Intermediate – Morning Star

What is a Morning Star?

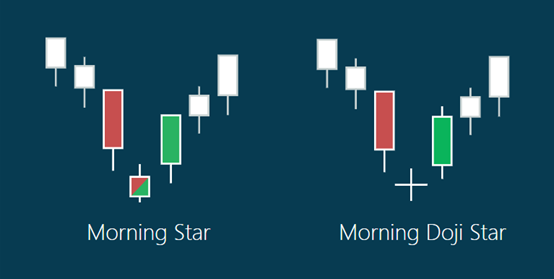

A bullish three period candlestick formation that consists of:

➟A long red candle followed by:

➟➟a small red or green candle (or doji) that gaps below the close of the previous candle followed by;

➟➟➟a long green candle (stronger signal if gaps up)

This is considered as “a leading short-term” reversal indicator

Why is a Morning Star important?

The red candlestick confirms that the downtrend remains intact and bears dominate.

When the second candlestick gaps down, it provides further evidence of selling pressure.

The small candlestick indicates indecision and a possible reversal of trend. If the small candlestick is a doji, the chances of a reversal increase (referred to as morning doji star).

The third long green candlestick provides bullish confirmation of the reversal.

So how do I use it?

Since morning stars are signals of a potential bullish reversal after a downtrend they are helpful in confirming a significant bottom especially when found near support. They are most useful in stop-loss placement with stops typically placed just below the completed formation.

Example 1 – EUR/AUD, 2min (1-23-2009)

In the above example we have two completed morning star formation which are followed by bullish market reversals.

Follow Regain capital

latest articles

-

- Mar 11,2022

-

- Jan 25,2022

-

- Jan 25,2022

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 17,2022