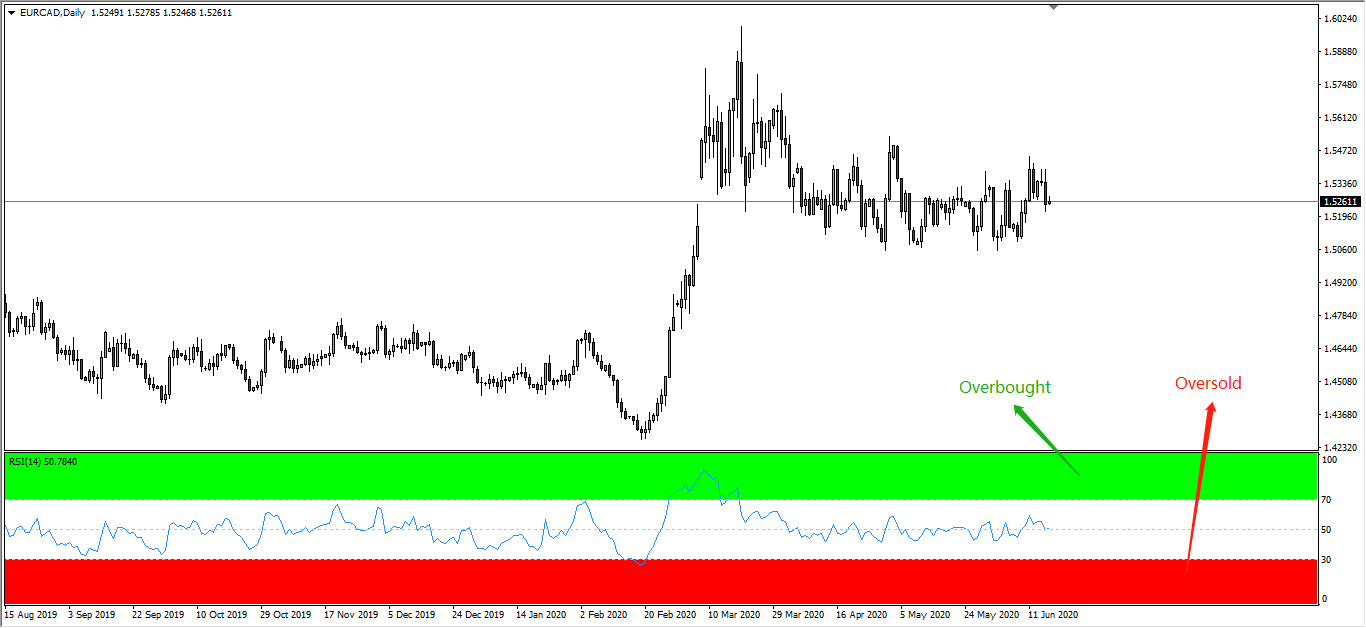

▸The application for Stochastic

is somewhat similar to the Relative Strength Index (RSI); Investors normally combine both indicators together

to obtain the same signal.

▸The concept applies the famous

saying of ‘Buy Low , Sell High’

▸Investors will sell when the

Stochastic lines are above 80; while buy when the lines are below 20.

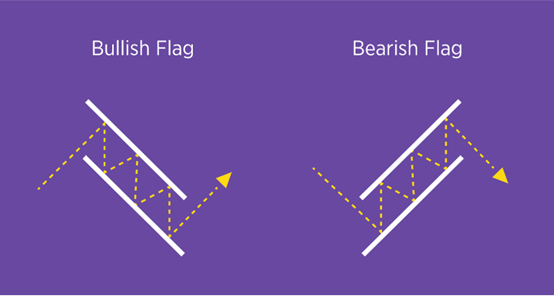

▸One thing to note about the

Stochastic is that the lines may stay around the overbought & oversold levels for a long period of time;

Investors are advised to closely

monitor price actions for any breakout confirmation before trading with Stochastic signals.

![]()

Follow Regain capital

latest articles

-

- Jun 18,2020

-

- Jun 17,2020

-

- Jun 15,2020

-

- Feb 06,2020

-

- Jan 06,2020

-

- Jan 03,2020