Crude Oil Under Pressure By Renewed Covid-19 Concerns

Crude oil suffered major losses on Monday, recording an intraday losses of nearly 6% to $66, before paring most of its losses back to its $69 levels. The sell-off in the crude market was fueled by renewed concerns over the Covid-19, Omicron variant, after countries across Europe and the United States reported a surge in its daily infections.

Latest research on the Omicron variant shows that the strain has a higher transmission rate than the Delta and no solid evidence to prove that it is less severe. Countries such as Australia, London, and Germany reinstated restrictions within the nation, while the Netherlands announced a nationwide lockdown to curb the spread.

With global Covid-19 cases on the rise again, resulting to lockdown measures from major economies, investors’ concerns had since prompted demand for safe-haven assets while causing the sell-off on riskier assets such as the crude oil. A slowdown in the global economic recovery suggests weaker oil demand ahead, with the International Energy Agency (IEA) lowering its demand forecast in 2022.

In other news, US President Joe Biden’s $1.75 trillion domestic investment bill was rejected by US Senator Joe Manchin on Sunday, dampening the US economy outlook ahead following lesser stimulus and slower growth. The cloudy outlook surrounding the global economic recovery had dampened oil market’s sentiment, causing the black commodity to trade below its $70 levels.

Despite concerns over weaker demand ahead, the US continues to add oil and gas rig count, where total rig operating in the week to December 17 rose to 579, its highest number since April last year. Investors will shift their focus over to Wednesday’s US oil inventories report to further gauge the oil price movement ahead.

——————————————————————————————————————

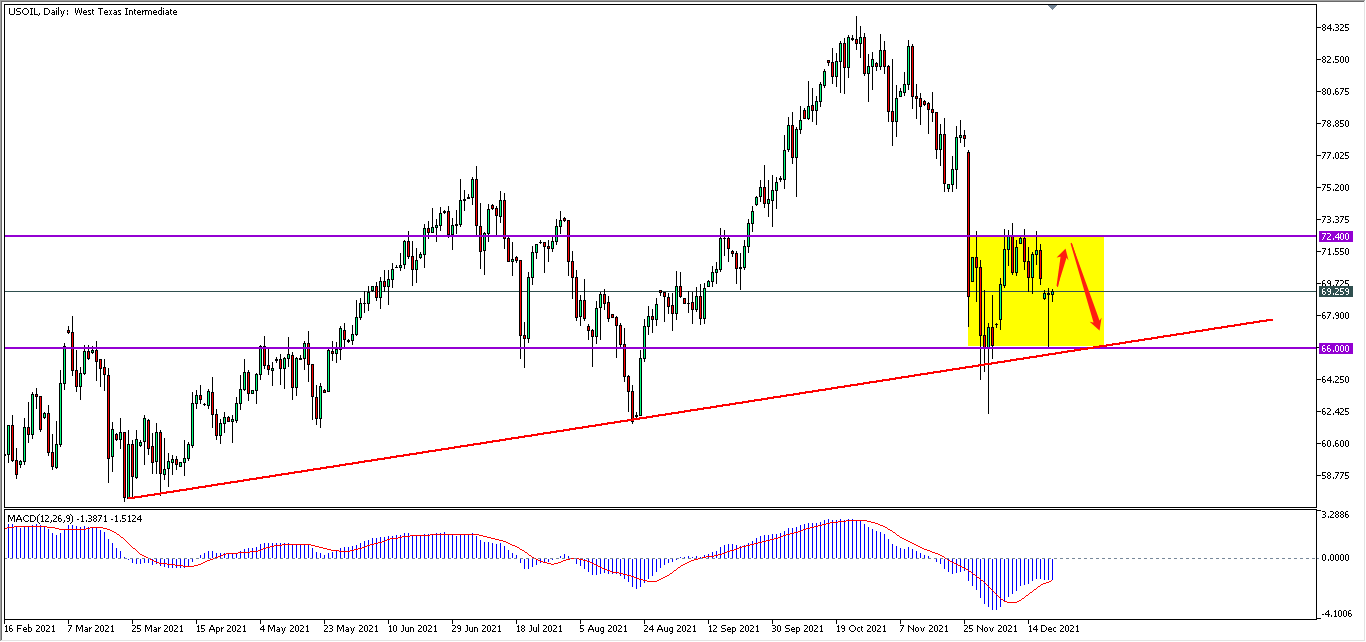

From the technical front, crude oil in its D1 timeframe continues to be supported by its longer-term upward trendline. However, price is currently traded within a broader side-way channel, restricted by the upper bound resistance of 72.40 and lower bound support of 66.00. MACD, showing a diminishing bearish momentum, alongside with yesterday’s bullish pinbar pattern from the support zone, suggests oil to extend its rebound further towards the top-level of the channel.

Follow Regain capital

latest articles

-

- Jan 17,2022

-

-

-

- Jan 12,2022

-

-

- Jan 11,2022