GBPUSD WEEKLY ANALYSIS – Price Action Failed To Break Above; Heading Back Towards Support Zone

Market Strategist

GBPUSD WEEKLY ANALYSIS – Price Action Failed To Break Above;

Heading Back Towards Support Zone

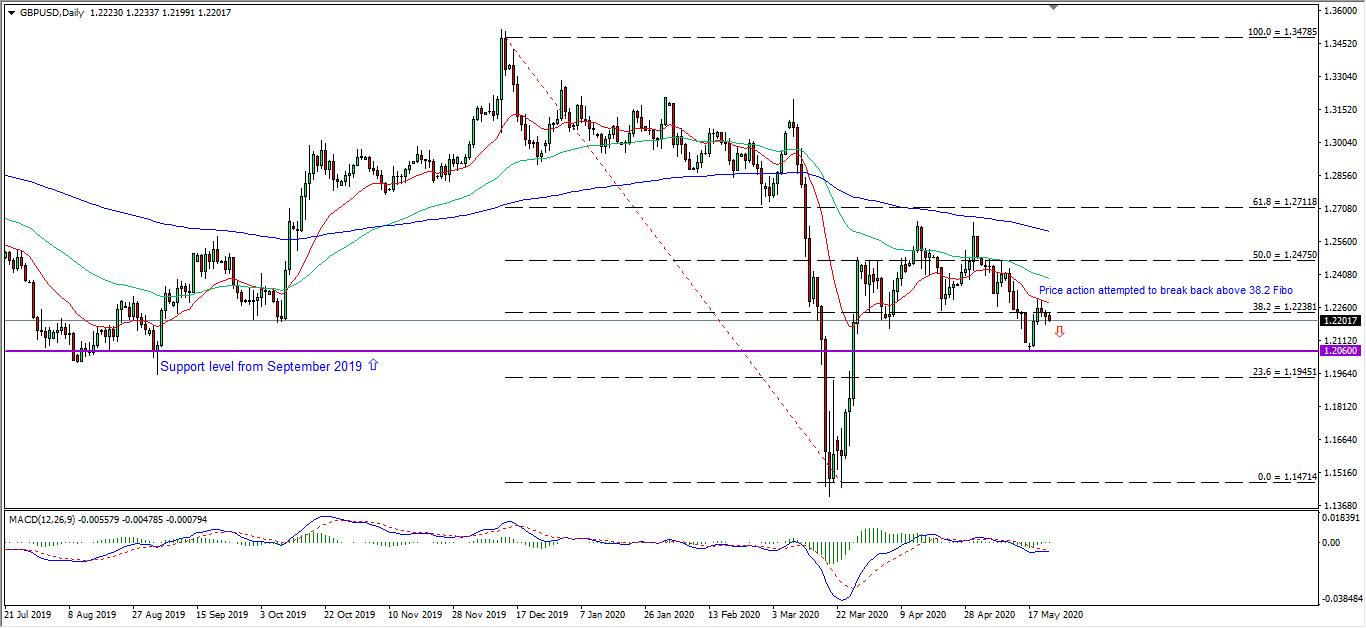

Following the previous report on GBP/USD, price action extended

lower towards the support level from September 2019 near 1.2060, before

rebounding from the level to retest its 38.2 Fibonacci level near 1.2240.

However, the pair was then rejected by its 20EMA near to the 1.2300

psychological level and was traded lower back below the 38.2 Fibo level. Price

action is suggested to extend its loss back towards the support of 1.2060,

whereby a further breakout would suggest the pair to extend even lower towards

the 23.6 Fibo level near 1.1940.

Following the price action’s rebound from its support level, the

bearish momentum from the MACD slowly diminishes, however, failed to form a

golden cross, now continues to signal a bearish momentum. In terms of moving

averages, both short-term and long-term EMA are also supporting further

downside potential for the pair.

From the fundamental front, the Bank of England (BOE) had shifted

their stance towards their monetary policy during the recent speech on

Wednesday, led by Governor Bailey. Previously, the BOE mentioned that negative

interest rate is not something that they are looking into. However, Bailey

later stated that although negative rate is a very complex policy tool that

differs depending on the structure of a country’s financial system, they will

continue to monitor how UK’s economy responds to recent cuts first before

implementing a negative rate.

The shift in tone by the BOE had led the market’s expectation

negative rate adoptions higher, causing investors to sell-off the currency.

Furthermore, Brexit negotiations failed to report any progress, with the

deadline to request for a further extension beyond 31st December is

now due in 6-weeks time. Although UK Prime Minister Boris Johnson had

reiterated that no form of extension would be considered, it increases the

likelihood of a no-deal Brexit.

All in all, the outlook towards the UK’s economy and its currency is

not looking good, dragging down investors’ confidence overall as well.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022