OIL WEEKLY ANALYSIS – BULLS STUBBORN UNDER RISK AVERSION

Market Strategist

OIL

WEEKLY ANALYSIS – BULLS STUBBORN UNDER RISK AVERSION

Oil initially dropped on Monday on worries of

a second wave of coronavirus but rebounded after the Federal Reserve promised

to buy corporate bonds. With oil prices moving into a more stable trading range

between $35 and $40, the market remains supported just by technical.

![]()

Yesterday, the Philly Fed Manufacturing Index

climbed to a high of 27.5, against all the odds where economists’ forecast was

about a -23.0. The data proved a resilient recovery in the U.S. economy despite

rising cases in the country. As the manufacturing sector represents a

significant oil consumption sector, oil traders gauge the data as an

improvement in overall demand.

![]()

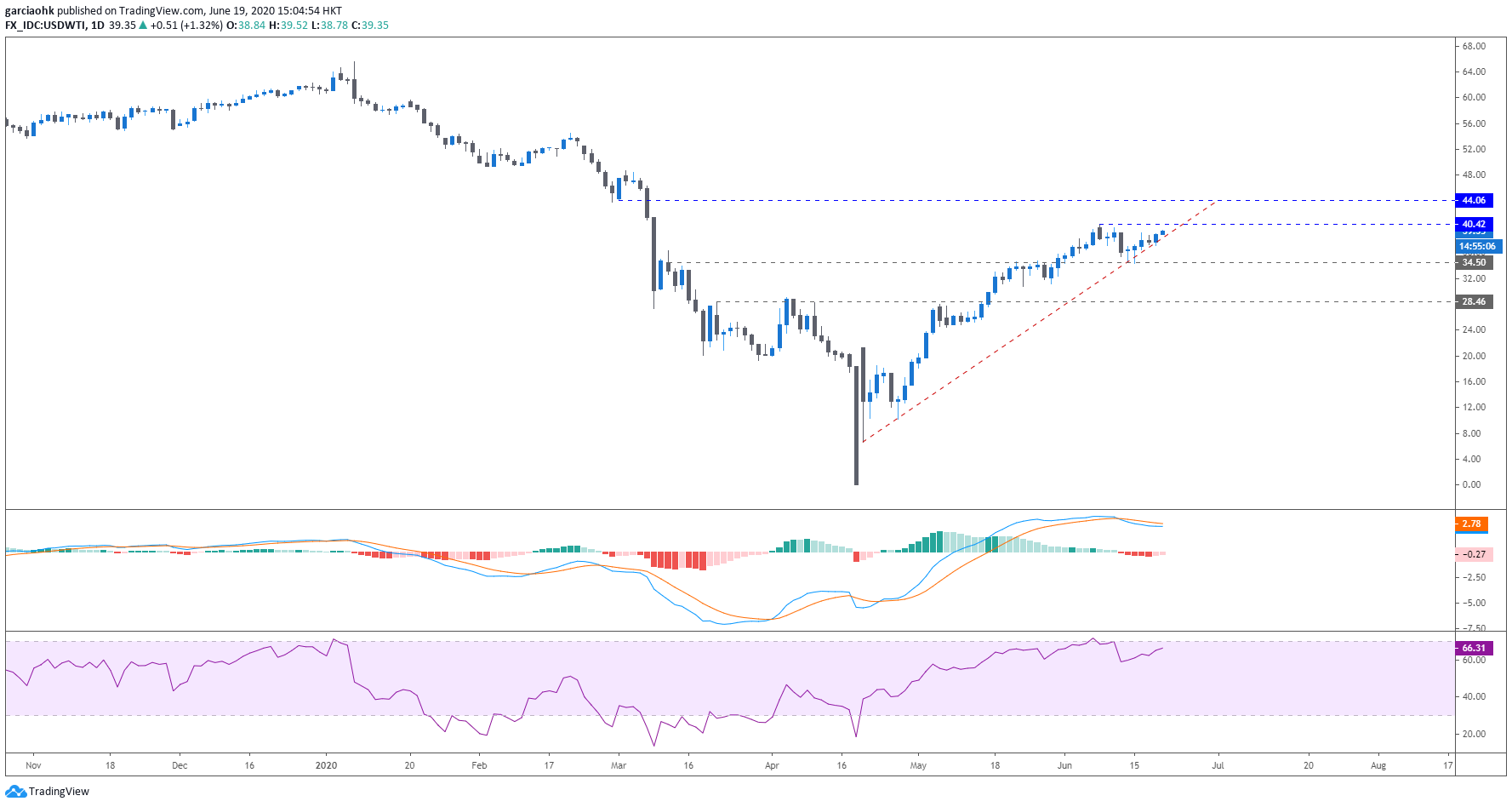

On the technicality of the price structure,

the oil benchmark was able to claim back 14.70% of the value from the lower

recorded on Monday. With the price continuing to hold tight to the rising

trendline, give a clear path to retest the 40$ handle, where bulls are lining

up to dive-in and most probably push the WTI index forward to the 44$ handle.

MACD in a diminished bullish momentum with RSI in an overbought zone, price

should experience some correction in the intraday realm.

![]()

Taking about the intraday in H4, the price

structure has practically created an inverse Head-and-Shoulder formation, a

technical pattern that supports the uptrending bias.

![]()

The second wave of coronavirus infections

poses a threat to oil. A feared second wave of coronavirus infections may have

arrived, with cases rising in many parts of the U.S., Germany, and Portugal

also reported an increase in new cases. Meantime, the pandemic’s epicenter is

now the third world, with most cases in Latin America increasing much more

rapidly. In China, new cases raised fears of a return of the virus. The

government already moving into a level II emergency response has already cancel

inbound flights for a total of 40%. With much of the market betting in a steady

rebound in demand, any resumed lockdown or economic hit would pull oil back

down as the pandemic continues to weight on the energy market. Happy weekend.

See you all next week.

![]()

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022