Beginner’s Guide-Buying and Selling Currency Pairs

What Is a Currency Pair?

A currency pair is the quotation of two different currencies, with the value of one currency being quoted against the other. The first listed currency of a currency pair is called the base currency, and the second currency is called the quote currency.

Currency pairs compare the value of one currency to another—the base currency (or the first one) versus the second, or the quote currency. It indicates how much of the quote currency is needed to purchase one unit of the base currency. Currencies are identified by an ISO currency code, or the three-letter alphabetic code they are associated with on the international market. For example, the ISO code for the U.S. dollar would be USD.

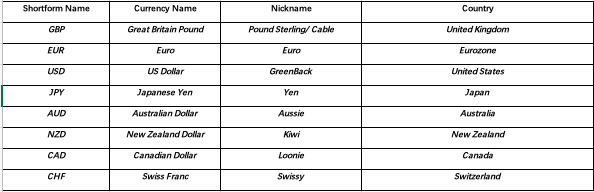

Below are the main currencies that could be traded in the Forex Market.

Forex trading is the simultaneous buying of one currency and selling another and usually is traded through a broker or dealer, and are traded in pairs. For example, the euro and the U.S. dollar (EUR/USD) or the British pound and the Japanese yen (GBP/JPY).

Major Currency Pairs

The most traded pairs of currencies in the world are called the Majors. They constitute the largest share of the foreign exchange market, about 85%, and therefore they exhibit high market liquidity. The Majors are: EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, NZD/USD and USD/CAD.

Minor currency pairs

Besides that, currency pairs that isn’t paired with the US Dollar (USD) are also known as cross-currency or minor pairs. The most actively traded crosses are derived from the three major non-USD currencies such as EUR, JPY and GBP. Attached below are the major cross pair or minor pair

Here are a few minor currency pairs:

EUR/GBP — Euro/British pound

EUR/AUD — Euro/Australian dollar

GBP/JPY — British pound/Japanese yen

CHF/JPY — Swiss franc/Japanese yen

NZD/JPY — New Zealand dollar/Japanese yen

GBP/CAD — British pound/Canadian dollar

*The most widely traded minor pairs consist of the euro, yen or British pound.*

Exotic currency pairs

An exotic currency pair includes a major currency and the currency of a developing economy (such as Brazil or South Africa).

*For exotic pairs, these pairs aren’t as heavily traded as the major pairs, so the transaction costs (spread) associated with trading these pairs are usually bigger. *

When should you BUY and SELL while trading in Forex?

The value of currencies appreciates or depreciate against other currencies because of the difference in demand and supply, whereby the demand and supply mostly depends on the health of a country’s economy. If the economy of a country is strong, the demand for its currency will normally be higher. Generally, a buy position in forex trading means you are buying a currency which you feel that its value will strengthen against another currency; a sell or short position in forex trading means you are selling a currency you hope that its value will weaken against another currency. Similarly, we can SELL the pair if you think that the base currency will DEPRECIATE compared to the quote currency.

Taking a position in the Forex market

When a buy (sell) order is executed, it basically means you are entering a buy or long (sell or short) position for the instrument instead of buying (selling) ‘physical’ money and thus no physical exchange of money ever takes place.

A Buy position is executed when we expect market for the base currency to be stronger or the quote currency to be weaker. (The currency pair increases in value). For example, if you expect the euro to strengthen against US dollar, you enter a buy position for the pair EUR/USD. When the pair appreciates in value, you then close your position to earn your profits.

Vice versa, a Sell position is executed when we expect market for the base currency to be weaker or the quote currency to be stronger. (The currency pair decreases in value). For example, if you expect the pound to weekend against the US dollar, you enter a sell position for the pair GBP/USD. When the pair depreciates in value, you then close your position to earn your profits.

*Take note that sell positions in the FX market are all short selling, which means that you are borrowing the asset from your broker, and when you close your positions, you are buying back the asset from the market to return to your broker. Therefore, if you sell a currency pair at a higher price, and when the price of the currency falls, you buy

Follow Regain capital

latest articles

-

- Mar 11,2022

-

- Jan 25,2022

-

- Jan 25,2022

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 17,2022