Dollar Pressured Lower By Improving Risk Sentiment Amid Hawkish Fed

Dollar index gave up earlier gains after an attempt to reclaim its November highs near 96.85, plunging 0.24% back towards 96.28. Dollar was initially supported by the Fed’s hawkish comments during its policy meeting Wednesday, after Chairman Jerome Powell announced a faster reduction pace in its overall asset purchase while signaling three possible rate hikes in 2022.

Dollar enjoyed a rocket ride higher, pressuring the rival euro to a three-weeks low near 1.1220, and the safe-haven gold to a two-months low near $1750. However, the news was later digested as improving risks sentiment, causing a shift in preference from the dollar back into riskier stocks, currencies and energies market.

The dollar’s move lower was argued as a technical correction, while investors await further market signals from a set of central bank policy meetings later today. The main highlight will be on the European Central Bank (ECB) and the Bank of England (BOE) policy meetings, where both are widely expected to maintain a same policy stance amid underlying uncertainties from the new Covid-19 strain.

Despite yesterday’s shift in risk preference, the dollar’s appeal remain strong following the Fed’s comment, where the US economy continues to show robust recovery, while inflation no longer proves to be transitory. Comparison in terms of economic recovery still puts dollar ahead of the euro, where further dovish comments from the ECB today could pressure the the currency lower.

Aside from the BOE and ECB policy meetings, the Swiss National Bank (SNB) will also hold its quarterly policy review today, followed by another policy meeting from the Bank of Japan (BOJ) tomorrow. However, impact on the safe-haven Yen (JPY) and Franc (CHF) is expected to be mild as movement on these assets are driven mainly by overall market risks.

——————————————————————————————————————–

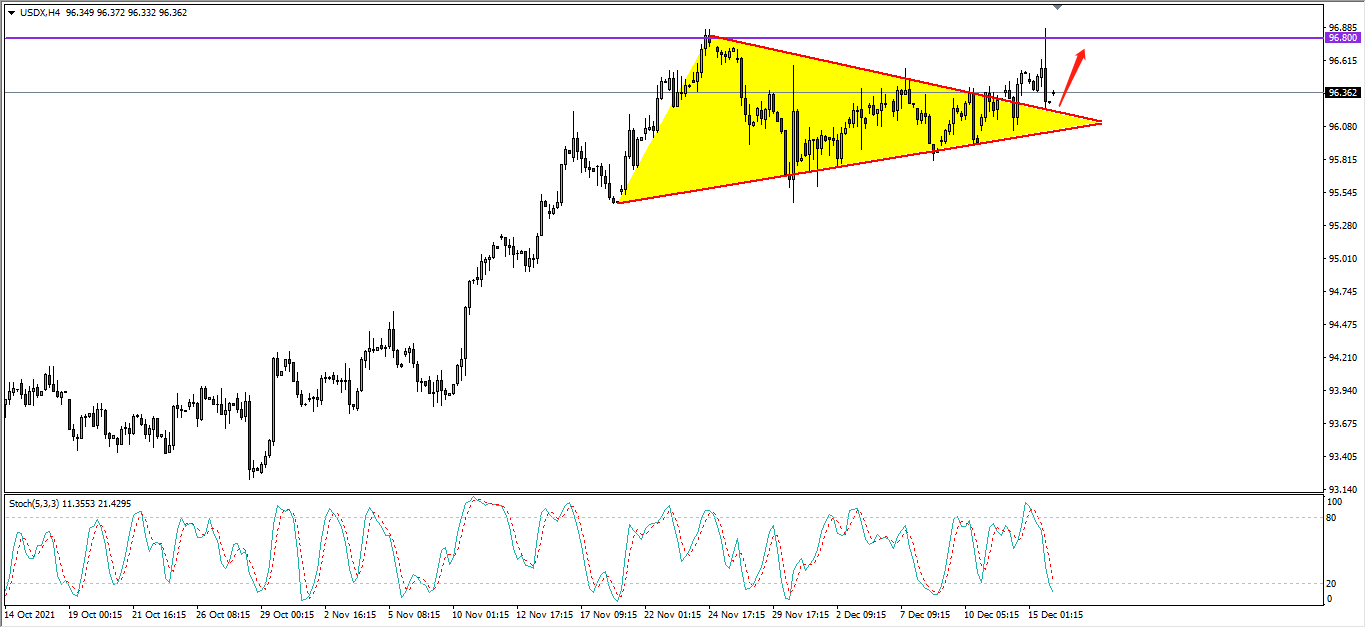

From the technical front, the dollar index in its H4 time-frame completed its technical correction after a breakout higher from its narrowing triangle. With the Stochastic Oscillator hovering near to its oversold region, the dollar is suggested to rebound higher back towards the 96.80 resistance level. A breakout from the resistance level is required as a confirmation for the dollar to extend its uptrend higher in the near-term.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022