GBP/USD Evening Star Formation

Market Strategist

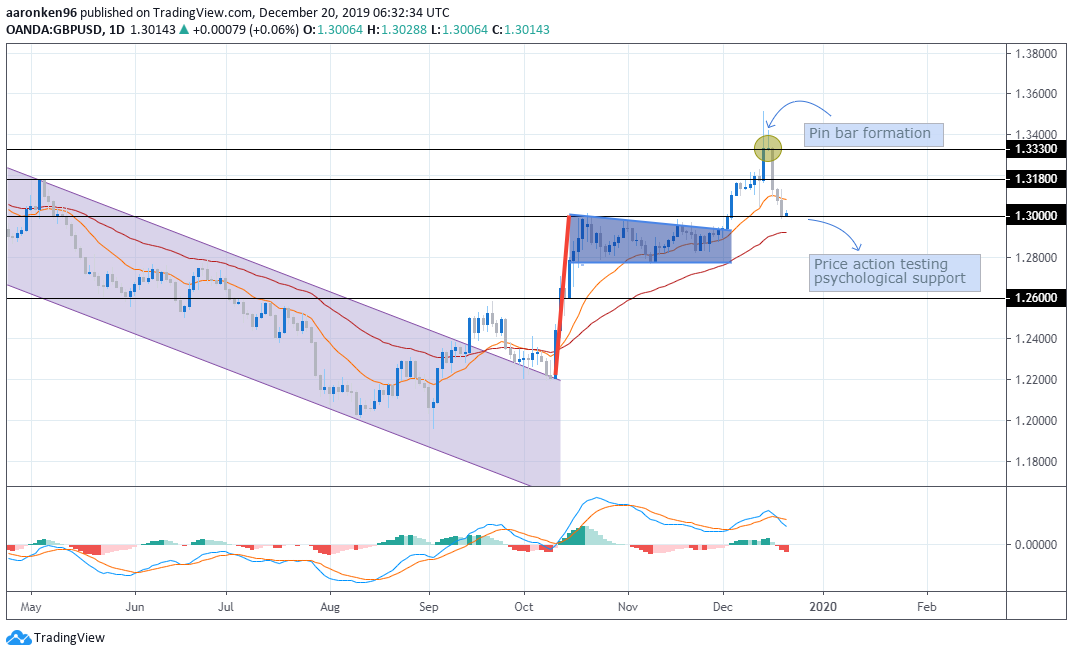

Following the previous report on GBP/USD, the pair breakout above its bullish flag formation while hitting more than a year high near 1.3500 level. However, the pair loses its upward momentum, forming an evening star below its 1.3500 level, while currently testing back the 1.3000 level.

In terms of MACD, momentum shifted to the bearish zone, together with a death-cross formation. The pair has the potential to further its losses after successfully breaking below the 1.3000 demand zone. In terms of EMA, the candle closed below 18EMA, aiming for the 50EMA as the next downward target. With sufficient pressure and breakout confirmation below the 1.3000 level, reaching the 50EMA wouldn’t be a problem.

From the fundamental point of view, initial bullish support towards the 1.3500 level was supported by UK election results, with PM Boris Johnson’s Conservative Party securing a majority, allowing Johnson to ratify the Brexit deal through the Parliament and deliver Brexit by January 31. The Withdrawal Agreement Bill (WAB) is expected to be presented today, while Johnson hopes to complete the bill as early as Christmas.

However, the bullish hype started to diminish from the start of the week, mostly due to profit-taking by investors. Moreover, the bearish pin bar formation proved market skepticism towards Brexit as delivering it and getting it done entirely are two different things. The UK after Brexit will then need to focus on reaching a trade agreement with the EU before the end of June 2020, allowing the European Union to have six months to approve the trade deal before December 2020. Risks of a no-deal scenario resurfaced after PM Johnson ruled out any forms of extension on the transition period, meaning that the country will still Brexit without any trade deal with the EU.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022