Impact of US Jobs Data: Stronger Dollar; Gold Unstoppable

US released its monthly jobs data: Non-Farm Payrolls (NFP); Unemployment Rate; Average Hourly Earnings last Friday. NFP represents the total number of jobs created for the non-farm sector in the US for the previous month; the Unemployment rate shows the overall percentage of people in the labor force who are currently unemployed; the Average Hourly Earnings indicates the growth of average hourly wages in the US.

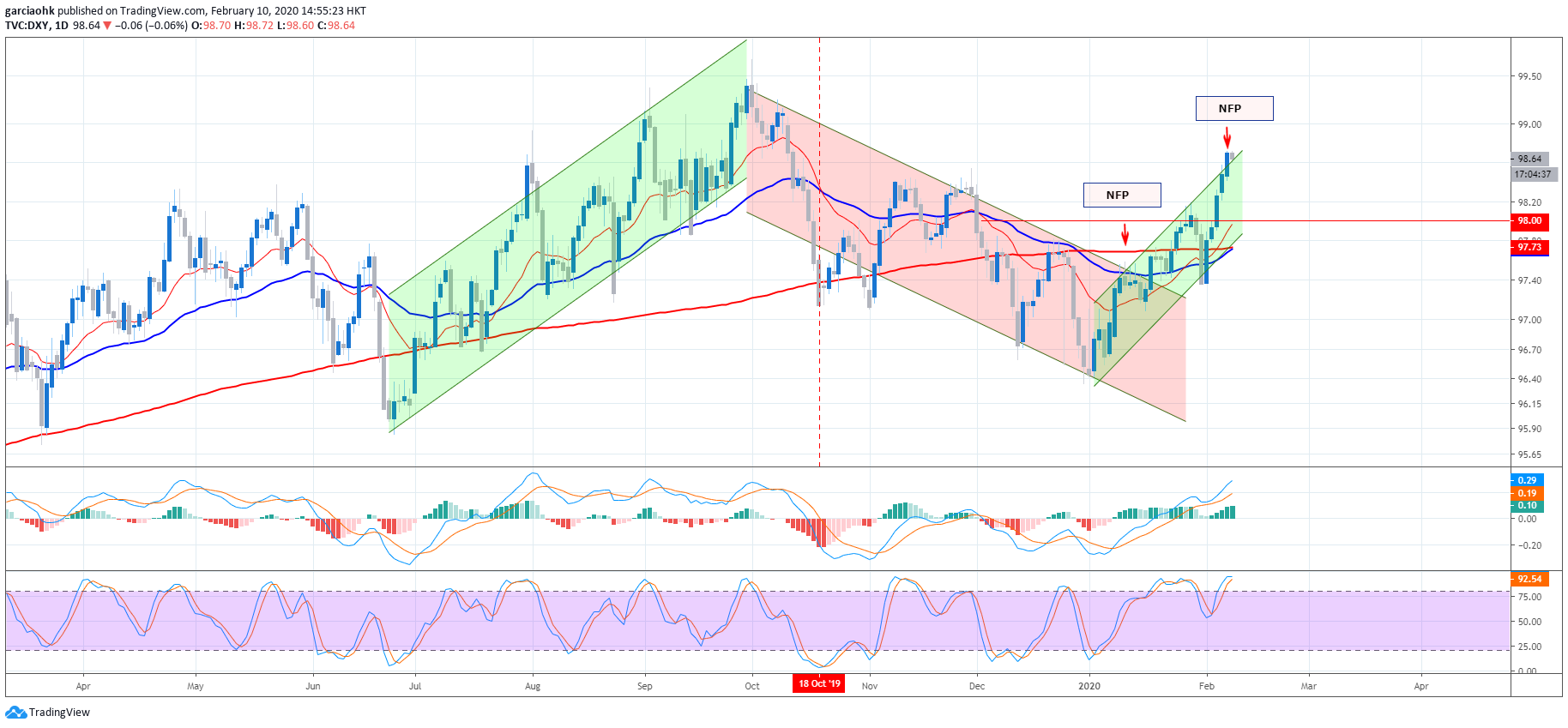

According to last Friday’s reports, the total number of jobs created for the month of January rose to 225K, beating economists’ expectations to increase only to 160K. However, the unemployment rate rose to 3.6% from the previous record low of 3.5%, while wage growth was slower than expected, with a reading of 0.2% compared to 0.3%. However, when compared to the previous reading, wage growth picked up from 0.1% in December to 0.2%.

As the much-anticipated data is well-known for its impact towards more significant market movements, last Friday’s release of US jobs data provided the catalyst needed for the DXY (Dollar Index) to climb higher above its 98.00 handle. Major currencies paired against the US dollar were pressured, with both the pound and euro both pressured towards crucial support zone.

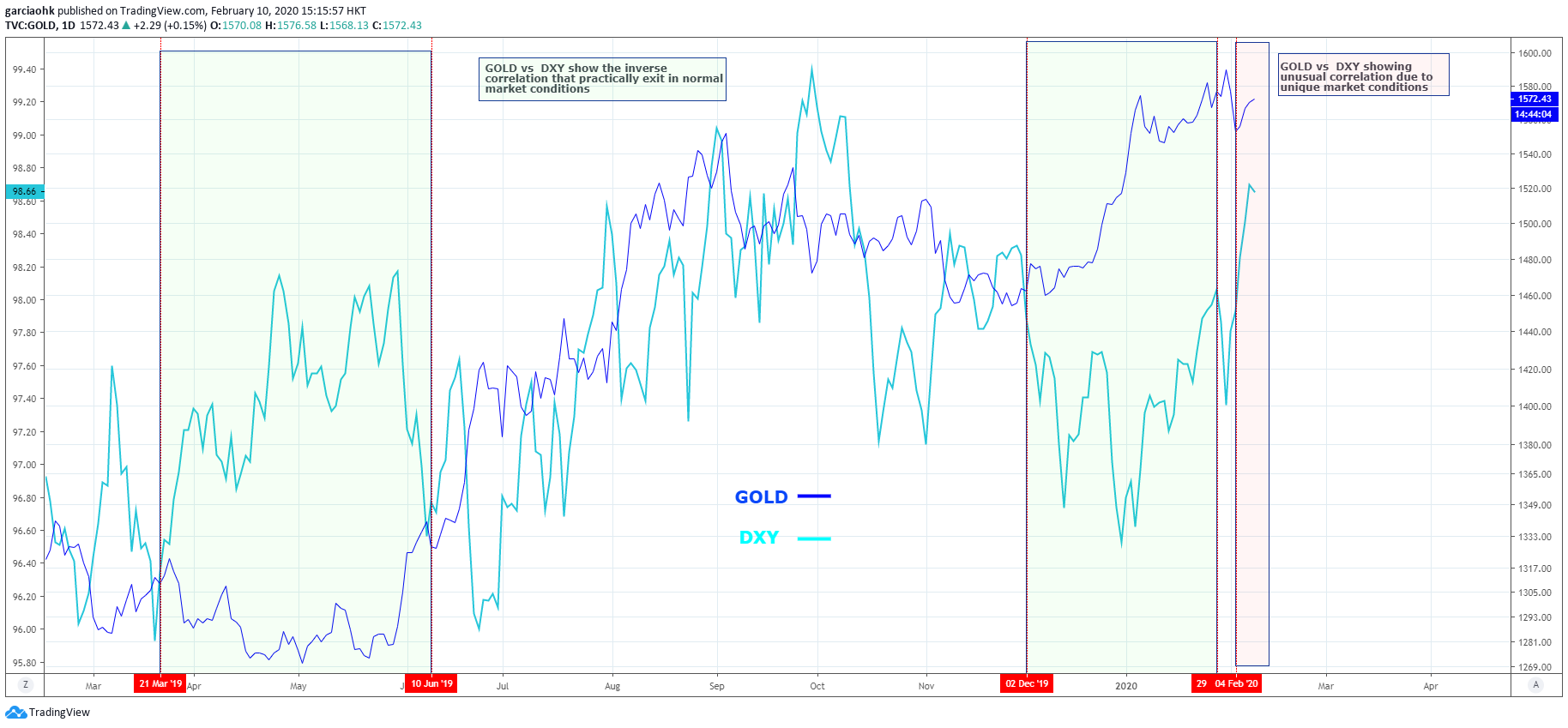

Nonetheless, confusion is lingering around the gold market, whereby the overall upbeat data from the US failed to drag the safe-haven lower. When compared with other safe-haven assets such as the Yen and Swiss Franc, gold managed to hold its grounds while recording gains on Friday above its $1,570 handle.

From the more significant point of view, global market risks were offsetting the impact of bullish data on the gold price, providing to the yellow metal the support needed to fight-off a stronger dollar. Persisting market risks such as Outbreak of Coronavirus, trade war, and global economic slowdown remain the fundamental factor for a higher gold price.

Comparing the gold market against the DXY market, stronger rally in the safe-haven gold is telling the market that it requires more than just upbeat data for gold to lose its shininess. Further signals can be obtained during the release of US inflation data, namely: Core CPI.

Photo Credit: http://jewel1067.com

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020