Advanced Level – MACD – Histogram

(A) Introduction

▸ In any investment trading, identifying the current momentum of an

instrument is where investors are able to make money from.

▸ One indicator that is widely used in Technical Analysis is the Moving

Average Convergence Divergence (MACD) Histogram

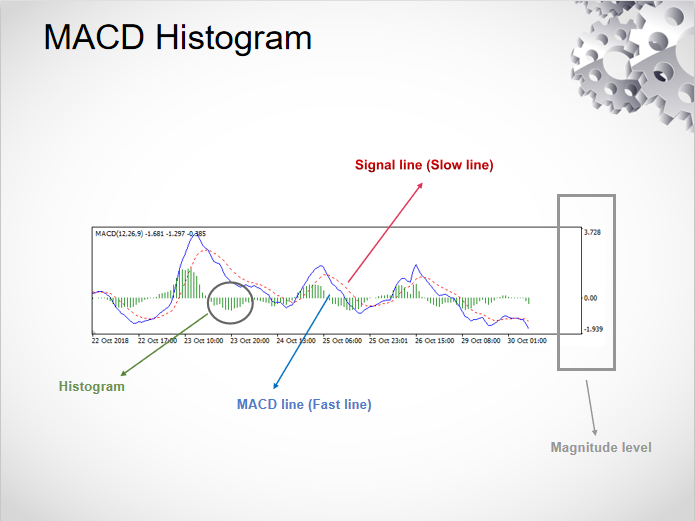

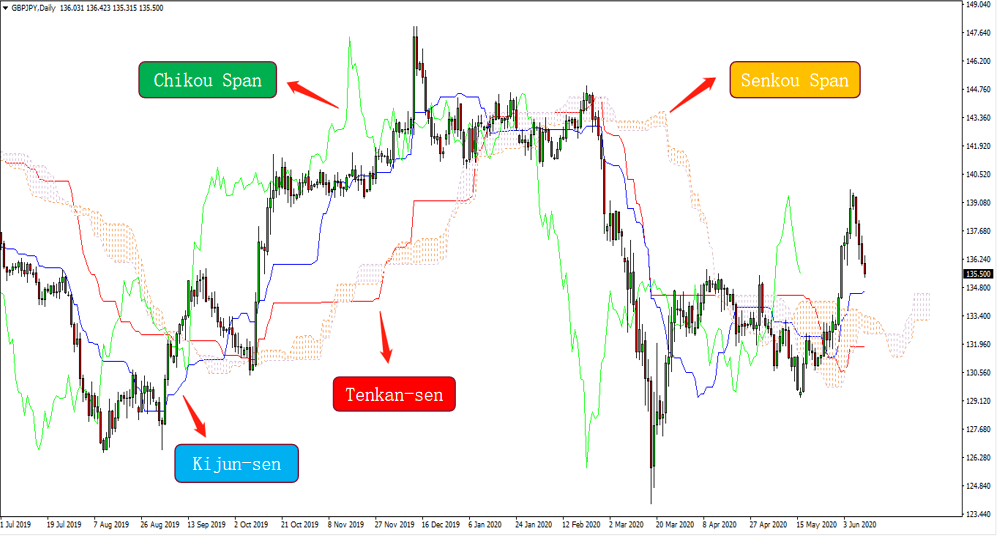

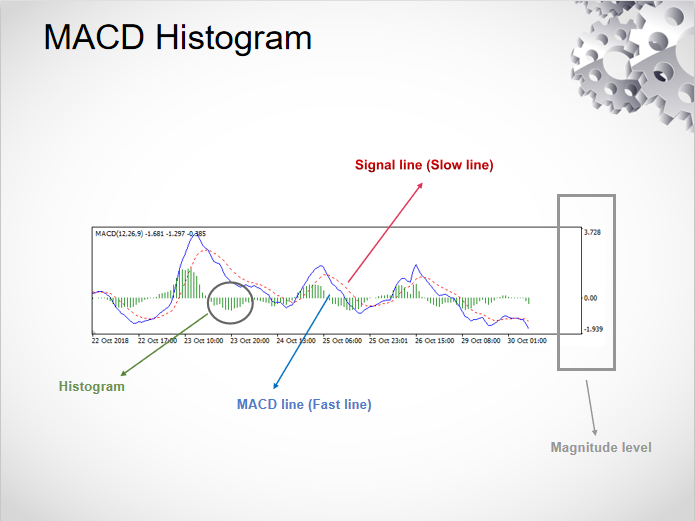

▸ In a MACD Histogram chart, there will be three numbers used for its

settings. The default settings for most charting software are 12 (Fast EMA), 26

(Slow EMA), & 9 (Signal SMA).

▸ To interpret it, the ‘12’ is the previous 12 bars of the faster moving

average; the ‘26’ is the previous 26 bars of the slower moving average; the ‘9’

is the previous 9 bars of the difference between the two moving averages.

▸ The MACD line is calculated by

subtracting the 26-period EMA from the 12-period EMA to obtain the MACD line,

while a nine-day EMA of the MACD known as the ‘signal line’ is plotted on top

of the MACD line. The

▸ Histogram provides the current

momentum of the instruments whereby if the histogram is above the 0.0 magnitude

level, the instrument is currently moving in a bullish momentum; below the 0.0

magnitude level, the instrument is moving in a bearish momentum.

▸ Similar to the Moving Average,

the MACD Histogram provides indication on a general trend of the instruments

which measures the relationship between two moving averages of an instrument

price

▸ It is a better indicator

compared to Moving Average as the MACD histogram features two signal line and

it reduces the time lag of crossovers.

▸ The indicator also provides the

current momentum (bullish/bearish) of the instruments.

(B) Uses of MACD Histogram

I)

Crossovers

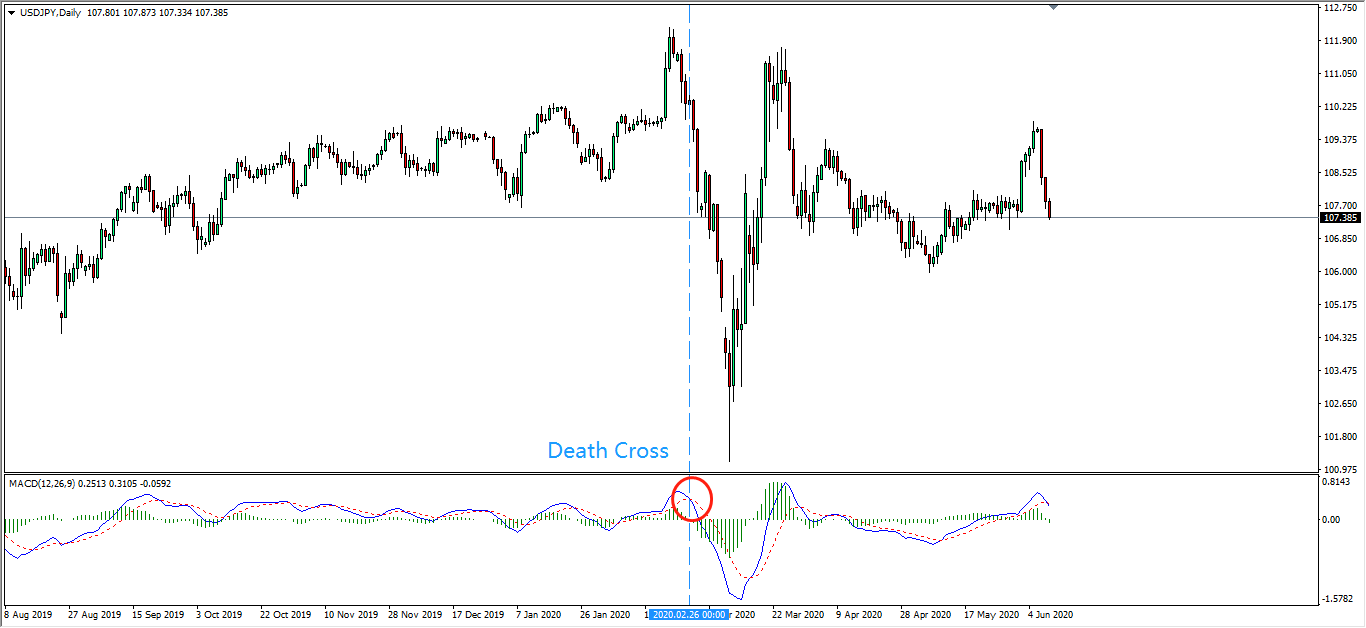

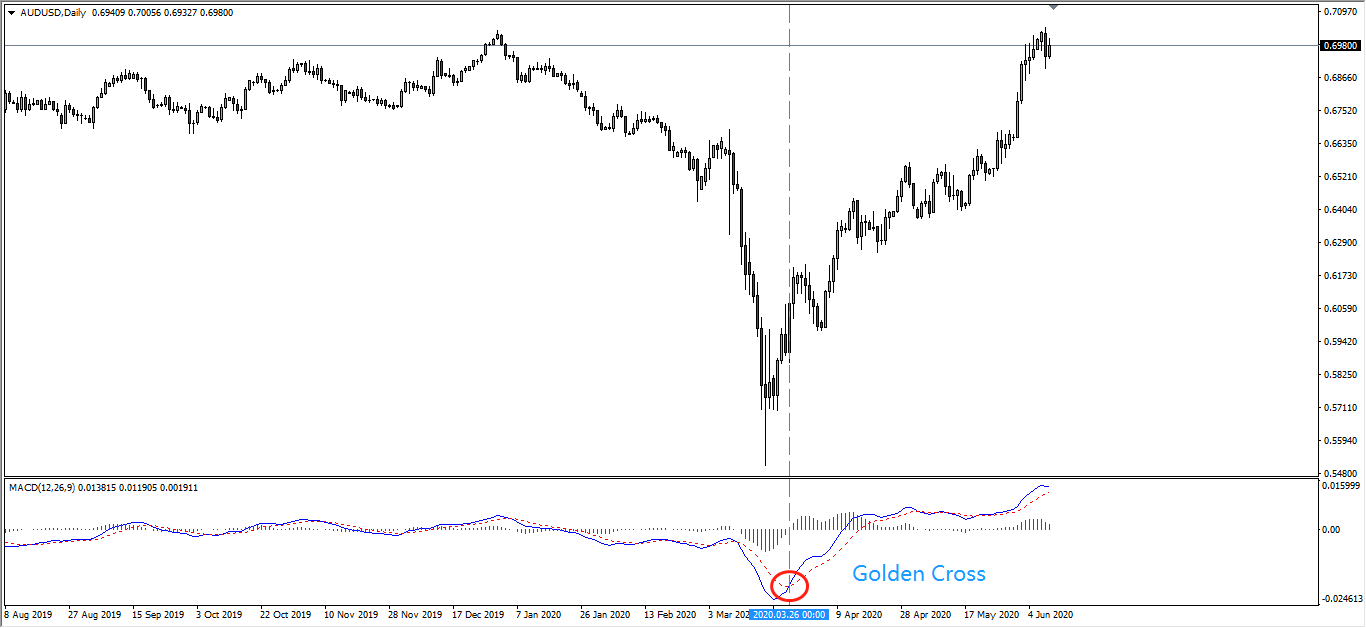

▸ Signals obtained from crossover

between the signal line and MACD line whereby if the MACD line crosses below

the signal line indicates a sell-signal (death cross); crosses above the signal

line indicates a buy-signal (golden cross).

II)

Divergence

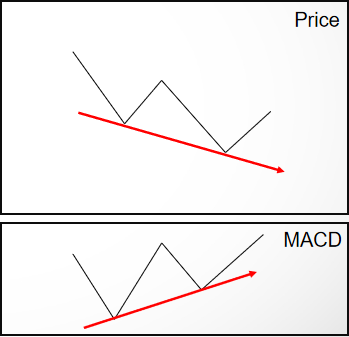

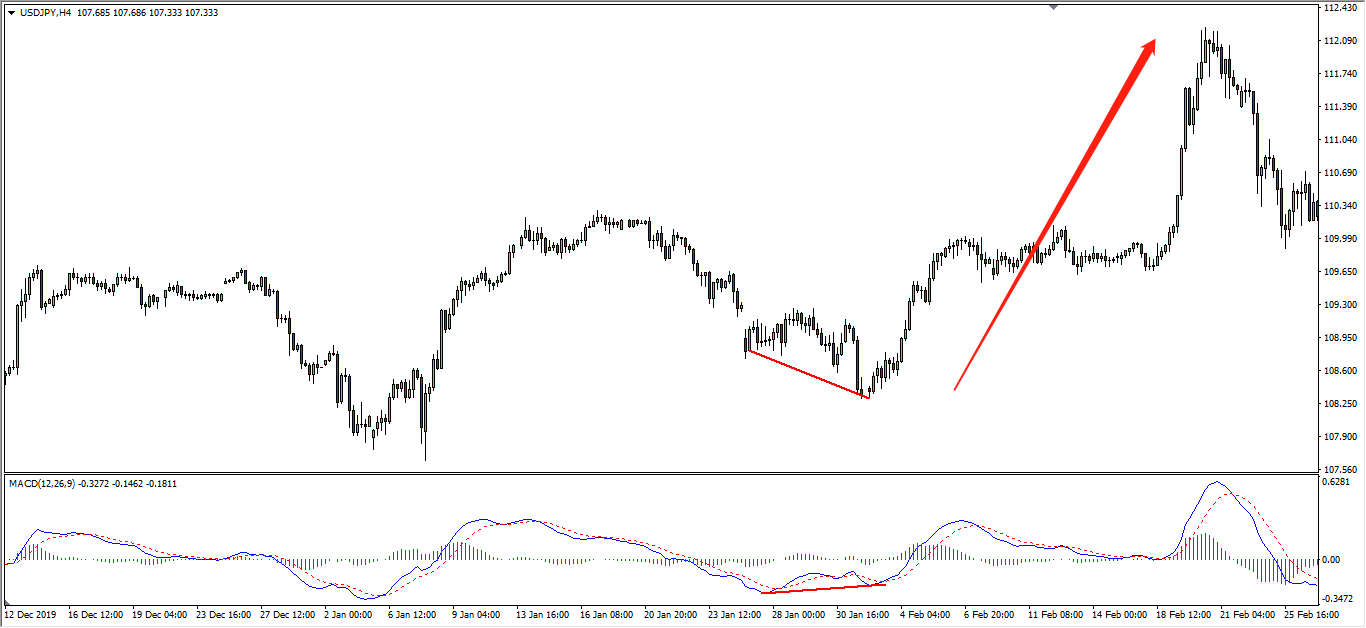

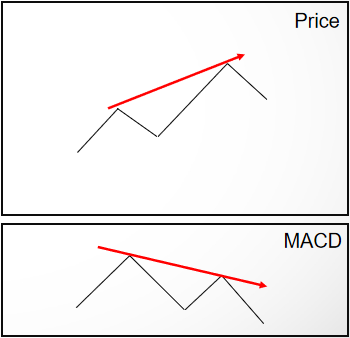

▸ Divergence signal which

indicates differences in direction between the price action of the instruments

and the MACD indicator. Can be differentiated into Positive (Bullish) or

Negative (Bearish) divergence.

▸ A positive divergence occurs

when price action indicates persistent downtrend while the MACD indicates

persistent uptrend. This signal suggests the instrument to rebound ahead.

▸ A negative divergence occurs

when price action indicates persistent uptrend while the MACD indicates

persistent downtrend. This signal suggests the instrument to retrace ahead.

(C) Limitations of MACD Histogram

▸ One of the major disadvantages

for the MACD is that it is subjective to the user in terms of desired

time-frames or settings. That said, different people with different trading

patterns whom also have different settings for their MACD may acquire different

results or signals.

▸ The crossover signal is a

lagging indicator as it still takes into calculation of moving average which is

based on past price actions.

▸ The divergence signal may be

early signals as it may signal a reversal too early and causes investors to

enter the market before the price action reacts to the trend reversal.

Follow Regain capital

latest articles

-

- Jun 11,2020

-

- Jun 11,2020

-

- Feb 27,2020

-

- Feb 27,2020