The Strength Of US Dollar; A Kind Of Safe-Haven

The dollar index, traded against a basket of six major currency pairs, started its rally since the start of the year 2020. As of now, the index had gained over 2.67% from 96.00 in January to 98.60 today. The strong rally continues to be supported by a stable US economy and global risk, which put the US dollar under the spotlight.

Recent economic data from the US prove that the country is doing well, despite global market risks such as global economic slowdown, trade uncertainties, and the latest Coronavirus (CoV) outbreak. Market preference towards the dollar remained on the upside, making the dollar safe-haven assets amid global turmoil.

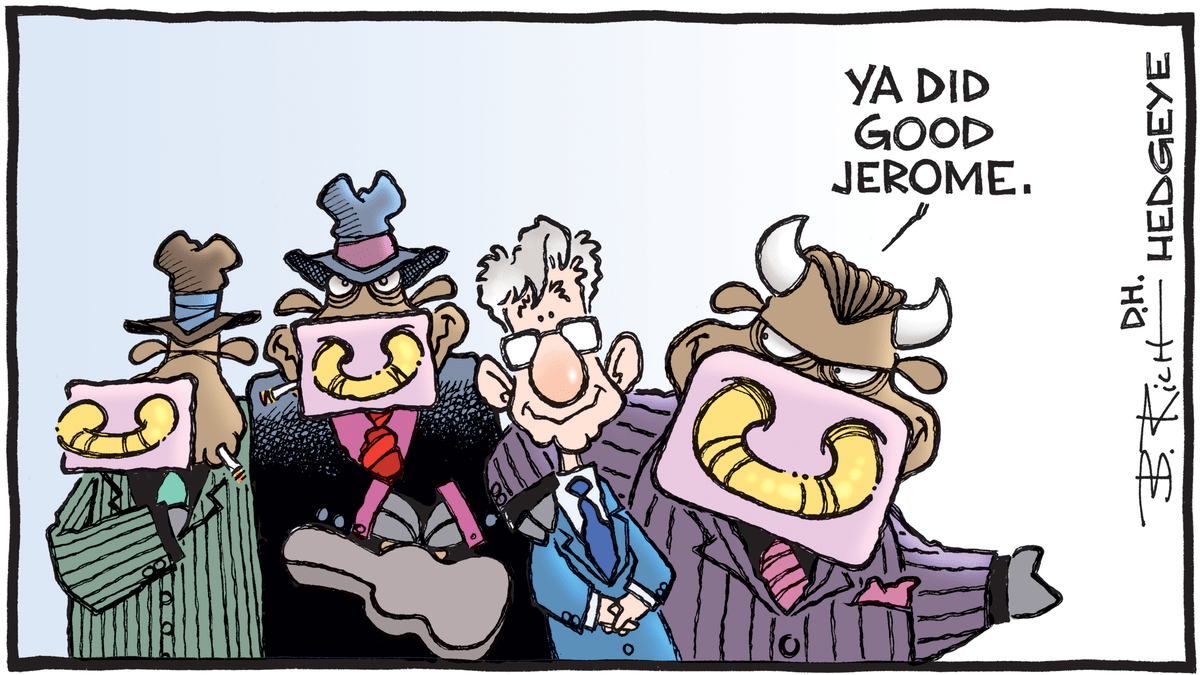

During the Federal Reserve (Fed) 2-day testimonial, Chairman Jerome Powell reiterated that the US economy remains resilient, with wage growth picking up, unemployment at a record low, and increasing job creation. With key data pointing towards the upside as well, the Fed does not see the need to cut interest rates in the meantime.

However, Powell did mention about the country’s rising debt that is considered as a long-term issue and stated the need to tackle the problem. Aside from that, Powell also mentioned the latest outbreak of the CoV and the impact it has on the global economy but emphasized that it is still early to take measures against the epidemic.

The reason that the dollar is gaining against other safe-haven such as the Yen and Swiss Franc amid the global risk is because of market confidence towards the US economy. Despite being pressured by concerns of export disruptions to China and its tourism to the US, the country was still able to sustain well and continue expanding, as seen in the set of economic data throughout January.

Furthermore, the interest-bearing dollar also received higher demand when compared to other major currencies, as the economic outlook for other countries is falling short against the US. Further confirmation will depend mainly on upcoming financial data from the region.

Photo Credit: https://app.hedgeye.com/

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020