Intermediate – BOLLINGER BANDS (BB)

BOLLINGER BANDS (BB)

![]()

(A) Introduction

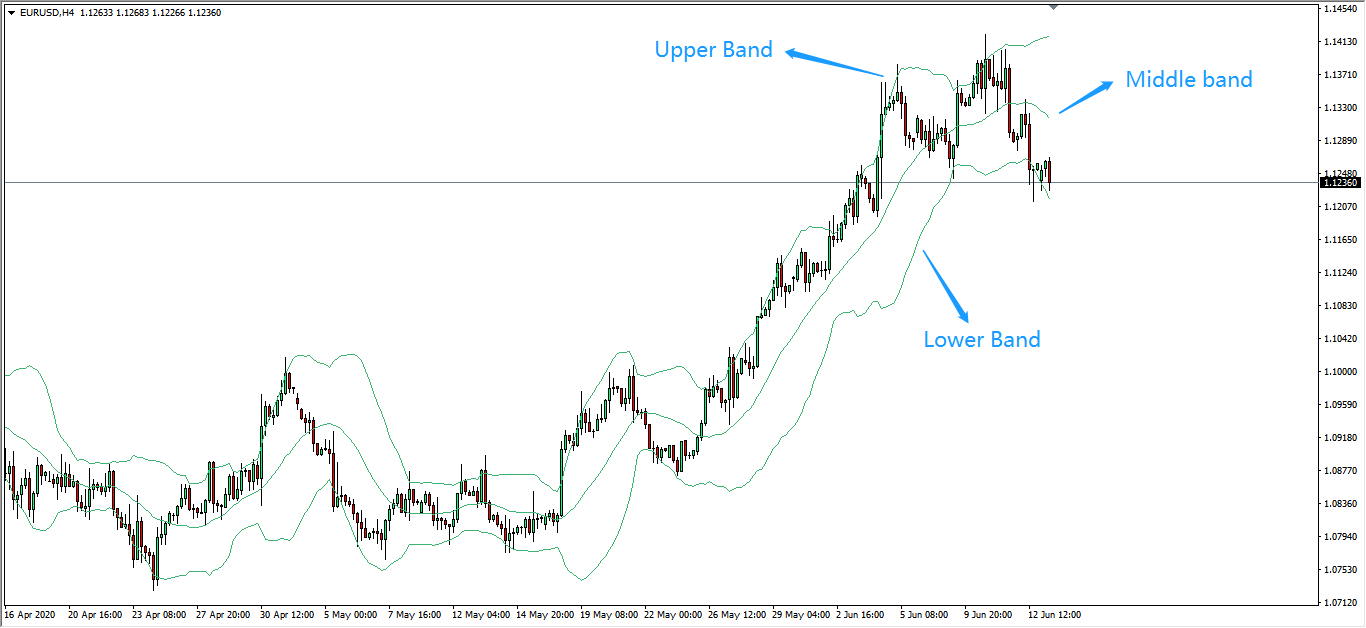

▸A technical indicator used to

measure the volatility of the market and/or instrument.

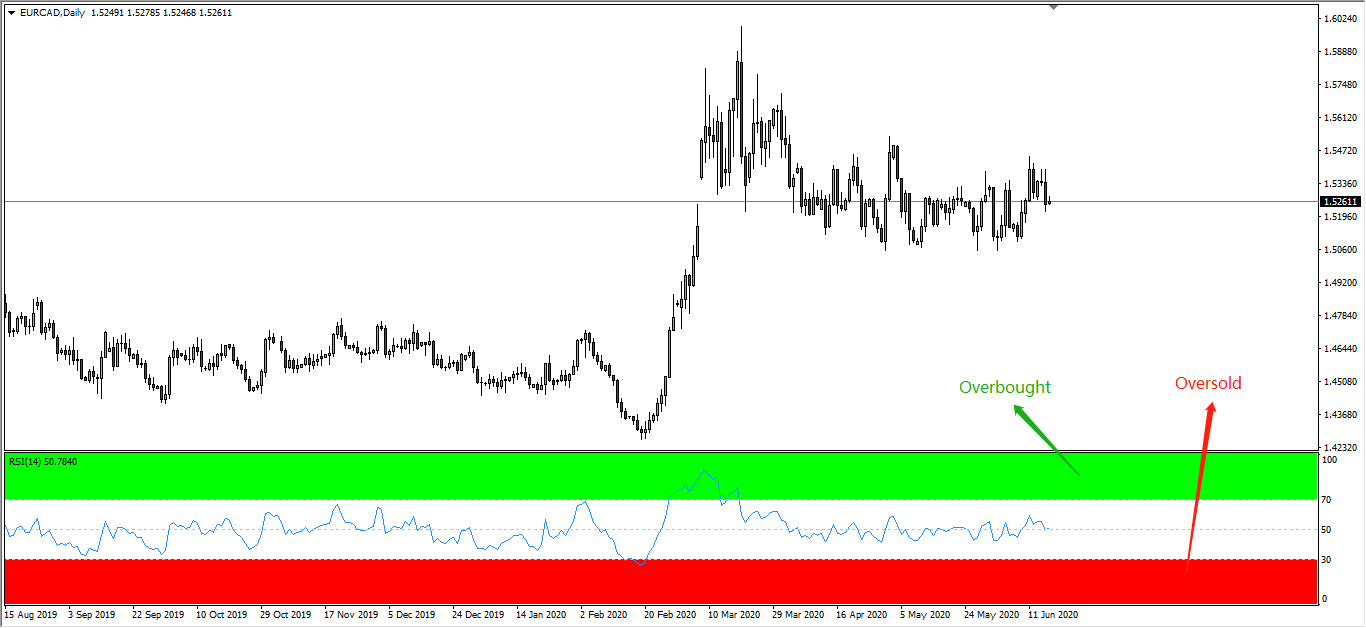

▸It is also used to identify

when an instrument is currently overbought or oversold.

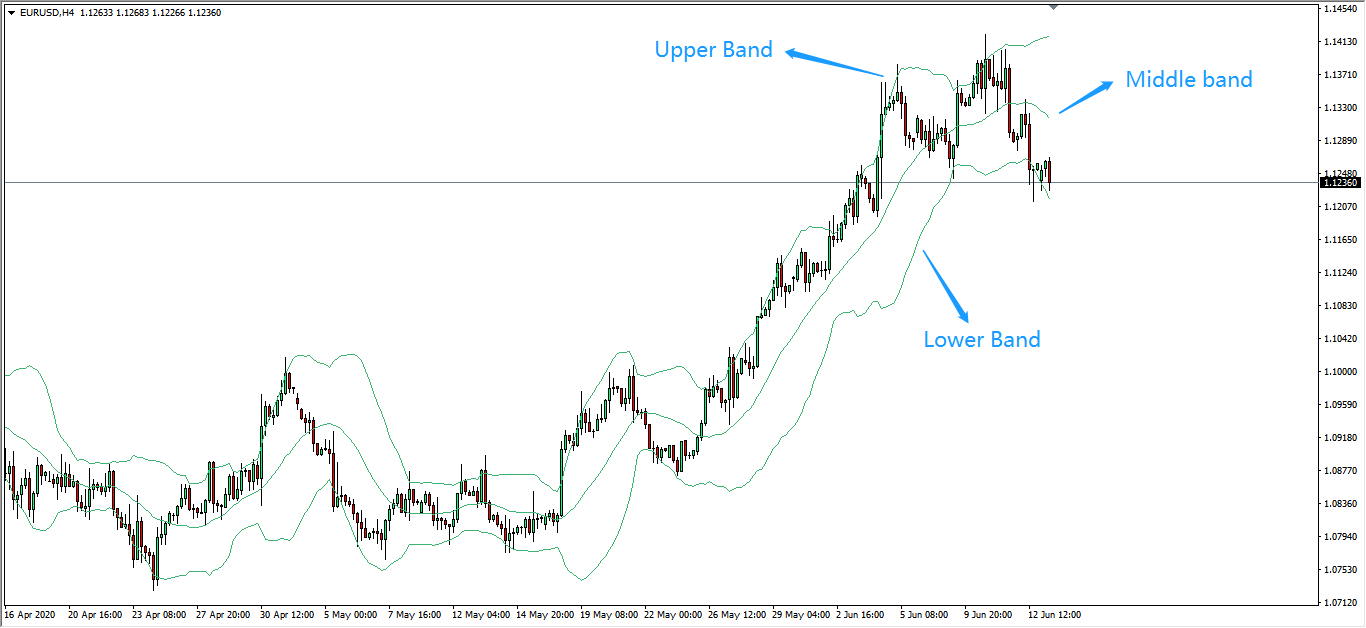

▸Composed from three bands

(lines):

1) Middle band : A simple moving

average (SMA) by default of 20 periods (20-SMA)

2) Upper band : +2

standard deviations from the 20SMA

3) Lower band : -2

standard deviations from the 20SMA

▸As it measures volatility,

the bands will adjust accordingly to ever-changing market conditions.

▸The term standard deviation

(SD) here suggests that most of the recent price action are restrained within the upper and lower bands.

▸As the middle band uses the

SMA, the BB indicator suggests that price action tends to return to the middle of the bands.

![]()

(B) Overview

![]()

(C) Application Of BB

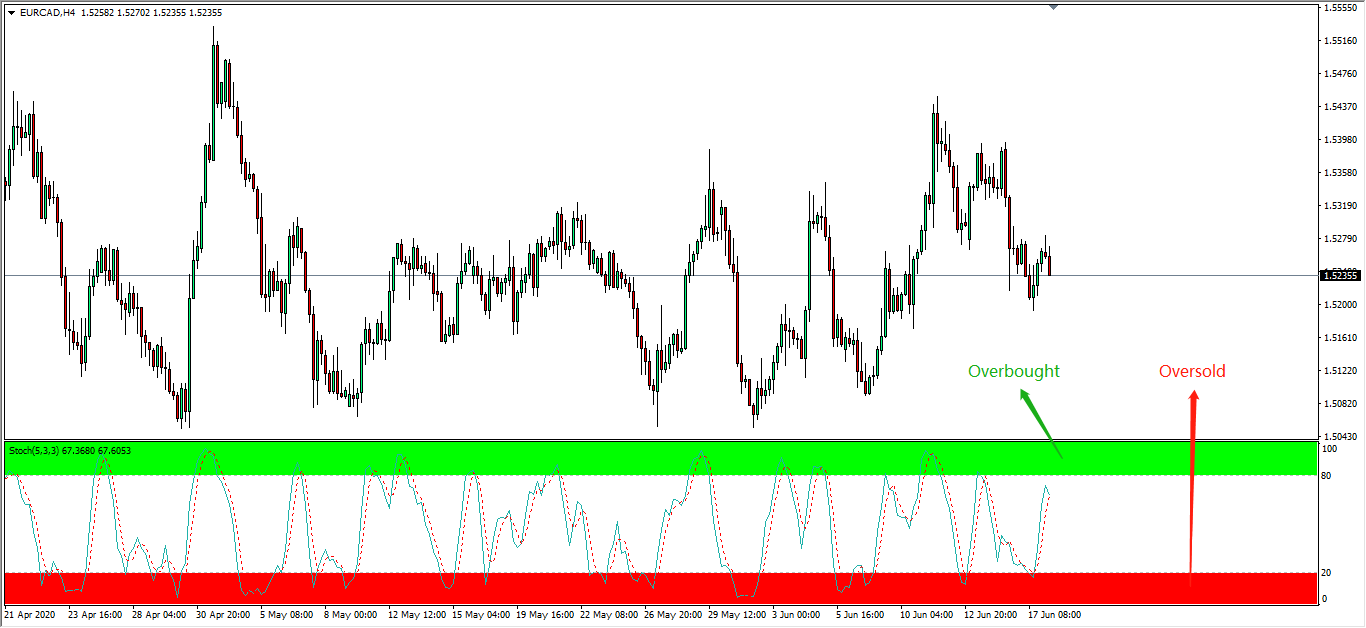

▸The highlights of the BB

indicator is when the three bands squeeze closer together while narrowing the moving average, it

signals that the instrument is going to experience

higher volatility ahead, thus suggesting a good chance to enter the market.

▸When the bands are wider apart

from each other, it signals that the instrument is going to experience lower volatility ahead, thus suggesting

a good chance to exit the market.

▸The upper and lower bands acts

as strong resistance and support level most of the time, as the application of SD suggests price action to

fluctuate within the two bands.

▸The middle band acts as a

breakout confirmation, where if the price actions breaks the middle band from the bottom-up its

a buy signal ; if price actions breaks from the top-down its a sell signal.

▸A breakout above or below the

upper and lower bands normally suggests a major event, or one can say an unusual market conditions. Under

this circumstances, investors are not advised to refer

these breakouts as a trading signal.

![]()

Follow Regain capital

latest articles

-

- Jun 18,2020

-

- Jun 17,2020

-

- Jun 15,2020

-

- Feb 06,2020

-

- Jan 06,2020

-

- Jan 03,2020