GBPUSD WEEKLY ANALYSIS – Pound’s Rally In Questioned; Brexit Woes Remain

Market Strategist

GBPUSD WEEKLY ANALYSIS – Pound’s Rally In Questioned; Brexit

Woes Remain

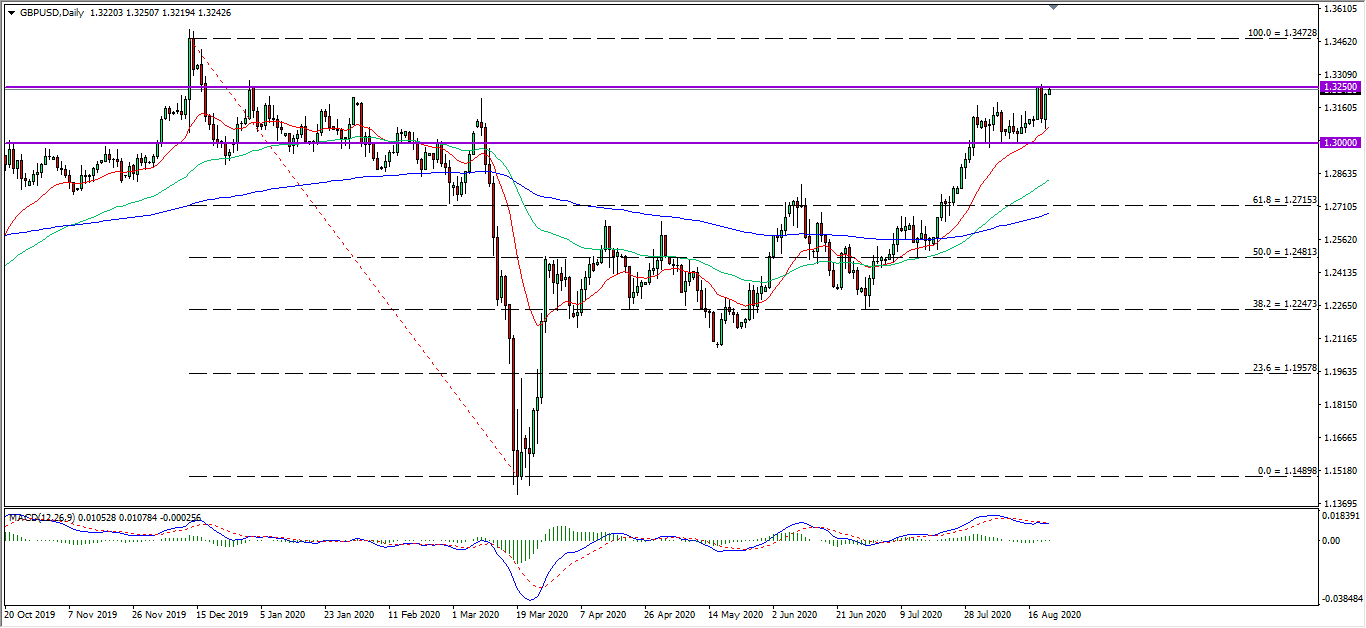

Following the previous report on GBP/USD, the pair gained strong

bullish momentum, breaking above its 61.8 Fibonacci level near 1.2700 and the

psychological resistance at 1.3000. The pair later found rejection from its

January resistance near 1.3250, retracing back to its 20-MA line (red). However,

the downward pressure was short-lived as the pair now retests the 1.3250

resistance. A breakout above the resistance suggests the pair to extend its

gains towards the 100.0 Fibonacci level at 1.3470, the level last seen since

December 2019.

In terms of MACD, bearish momentum has weakened but persists,

indicating potential technical correction for the pair after its strong rally

throughout July. Supporting a technical correction is the over-extended gap

between the 20-MA (red) and 60-MA (green), where the current resistance level

plays an important role in determining the pair’s near term movement. Failure

to break above that level could potentially send the pair into a consolidation

zone between 1.3000 and 1.3250; Or a strong technical correction towards its

60-MA line near 1.2800.

From the fundamental front, the GBPUSD rally was mainly supported by

the weakness in the dollar. Struck by the pandemic’s impact, and tensions

within the US government in implementing new stimulus had dragged the dollar to

its lowest level since May 2018. Lack of confidence in the world’s strongest

economy led investors into alternative markets such as the euro and the pound,

where economic recovery in other countries are more convincing.

Aside from the uncertainties arising from the US, investors’ focus

is now returning towards the UK’s major economy problem: Brexit. After talks

were stalled amid the pandemic, the UK and EU are now resuming to strike a deal

before the December 31 deadline. However, the situation is turning gloomy as

little time is left for negotiations. Fishing rights and post-Brexit

competition remain the sticking points for Brexit, where negotiators will meet

again on Friday to discuss these issues.

As a summary, the long-term trend for the pair remains

bullish-biased. However, a change in fundamentals such as Brexit updates might

affect the movement for the pair.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022