Advanced Level-FIBONACCI RETRACEMENT

Feb 27,2020

(A) Introduction

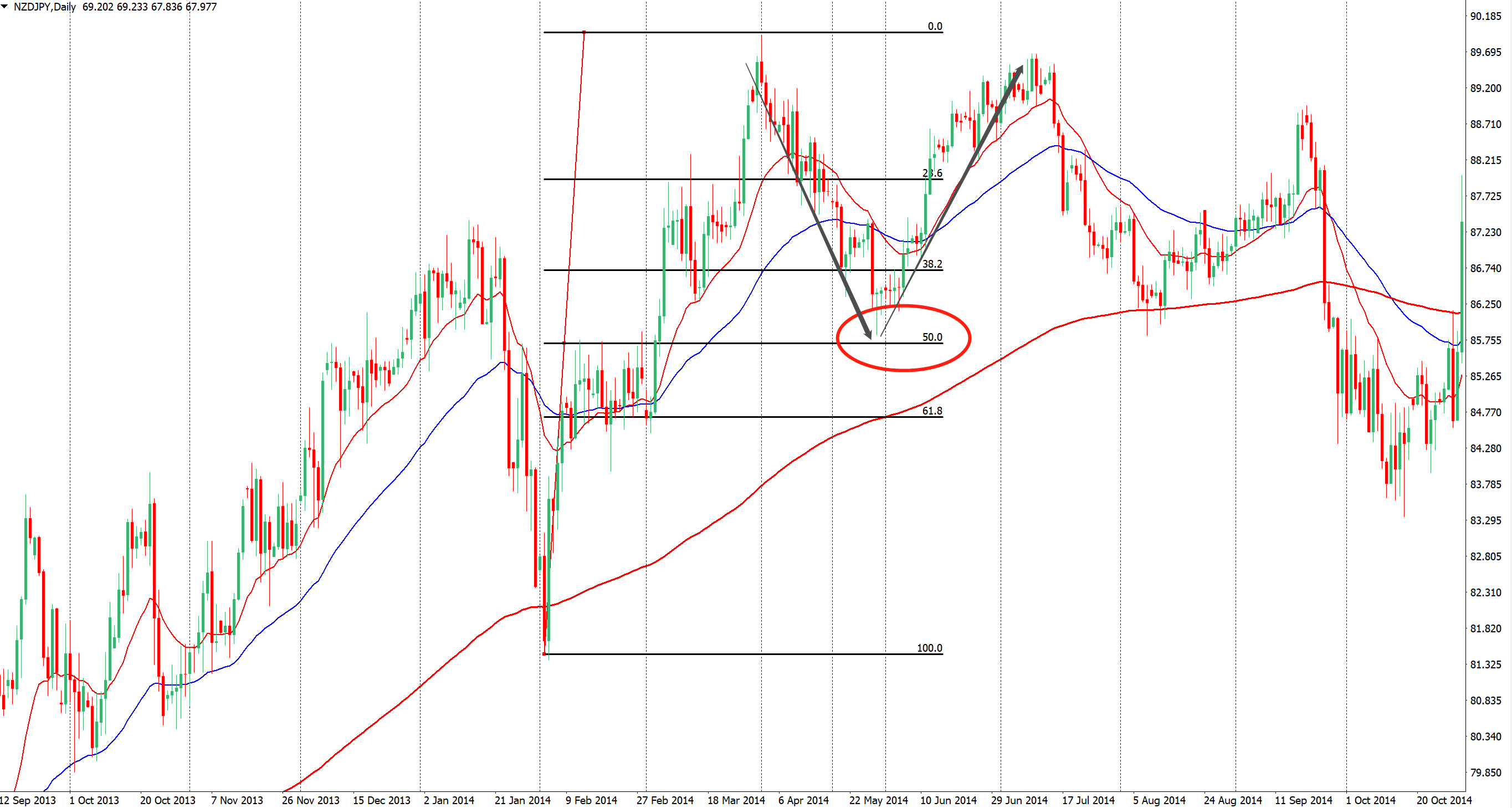

- ▸Fibonacci Retracement (Fibo) is a tool that is based on key numbers or also known as psychological levels which are used to predict levels for potential reversals.

- ▸Besides that, the key numbers can also be used as resistance or support levels.

- ▸Fibo can only be used when there is a potential trend reversal where it is then pulled from the starting point to the ending point of the previous trend before the reversal happens. Note that trend reversal can be a rebound or retracement.

(B) Uses of Fibonacci Retracement

- ▸In general, the Fibo is used when an instrument changes its major trend either from bullish to bearish or vice versa. A Fibo is then drawn showing key supports or resistance for the new trend.

- ▸The Fibo have 6 major key levels being: 0%, 23.6%, 38.2%, 50%, 61.8% and 100% where the breakout above or below the key level 23.6% normally acts as confirmation for the major trend reversal. This said, investors will normally wait until the retracement breakout from the 23.6% key level before entering into the market.

- ▸All of the key levels in the Fibo can act as psychological resistance and support levels.

(C) Limitations of Fibonacci Retracement

- ▸Fibonacci Retracement can only be used when there is a reversal in trend and not for instruments that has achieved new high or new lows.

- ▸Many traders will tend to wrongly draw the Fibo which would in turn provide false indications and signals. Therefore, it is utmost important to make sure to draw Fibo accurately.

Previous article: Advanced – Moving Average

Next article

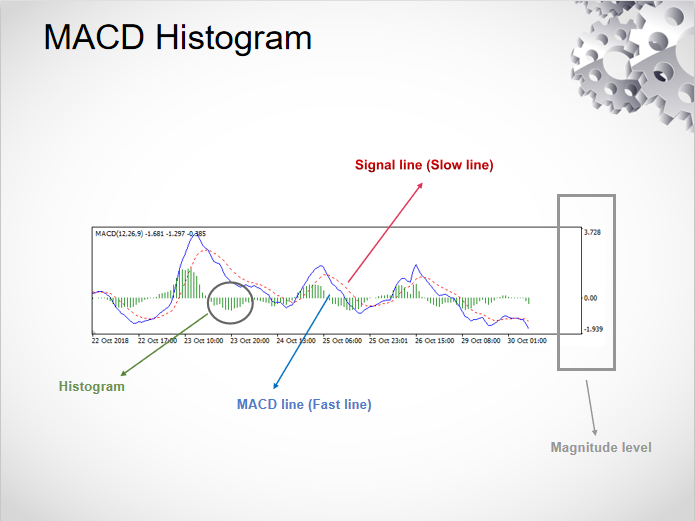

: Advanced Level – MACD – Histogram

Share :

Follow Regain capital

latest articles

-

- Jun 11,2020

-

- Jun 11,2020

-

- Feb 27,2020

-

- Feb 27,2020