Gold Within Broad Sideway Amid Mixed Market Signals

Spot gold (XAUUSD) was traded higher initially on Tuesday, climbing to an intraday high near $1820.23 a troy ounce, before paring all its gains to end the market lower by 0.33% back to $1806.52.

Spot gold (XAUUSD) was traded higher initially on Tuesday, climbing to an intraday high near $1820.23 a troy ounce, before paring all its gains to end the market lower by 0.33% back to $1806.52.

The safe-haven metal was recently supported higher by emerging market risks, specifically towards the Covid-19, Omicron variant. Studies showed that the variant posses a higher transmission rate than any other variant, causing a resurgence in global Covid-19 cases which led certain countries to reinstate lockdown measures.

Market sentiment was dragged lower as investors were worried that fresh restrictions and lockdown measures would once again derail the global economic recovery, prompting demand for safe-haven assets.

Also supporting the inflation-hedging metal was rising inflationary pressures following a pickup in overall global economic activity. As the Covid-19 situation improves, consumer confidence grew alongside, causing a surge in goods prices.

However, gains on the metal was capped by encouraging news surrounding the Omicron variant after research shows that individuals contracted with the variant only showed mild symptoms. Investors’ risk appetite were boosted following optimism that despite the rising new daily infections, global economic recovery would not be jeopardized.

Gold’s movement ahead will depend on the Covid-19 progress, and also major central banks’ decision on its monetary policy for the year ahead. Should more central banks start to tighten their policy further to counter against rising inflation, demand for the metal could decrease substantially.

——————————————————————————————————————-

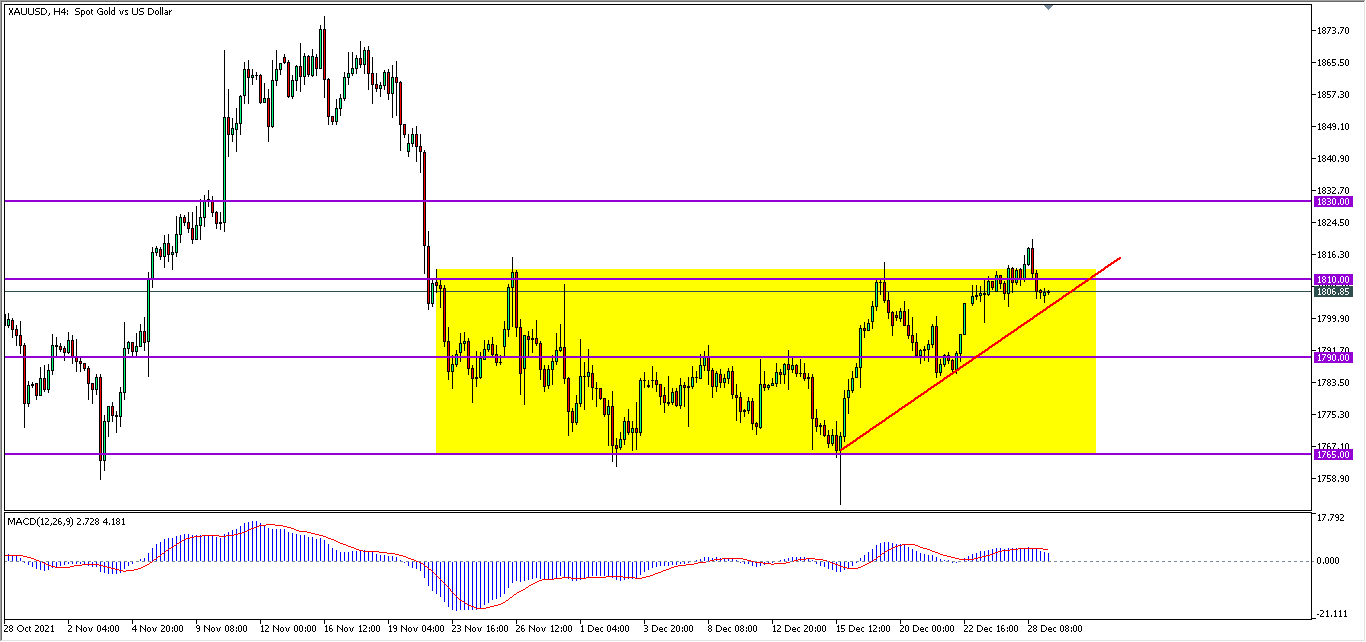

From the technical front, gold in its H4 timeframe successfully broken above its side-way channel, where price experienced a technical correction lower back towards the short-term upward trendline. A breakout back above the 1,810 resistance is required as confirmation for further bullish momentum; however, a breakout below the trendline suggests a false breakout. Investors can consider long positions with a stop-loss below the trendline and a take-profit below the major resistance near 1,830.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022