Intermediate – RELATIVE STRENGTH INDEX (RSI)

RELATIVE STRENGTH INDEX (RSI)

![]()

(A) Introduction

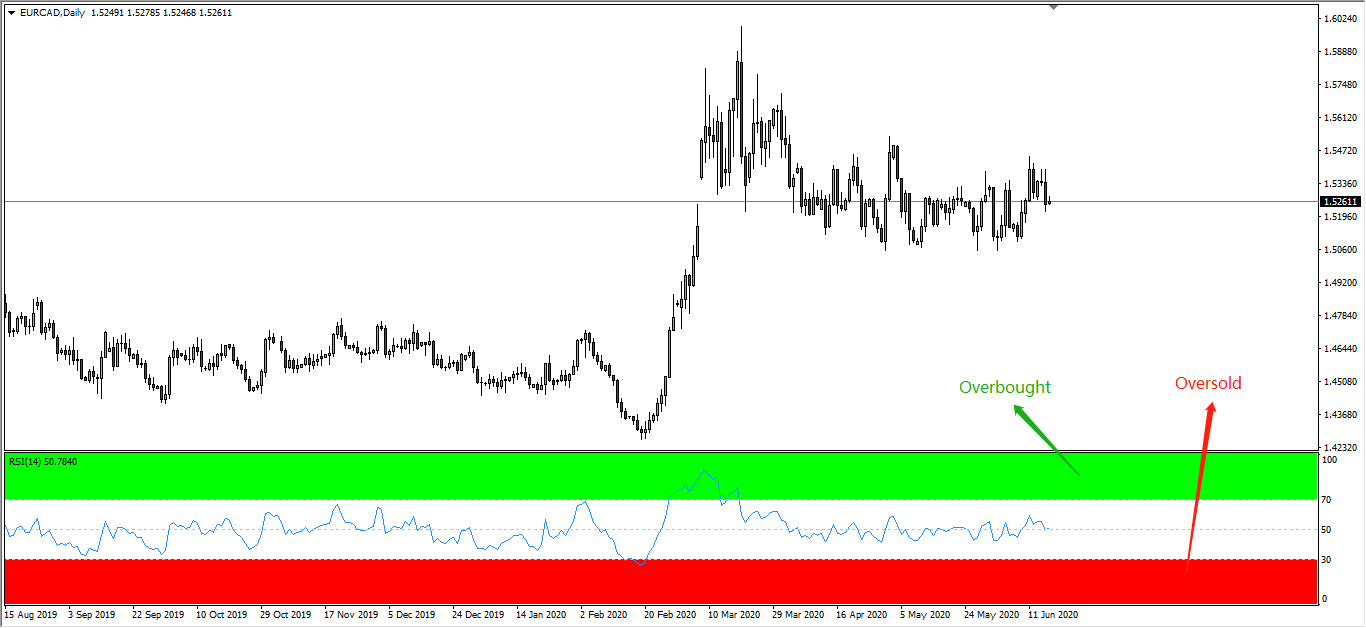

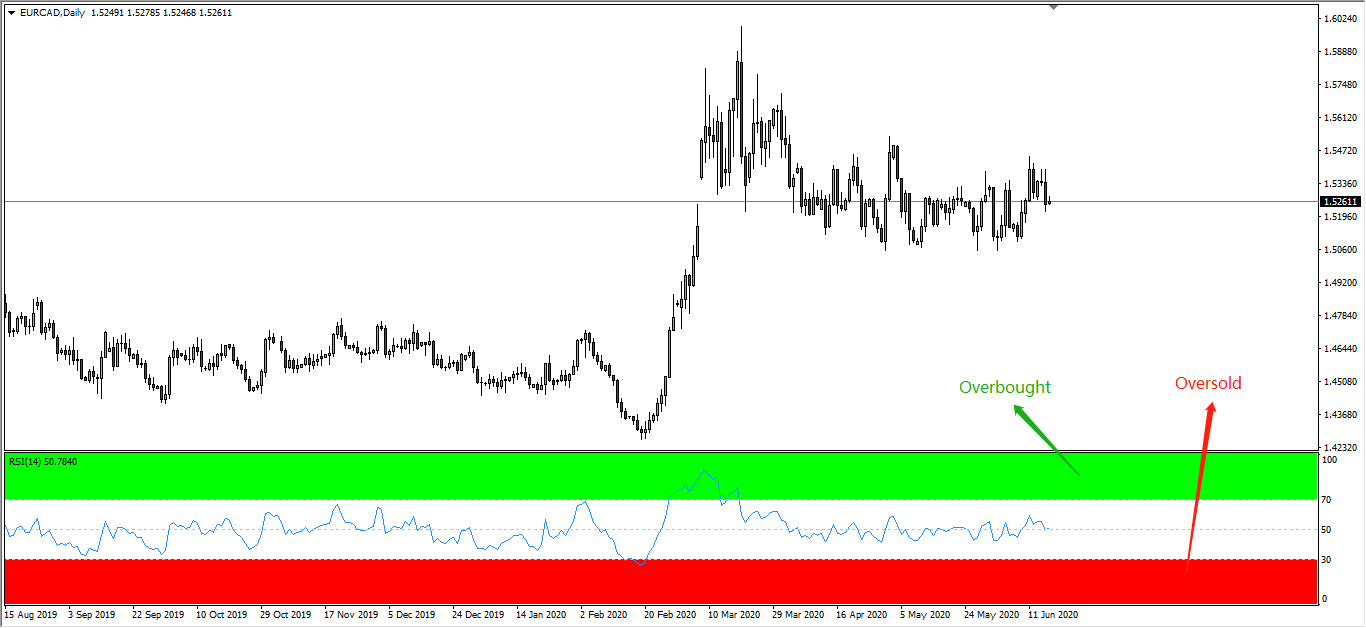

▸A momentum indicator used to

measure the extent of price changes of an instrument.

▸It is mainly used to identify

when an instrument is currently overbought or oversold following an existing trend.

▸Also used to identify potential

trend reversal

▸Displayed as an oscillator

(line graph), scaled from 0 to 100.

1) 70-100 : Indicates an overbought

market

2) 50 : Center-line

for trend reversal confirmation

3) 0-30 : Indicates an

oversold market

![]()

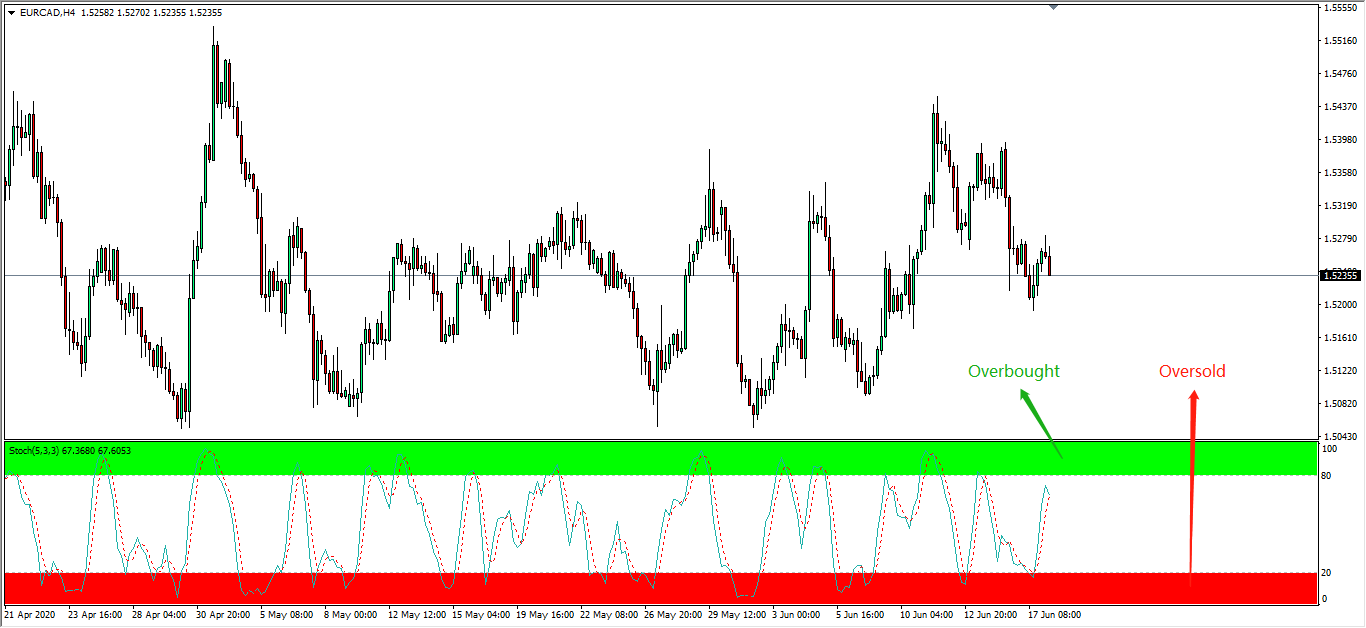

(B) Overview

![]()

(C) Application Of RSI

▸Investors can use RSI to

determine: potential tops to enter sell positions when the market is overbought ; potential

bottoms to enter buy positions when the market is oversold

▸The concept applies the famous

saying of ‘Buy Low , Sell High’

▸Investors can also look for

trend confirmations by monitoring the 50 center-line.

▸If the RSI breaks above the 50

line from the bottom-up, it indicates an uptrend; breaks below the 50 line from the top-down indicates a

downtrend

![]()

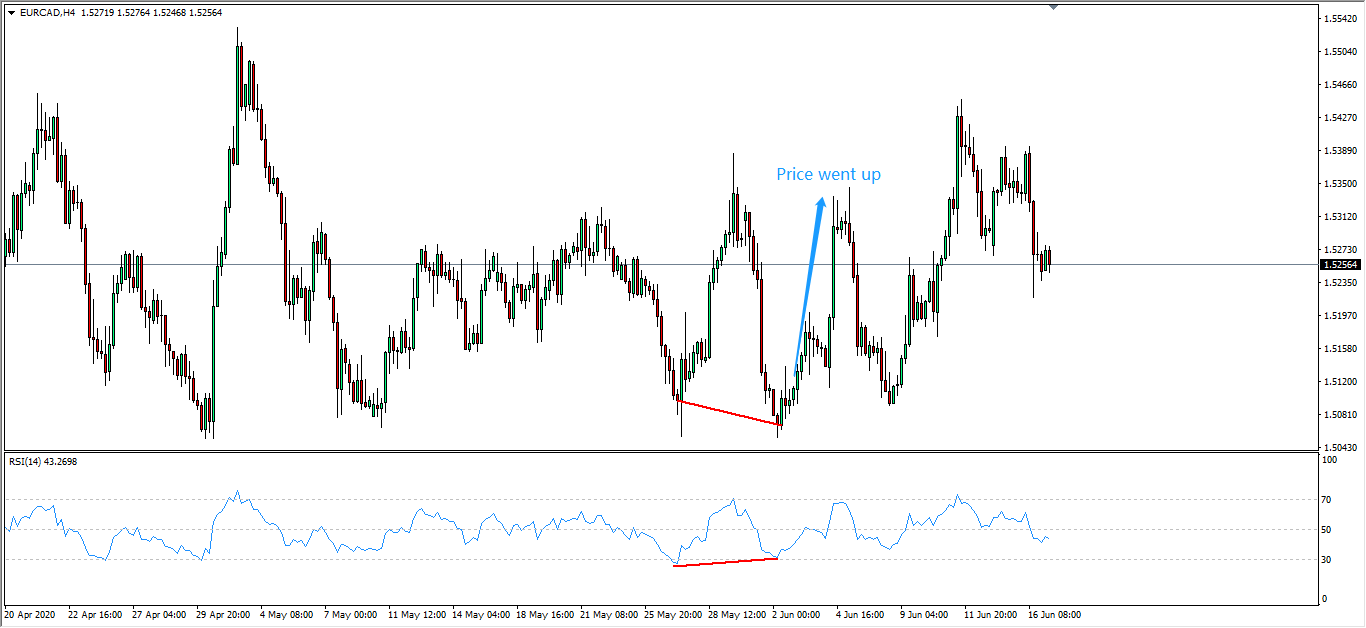

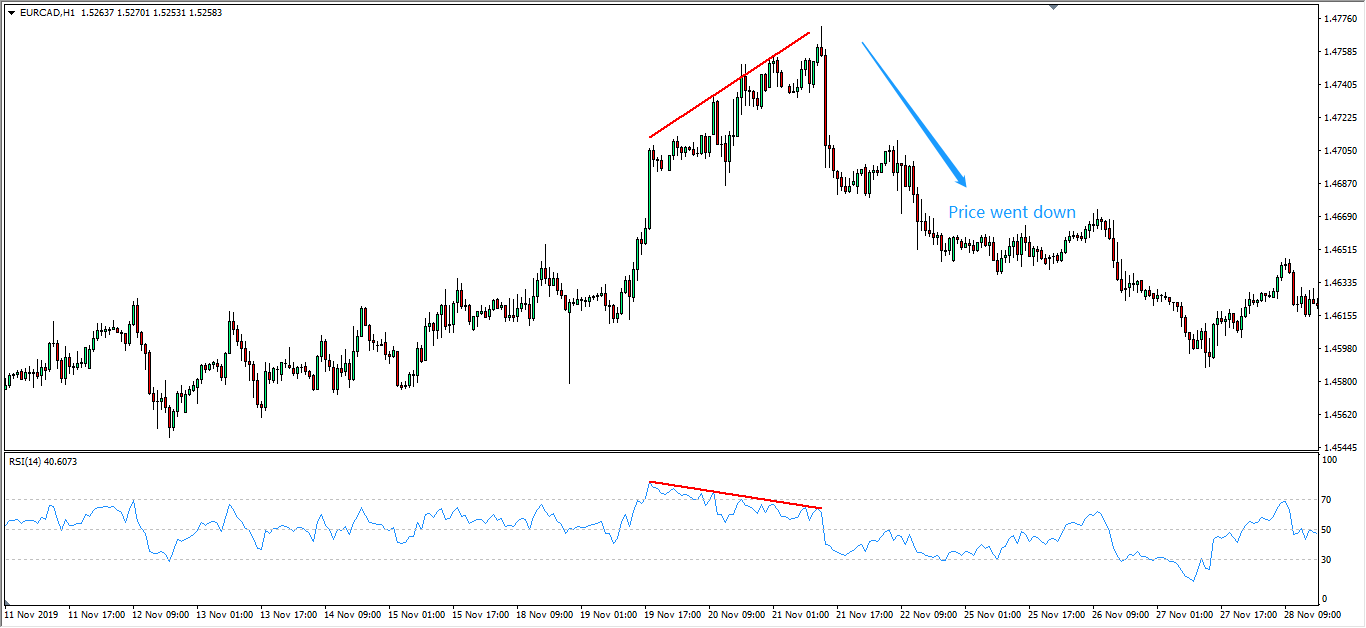

(D) RSI Divergence

▸Similar to the MACD, RSI can

also provide divergence signal whereby direction of price action is inverse with the direction of the

oscillator line.

▸Positive

divergence – Price action formed lower low but RSI formed higher low

▸Negative divergence – Price action formed

higher high but RSI formed lower low

![]()

![]()

Follow Regain capital

latest articles

-

- Jun 18,2020

-

- Jun 17,2020

-

- Jun 15,2020

-

- Feb 06,2020

-

- Jan 06,2020

-

- Jan 03,2020