Advanced Level – Ichimoku Kinko Hyo

Ichimoku Kinko Hyo (Ichimoku)

A) Introduction

▸ An indicator that measures or

determine 3 main things:

1) Future momentum of an

instrument’s price

2) Support &

Resistance Levels

▸ The indicator is mainly

designed for Yen (JPY) pairs. Thus this

means that it proves to be more effective on JPY pairs.

▸ In translation, Ichimoku

means ‘one glance’ , kinko means ‘equilibrium’

, while hyo means ‘chart’.

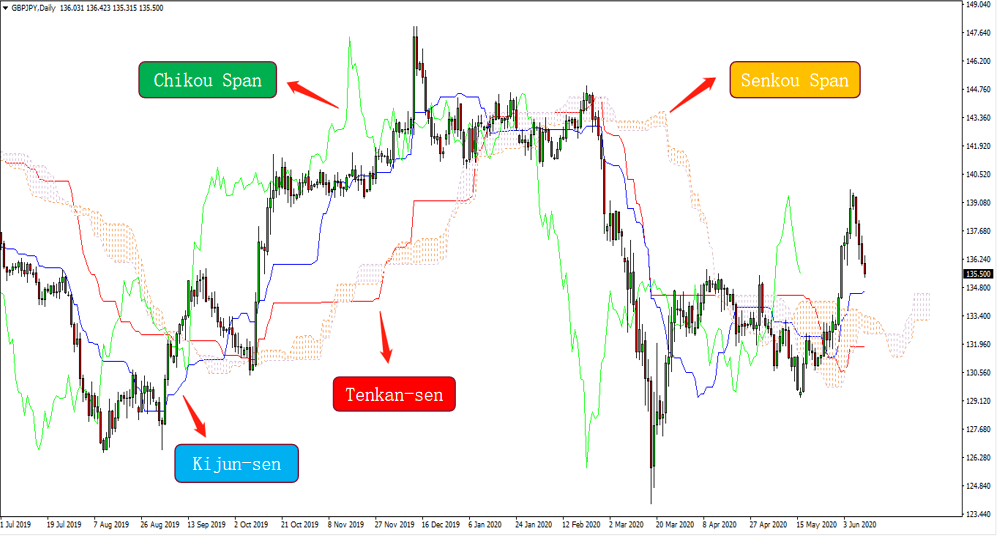

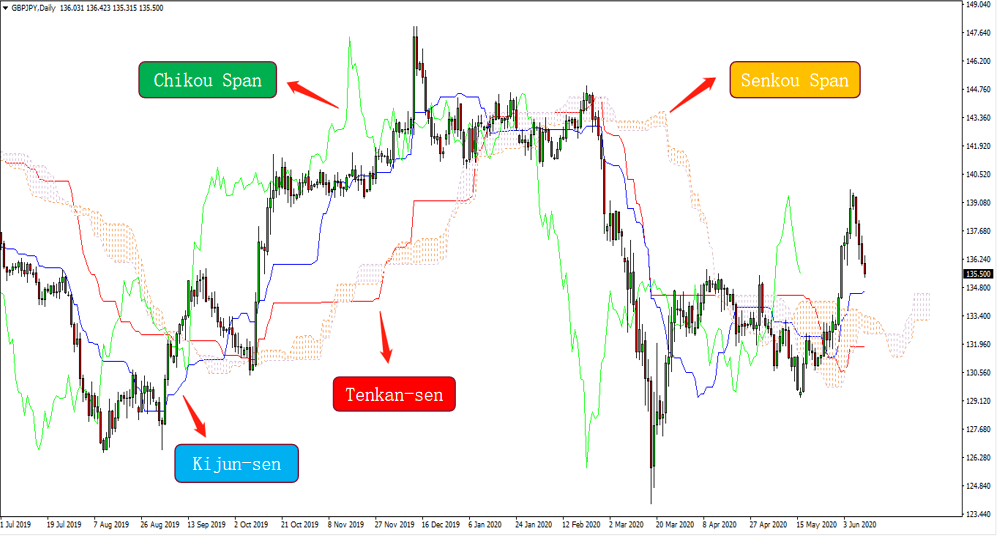

B) 5 Key Elements of Ichimoku

1) Kijun-Sen (Blue Line)

▸ Acts as an indicator of future price

movement.

▸ If the price action is above the

blue line, it has potential to climb

higher

▸ If the price action is below the

blue line, it has potential to fall

lower

▸ It is calculated by adding the highest high & lowest low for the past 26 periods and then divided by

2

(Highest

high + Lowest low)/2 for the past 26 periods

![]()

2) Tenkan-sen (Red Line)

▸ Acts as an indicator of the market trend

▸ If the red line is moving up or

down, it indicates that the market is

trending

▸ If the red line is moving

horizontally, it indicates that the

market is ranging (uncertain)

▸ It is calculated by adding the

highest high & lowest low for the

past 9 periods and then divided by 2.

(Highest high + Lowest low)/2 for

the past 9 periods

![]()

3) Senkou Span A (Cloud)

▸ Represents one of the two edges of

the cloud.

▸ Calculated by adding the tenkan-sen

& kijun-sen, dividing it by 2 and

plotted 26 periods ahead.

(Tenkan-sen + Kijun-sen)/2 plotted

26 periods ahead

![]()

4) Senkou Span B (Cloud)

▸ Represents the other edge of the cloud.

▸ Calculated by adding the

highest high & lowest low for the past 52 periods, dividing it by 2 and

plotted 26 periods ahead.

(Highest high + Lowest low)/2

for the past 52 periods and plotted 26 periods ahead

▸ Having both the Senkou Span A &

B line, we can obtain the key resistance

and support level for future price movement.

▸ If the price is above the Senkou

span, the top line represents the 1st support level while the bottom line represents

the 2nd support level.

▸ If the price is below the Senkou

span, the bottom line represents

the 1st resistance level while the top line represents the 2nd resistance level.

▸ If the price is in the middle of the

cloud, it suggests to wait for a

breakout before entering the market.

![]()

5) Chikou Span (Green Line)

▸ Acts as an signal indicator.

▸ If the line cross the price from the bottom-up direction, it is a buy signal.

▸ If the line cross the price from the top-down direction, it is a sell

signal.

▸ Calculated using today’s closing

price plotted 26 periods back on

the chart

C) Overview

D) Application Of Ichimoku

(Signal)

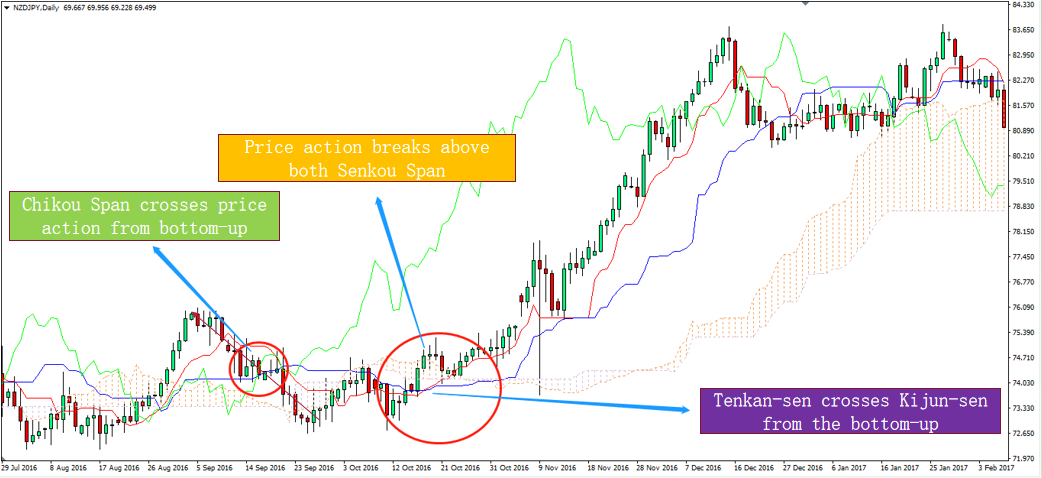

1) Buy Signal

▸ When price action breaks from the

bottom-up of both the Senkou span

(Cloud)

▸ When Tenkan-sen (red) crosses above

the Kijun-sen (blue) from the bottom-up

▸ When Chikou span (green) crosses

above the price from the bottom-up

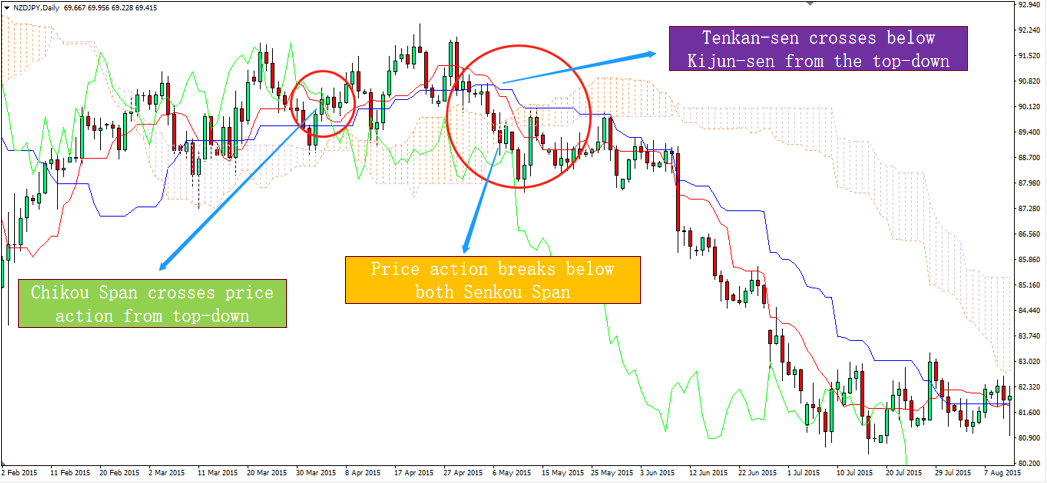

2) Sell Signal

▸ When price action breaks from the

top-down of both the Senkou span

(Cloud)

▸ When Tenkan-sen (red) crosses below

the Kijun-sen (blue) from the top-down

▸ When Chikou span (green) crosses

below the price from the top-down

Follow Regain capital

latest articles

-

- Jun 11,2020

-

- Jun 11,2020

-

- Feb 27,2020

-

- Feb 27,2020