GBPUSD WEEKLY ANALYSIS – Bumpy Road Ahead; BOE Interest Rate & Brexit Extension Decision

Market Strategist

GBPUSD WEEKLY ANALYSIS – Bumpy Road Ahead; BOE Interest Rate

& Brexit Extension Decision

![]()

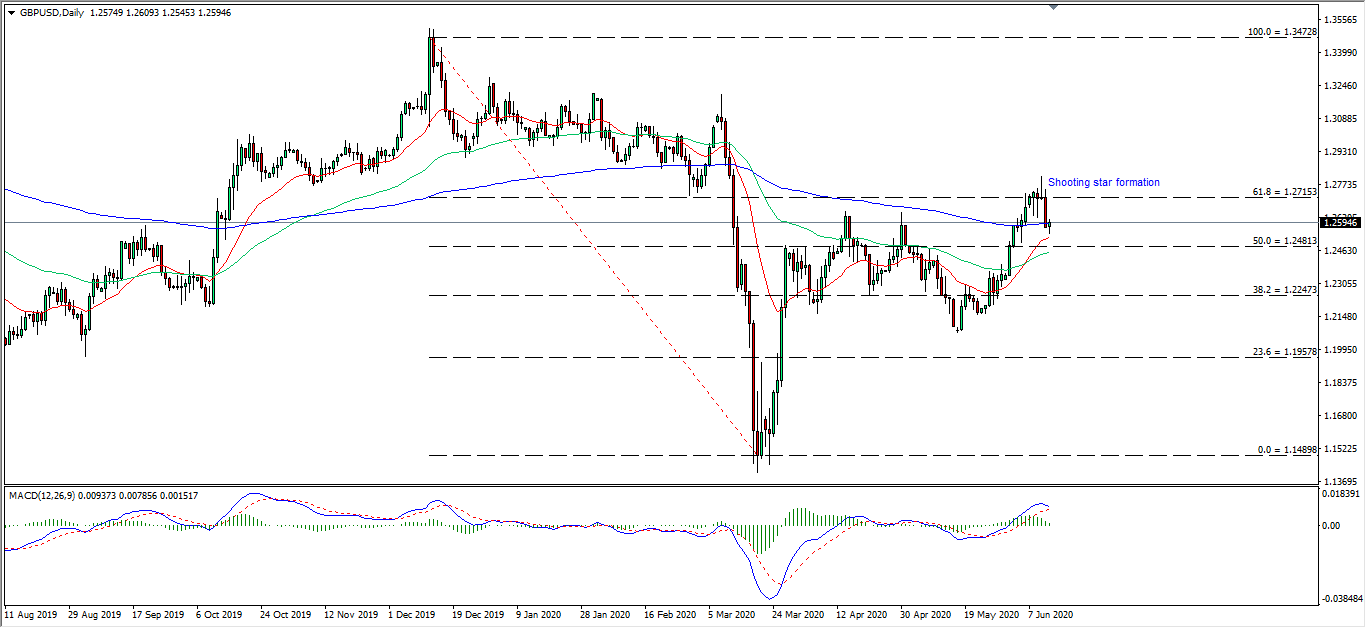

Following the previous report on GBP/USD, price action faced a

strong rejection from its 61.8 Fibonacci level near 1.2710, forming a shooting

star followed by a bearish engulfing candle that wiped out last week’s gains.

Price action expected to fluctuate between both 61.8 and 50.0 Fibonacci levels

where breakout from either side will provide a clearer long-term trend for the

pair.

In terms of MACD, bullish momentum is exhausted with a possible

death cross forming ahead. As the price continues to play between its 200EMA

(blue) and 60EMA (green), breakout from either side will provide further

confirmation of its near-term movement.

From the fundamental front, the Bank of England (BOE) will be

holding their monetary policy meeting on Thursday, where recent comments from

the central bank’s members are still considering negative interest rates as a

policy tool. This signals that the BOE will consider slashing their rates to

negative for the first time in history if the UK’s economy continues to slump

further amid the impact of the COVID-19.

Besides that, another downside risk faced by the UK is the Brexit

negotiations with the European Union where progress had been put to halt since

the pandemic. The UK have until the end of June to decide on whether or not

they want an extension for the Brexit transition period beyond the 31st December deadline.

Two scenarios that could be expected on the

decision are:

1) The UK request for an extension beyond the 31st December

deadline, giving both sides more time to strike a deal thus reducing the risk

of a no-deal Brexit.

2) The UK does not request for an extension, leaving them less than 6 months

time to reach a deal with the EU. This scenario will raise concerns towards a

higher chance of a no-deal Brexit.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022