Dollar Extended Gains Following Soaring Inflation Ahead Of Fed Meeting

Dollar index extended gains back to its 3-weeks high on Tuesday, supported higher by a stronger-than-expected inflation data. The US Producer Price Index rose 0.8% in November, signaling soaring goods price from the producers’ front while boosting optimism for an earlier rate hike further.

The Federal Reserve (Fed) is expected to deliver a hawkish stance in terms of its policy stance ahead, where several Fed members agreed that a more rapid reduction in asset purchases must be conducted to provide leeway for an earlier rate hike if needed.

Fed Chair, Jerome Powell, reiterated earlier this year that a rate hike will only take place once the Fed’s dual-mandate of maximum employment and inflation above the bank’s target is achieved. November’s US unemployment rate fell to its lowest level since the start of the pandemic at 4.2%, while hovering closer to pre-pandemic levels near 3.5%.

However, optimism for an earlier rate hike was boosted mainly by surging US inflation levels, where soaring goods price that would threaten overall economic recovery pressured the Fed to take action on its monetary policy sooner than expected.

Further supporting the dollar’s rally was the euro’s weakness, where market widely expects the European Central Bank (ECB) to maintain a loose monetary policy for an extended period of time, especially when the recent Omicron variant hampered the bloc’s recovery.

The difference in policy stance between the Fed and the ECB had since shifted investors preference back into the dollar, while pressuring the euro to 1.1200 against the dollar, its lowest level since June 2020.

—————————————————————————————————————–

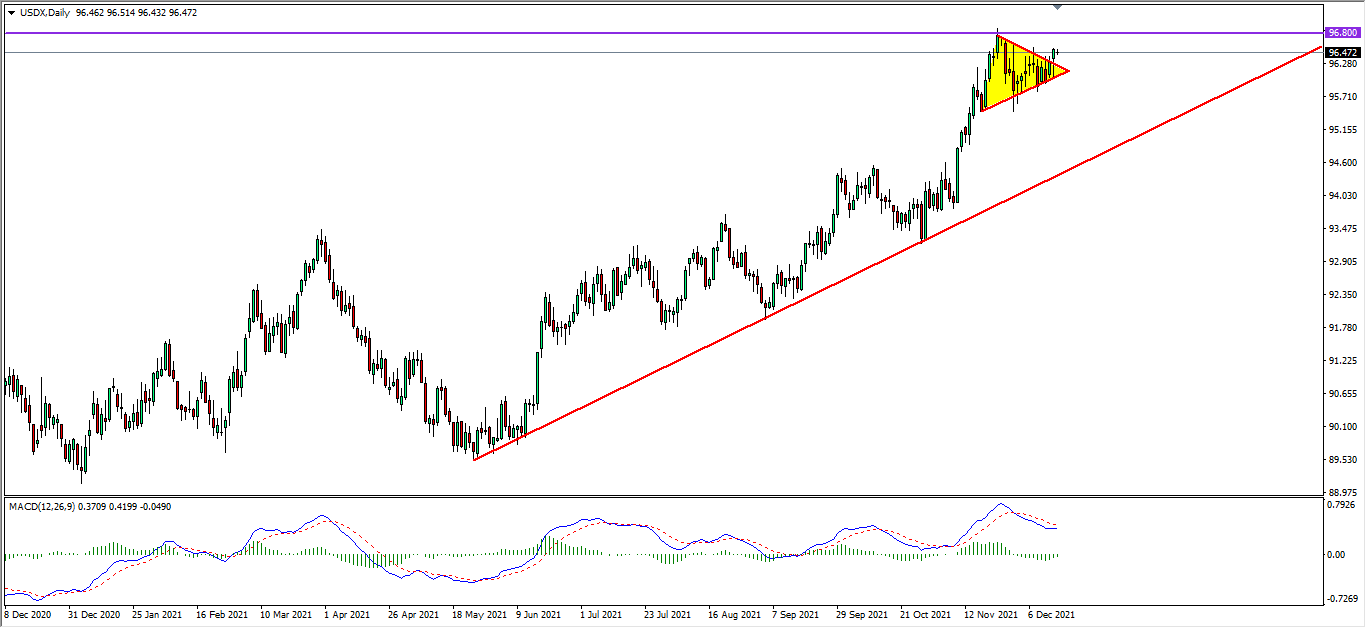

From the technical front, the dollar index in its D1 timeframe continues to extend higher while breaking above its short-term narrowing triangle. MACD, signaling a diminishing bearish momentum, suggests the end of a technical retrace and further upside potential should the dollar breaks above its resistance level 96.80. Despite the recent bullish momentum, failure to break above the resistance zone could suggests the dollar to experience further pullback towards its upward trendline.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022