Impact of Coronavirus In Different Scenarios

In our previous article, we discussed the outbreak of the Coronavirus (CoV) and its impact on the financial market. As of now, the epidemic virus had caught global attention, with China citizens isolating themselves as a step of precaution while the World Health Organization (WHO) and medical research centers around the world all struggling to prevent further spreading of the virus and also a find a possible cure for it.

As the virus profoundly affects the economic activity not only in China but in other countries as well, it would also affect the financial markets significantly. In the FX market, the US dollar, China Yuan, Australian dollar and New Zealand dollar, Canadian Loonie, safe-haven Yen, and Swiss Franc, as well as commodities including precious gold and crude oil, are the major markets that are impacted the most by the Coronavirus.

The fundamentals of the impact are full range, where it could directly affect a country’s currency due to weak economic outlook amid the virus, or it would jeopardize sectors with low oil consumption especially in China; harming global demand towards the oil, or it could act as a market risks catalyst, prompting prices of safe-haven assets.

In today’s article, we would be covering three possible scenarios, namely: good, neutral, and bad.

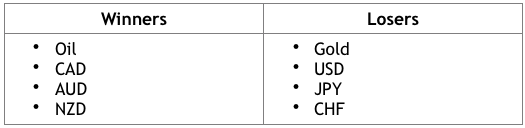

The Good

Under a ‘good scenario’ situation, we imply that the virus slowly decreases (becoming less severe), which would gradually diminish market fears while boosting economic confidence, thus restoring global oil demand.

As Canada’s economy is highly dependent on oil exports, the recovery demand and oil prices will also boost the Canadian dollar. Economy prospects in China will also tilt upwards, providing support for its major partners, namely Australia & New Zealand. Also, with lower risks, safe-haven such as gold, US dollar, Japanese Yen, and Swiss Franc will fall in demand.

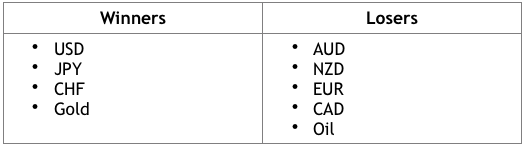

The Neutral

Under a neutral-scenario situation, we imply that the virus persists but does not intensify; this would then remain as a market risk where the global economic outlook is still dampened. This scenario would make safe-haven assets the most massive market winner while China Yuan, Australian, and New Zealand dollar continues to be pressured. Oil demand would remain low, applying pressure onto the Loonie as well.

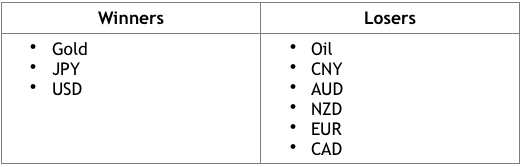

The Bad

Lastly, under a bad-scenario situation, we imply that the virus intensifies, and the outbreak worsens; this would place the virus as a serious global threat, causing investors to seek shelter in safe-haven assets; jeopardizing global economic outlook and growth altogether which could send oil price lower and also pressuring China, Australia, and New Zealand.

In the meantime, we must wait for the uncertainty cloud to settle and realize which scenarios will remain. Without any further comments, this 2020 will be well remembered.

Photo Credit: www.cartoonmovement.com

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020