Advanced – Moving Average

(A) Introduction

▸ One of the indicators used to smoothen out price action and obtaining the general path of recent past price movement.

▸This indicator draws a trend by calculating average of a defined number of time periods (candlestick).

▸For example, a 20-MA line is drawn by calculating the average closing price for past 20 candlesticks.

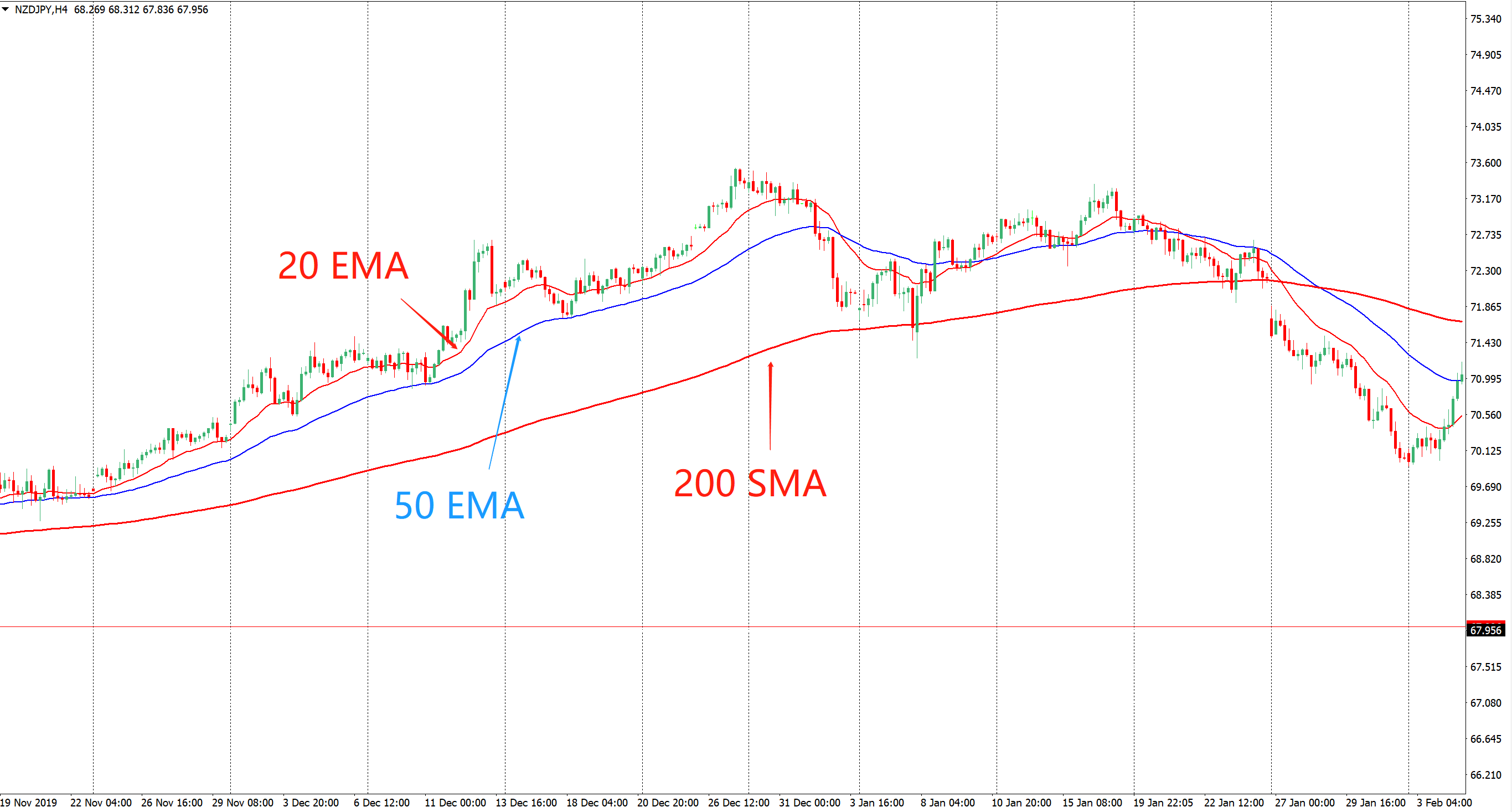

▸Investors can simply insert the desired number of average time periods according to their liking where it can vary from an average of 5 to 200 candlesticks.

▸The longer the period you use for the MA-line, the slower it reacts to the price movement (the further it is away from the price)

▸An Exponential Moving Average is different in a way that it takes into more consideration of the price actions in most recent periods than previous periods.

▸For example, a 5-MA average the movements of 5 candlesticks with the same weightages, however 5-EMA average the movements of 5 candlesticks but applies higher weightages on the 3rd, 4th & 5th candlesticks.

▸To simplify, EMA emphasis more on how traders react based more on the most recent price actions.

(B) Uses of Moving Average

▸Determine an overall trend for the instruments.

▸Obtaining signals from crossovers between 2 MA-lines whereby if the short-term MA-line crosses above the long-term MA-line (golden cross) indicates a buy signal; short-term MA-line crosses below the long-term MA-line (death cross) indicates a sell signal.

▸Can also be used as support and resistance.

(C) Limitations of Moving Average

▸A lagging indicator whereby signals from the moving average comes after the price reaction.

▸Only provide a ‘general’ trend based on past price actions.

▸Short period moving average will often have lower accuracy compared to longer period.

Follow Regain capital

latest articles

-

- Jun 11,2020

-

- Jun 11,2020

-

- Feb 27,2020

-

- Feb 27,2020