Dollar Rebounded Ahead Of Inflation Figures Amid Omicron Concerns

The dollar index managed to claw back Wednesday’s losses back above its 96 levels, rebounding up to 0.26% to end the market at 96.20. Renewed Covid-19 Omicron variant concerns allowed dollar to strengthen against its major peers, except for the safe-haven Yen, which gained 0.15% against a rising dollar.

Earlier this week, safe-haven assets were demanded lower following a set of positive news surrounding the newly discovered Omicron variant, where results proved that the variant is less severe than initially expected, but possesses higher transmission rate than other variants. Calming market fears was the assurance from top vaccine producer, Pfizer, that a booster shot accompanied by two earlier dose can fend off against the variant’s threat.

However, market risk sentiment shifted quickly after top nations such as the UK, announced tougher restrictions to curb the virus spread, making masks mandatory in public areas and encouraging employees to work from home. With a higher transmission rate, the Omicron variant could threaten more countries to reinstate lockdown measures, while derailing the global economic recovery.

As investors wait for further news development regarding the global Covid-19 issue, they will first place their focus over to upcoming inflation data from the US. The US is due to release its November Consumer Price Index (CPI) data later today, where further upbeat reading would portray strong spending activity and a healthy economic recovery.

Today’s CPI data would also provide further hints on the Fed’s policy decision next week, where concerns towards surging goods price could pressure the Fed to ramp up its policy tightening and raising its interest rates sooner than expected.

—————————————————————————————————————–

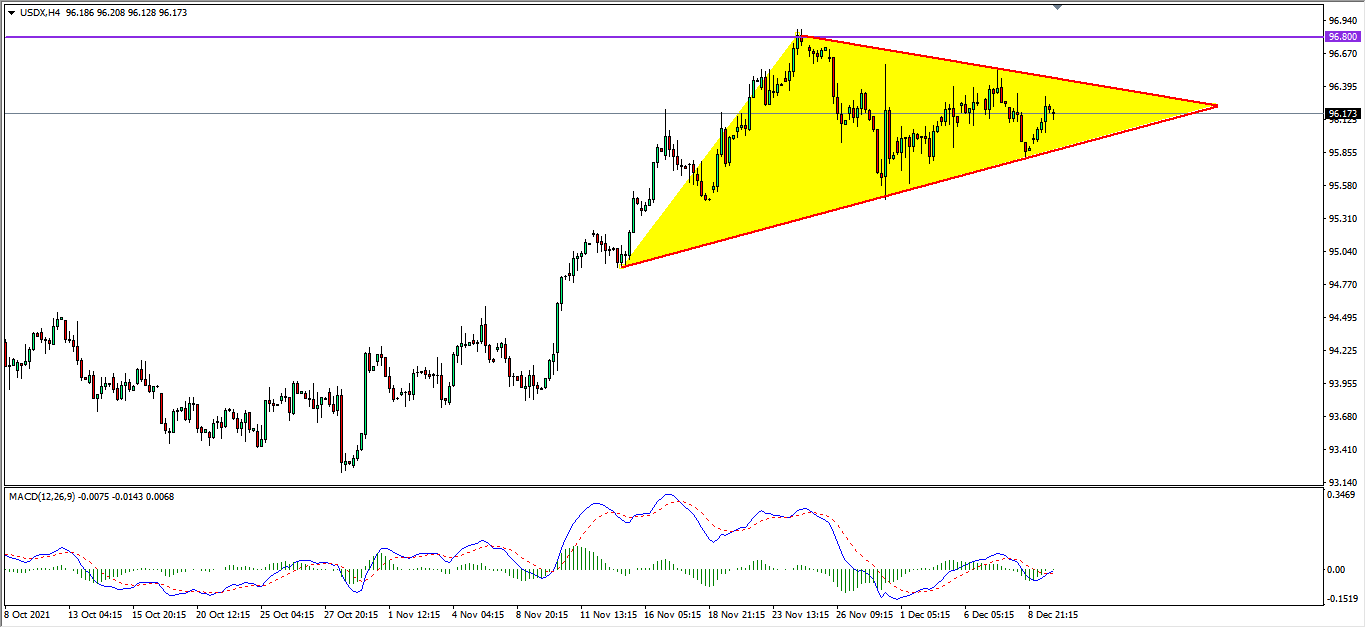

From the technical front, the dollar index in its H4 time-frame is currently traded within a narrowing triangle. MACD, showing bullish momentum associated with a golden cross signal, suggests the dollar to extend higher after successfully breaking above its narrowing triangle. A longer-term bullish confirmation would require a breakout above its previous high near the 96.80 resistance level.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022