Dollar Remained Within Tight Range; US Jobs Report In Focus

The dollar index (DXY) edged higher by 0.06% to 96.28 on Thursday, as optimism towards a potential rate hike earlier by the Fed kept the dollar supported.

The DXY continues to fluctuate within its 96 levels while market participants await further signals from the upcoming US jobs report. Prior to the Non-farm Payroll (NFP) report on Friday, investors will first place their attention over to tonight’s private pay rolls data (ADP) to gauge the dollar’s near-term movement.

The Fed reiterated that it would stick with its dual-mandate of inflation above the bank’s expectations and maximum employment before rushing to raise its interest rates. While inflation across the US continues to rise, the nation’s unemployment rate is still far from its pre-pandemic levels.

Confidence towards a robust US economic recovery had led to a major sell-off on the Japanese Yen (JPY), as the currency trades at a four-year low against the dollar near 116.

Investors continued to dismiss the surging global Covid-19 cases after latest reports showed that the Omicron variant, despite a high transmission rate, does not seem to possess vital threat to individuals who contracted the variant. The US recorded more than 2M cases since the start of 2022, while cases across Europe also hit an all-time high.

——————————————————————————————————————-

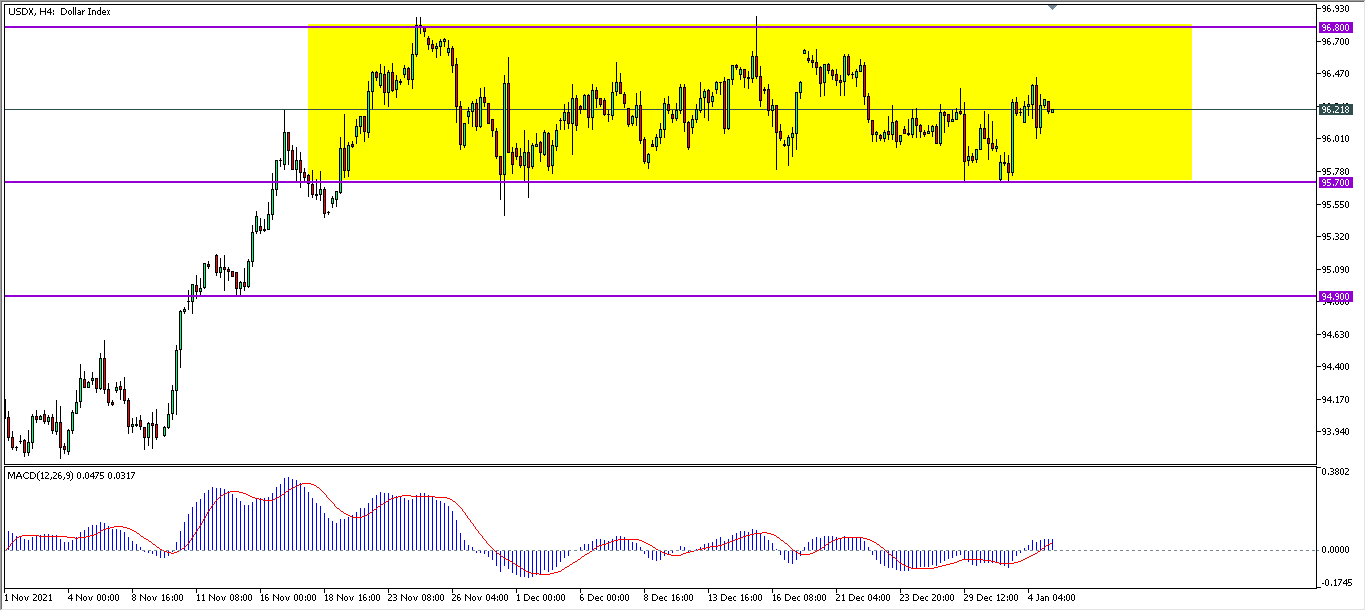

From the technical front, dollar index in its H4 timeframe continues to consolidate within a side-way channel between the 96.80 resistance and 95.80 support level. MACD, showing a bullish momentum, suggests the dollar to extend higher towards the top-level of its side-way channel. However, a breakout above the 96.80 resistance is required as confirmation for the dollar to continue its trading within a long-term uptrend.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022