GOLD RISE BUT WITH UNCERTAINTIES

Market Strategist

The gold market has tumbled essentially because uncertainties are hurting the risk appetite from the investors, a strong dollar with unexpected stock market gains has drifted apart the sentiment towards the precious metal, on the other hand, the current situation with the headlines that hoard the week, the trade war deal between the two super-economic powers.

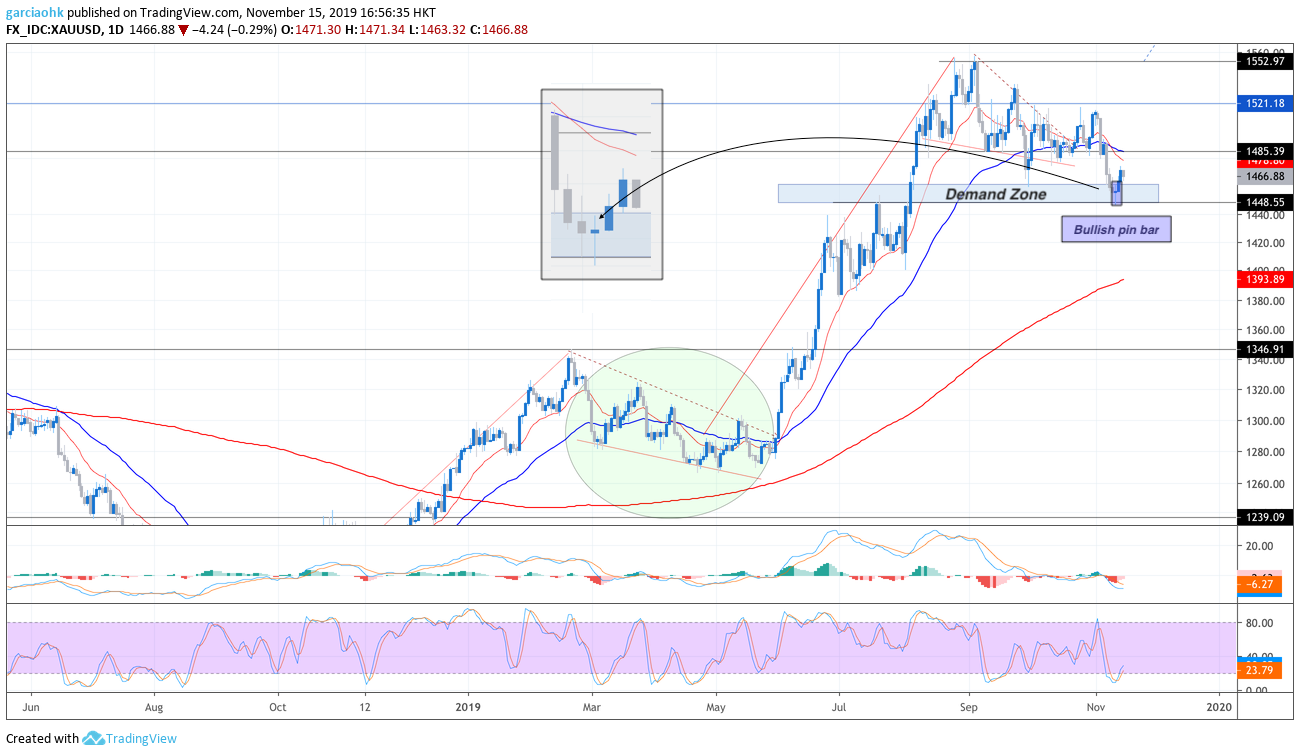

Technically speaking, the yellow metal reached the former demand zone forming a clear bullish pin bar candle as a signal of a possible end of price correction. Although, the expected uptrend continuation keeps tarnished by short-term bearish signals with an MA death-cross, clear bearish MACD, and a Stochastic moving away from oversold levels. Today’s session as when writing this report signaled a small reversal as a correction from yesterday’s gains.

This week price recovery was the consequence by the mixed-signal between a previously agreed term on the phase-one deal, the lack of clarity in the US-China trade negotiations on the tariff war’s toll on behalf of the health of the global economy change the risk-appetite from investors that immediately started to find shelter under the safe-haven.

Anything around trade-talks will bring confusion into the market, conceiving a cooling sentiment. However, we believe that the current gold weakness represents an exciting buying opportunity. However, please always keep in mind that the market can remain irrational longer than we can prevail solvent. A splendid weekend ahead for re-assessments and re-evaluation on your trades.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022