Oil Consolidates At Higher Levels; Market Signals Clouded

Crude oil was gaining initially Wednesday, reaching an intraday high of $78.25 per barrel, before paring nearly 2% of its gains back to $76.58. UK traded Brent oil climbed to a high of $81.22 per barrel, before closing the market at $79.80.

Over the week, the black commodity is still holding onto its gains; however, investors are currently gauging the market oil sentiment after the OPEC and its allies (OPEC+) agreed to continue with its plans to add 400K b.p.d of supply into the market for February.

The decision on Tuesday supported oil price higher as it attracts optimism that the market demand ahead would require additional supply. However, as global Covid-19 infections continue to rise, major oil importers such as China had locked down some cities to curb the virus spread. Should more countries follow through with lockdown measures, demand for the commodity could be badly jeopardize.

Adding to yesterday’s sell-off pressure was a weaker than expected inventories report from the Energy Information Administration (EIA). According to the reports, US crude inventories fell 2.14M barrels last week, missing economists’ expectations of a 3.28M drawdown. Catching investors attention was the 10M buildup in gasoline inventories, its largest buildup since the start of the pandemic, signaling weaker demand amid the end of the holiday travelling period.

Furthermore, earlier release of the Fed’s December policy meeting minutes showed the willingness of its members to increase interest rates earlier amid a strengthening economy and rising inflation levels.

——————————————————————————————————————-

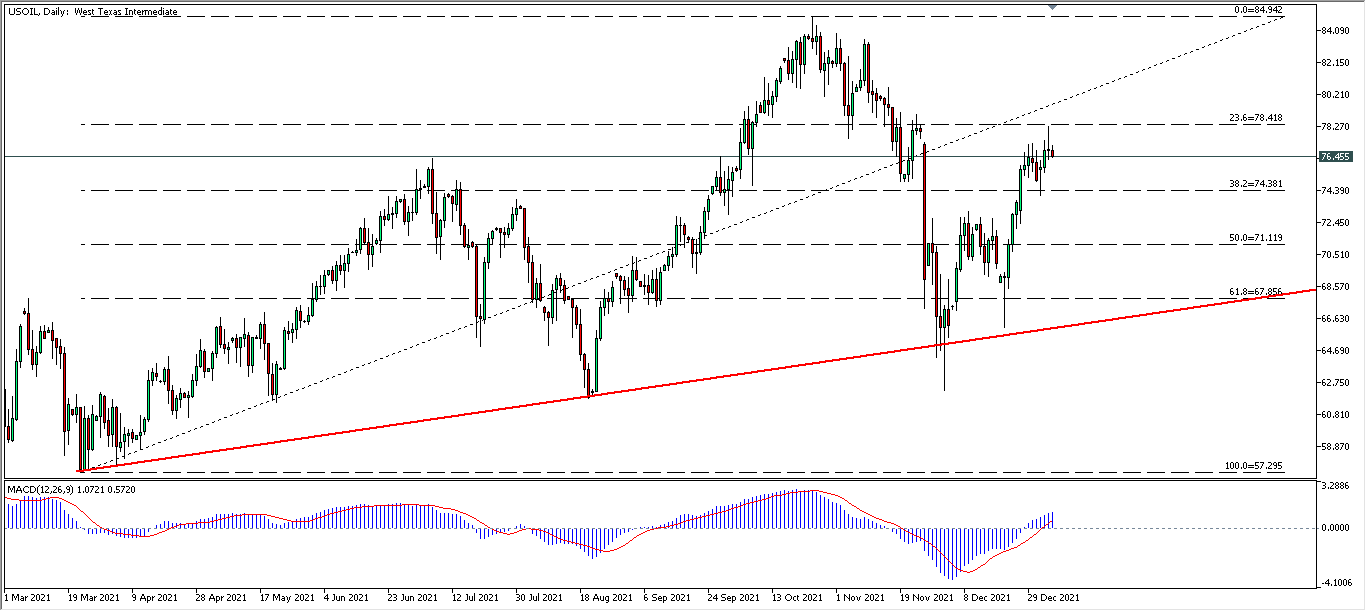

From the technical front, crude oil in its D1 timeframe continues to be traded within a longer-term uptrend. Price retraced after a failed attempt to test its 23.6 Fibonacci resistance near 78.40, where the candlestick formed a ‘pinbar’ pattern. Prices are expected to fluctuate between the 23.6 and 38.2 Fibonacci levels until further breakout confirmation is obtained. The MACD indicator, showing a buildup in its bullish momentum, suggests oil to extend higher after breaking above the its 38.2 Fibonacci resistance.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022