Beginner’s Guide-Forex Market Trading Hours

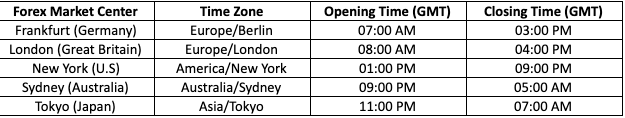

Although the forex market may open 24 hours a day, but that doesn’t mean that the market is always active throughout the entire day. The market consists of multiple trading sessions that could affect the volatility of the market in 24 hours. Below are the examples of major trading sessions in the Forex.

If we had to pick only one time of the day to trade the market, that would undoubtedly be the New York-London overlap, which starts at 1:00 PM GMT with the open of the New York session, and ends at 4:00 PM GMT with the close of the London session.

These trading hours have not only the highest liquidity, but also the highest volatility, as a lot of important market reports are released during these hours.

*Opening and closing times will vary during the October/ November and March/April as some countries shift to/from daylight saving.

Currencies and trading sessions: what and when to trade

Another important aspect of Forex trading session is knowing which currencies to trade during which trading sessions. Again, this is important for scalpers and day traders, as they hold their trades for a relatively short period of time compared to swing and position traders.

Currencies such as the Australian dollar and New Zealand dollar are less traded than other majors, such as the US dollar, euro, and British pound. The Sydney session, for example, could increase the liquidity for AUD pairs compared to other sessions. Bear in mind that the NY-London overlap can be used to trade any currency pair.

In between each forex trading session, there is a period where two session are open at the same time, overlapping with each other. Naturally these periods of time are the busiest times during the trading day because there are more trading volumes in the market with two active session combined. For instance, from 8PM to 12PM there are 3 trading sessions overlapping with each other which is Europe, London and U.S, causing that period to be the peak trading hours. Moreover, most US data and forex news are announced at this period, thus causing higher trading volume in the market. As a market trader, it is also important to schedule your trading hours according to the best period time so that you could utilize the most out of the trading session.

Trading Time Frames

When you are trading in the biggest financial market in the world, it is important to choose the suitable timeframe according to your personal trading style and strategy. Beginner forex traders usually focus on getting profits quickly therefore choosing a small timeframe but end up getting frustrated and lose money due to choosing the wrong time frame that doesn’t fit their trading style and personality. Timeframe refers to the period each candle represents the segment of time you choose to trade. Below are the examples of timeframes that you could choose according to your trading preference.

-

M1 = 1 Minute

-

M5 = 5 Minute

-

M15 = 15 Minute

-

M30 = 30 Minute

-

H1 = 1 Hour

-

H4 = 4 Hour

-

D1 = Daily

-

W1 = Weekly

-

MN = Monthly

Choosing a specific timeframe to analyze the market could define what kind of trader you are:

-

Scalper: Making profit on very small price changes, therefore focuses on smaller timeframes like 1 or 5 minutes.

-

Day-trader: Capitalize intraday movements, so probably the best timeframes are 15 minutes – 1 hour – 4 hours.

-

Investor: Getting a profit in the long term, trade on daily and weekly (or even monthly) charts.

Follow Regain capital

latest articles

-

- Mar 11,2022

-

- Jan 25,2022

-

- Jan 25,2022

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 17,2022