2020 BULLISH TREND FOR CRUDE OIL

Market Strategist

Crude oil market closed 2019 in a clear bullish note, OPEC+ output cut agreement, US-China trade war deal on phase-one, geopolitical and macroeconomic headlines, and wintertime worked out the perfect scenario for a bullish trend that represented a 47% price recovery from December 2018 to date.

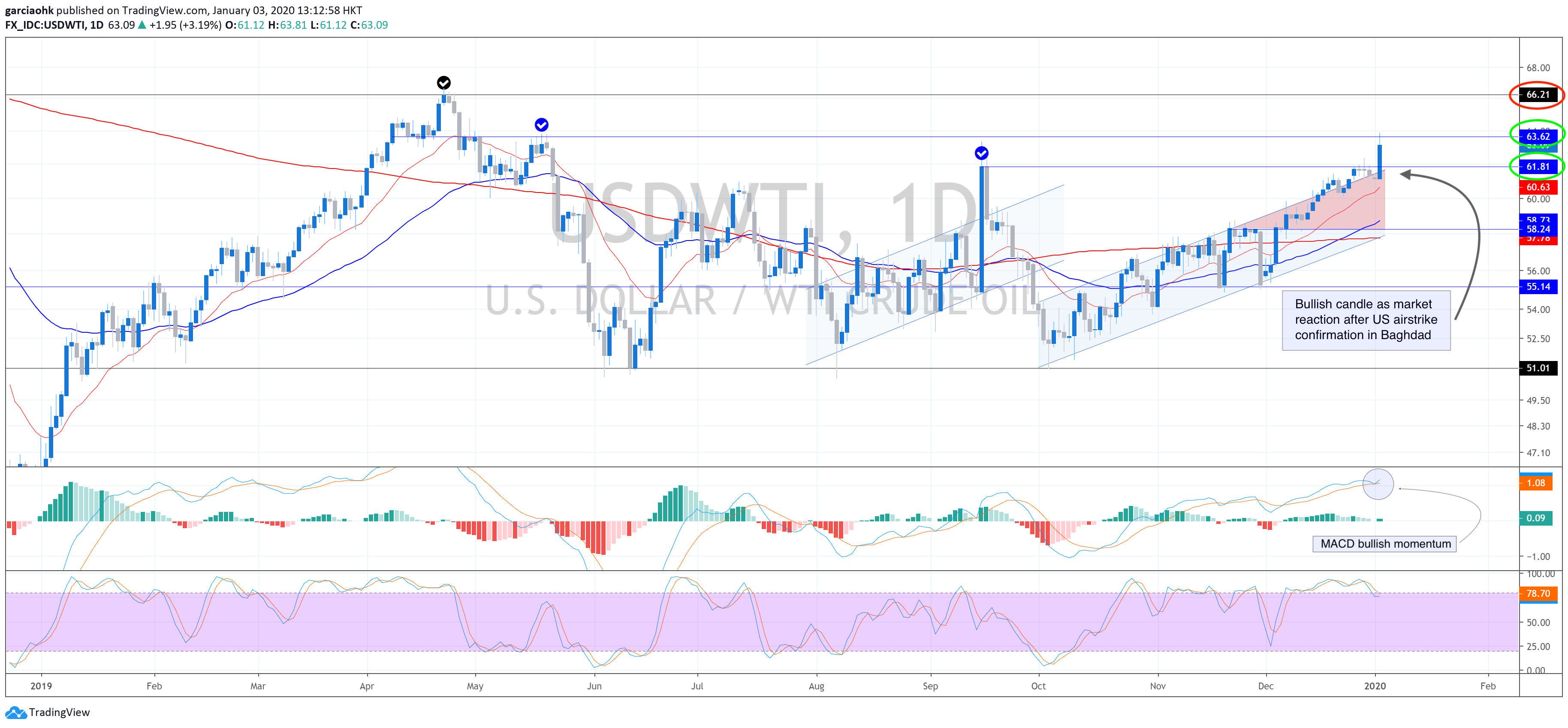

From the technical point of view, the presence of the bullish momentum remains intact, where daily exponential moving averages (EMA) are clear on the rise, with the 200 DMA subtly coming along as well. MACD still bullish and Stochastic retracing from the overbought zone as additional confirmation for a more available room for uptrend continuation on a broader look.

After four days in consolidation with real thin trading sessions and small daily losses, the market fundamentals remain in the bullish territory. Crude oil positive sentiment continues unstoppable where today breaking news about the airstrike in Baghdad has taken the market by surprise, the US-Iran tussle and the supply cut from the Organization of Petroleum Exporting Countries and Russia broadly known as OPEC+, along with the US-China phase one have kept the market bulls on the ascent.

The latest renewed economic optimism has pushed the market to critical levels such as 61.8 and 63.6 dollars per barrel were finally reached, confirmed targets in previous analysis. Now we are expecting that the market keeps working its ways straight to 66 handle. The market would look forward to today’s EIA’s weekly crude oil inventory report for additional momentum.

An excellent and unimaginable year 2020 to you all, be the market stay with us. We’ll be back on Friday with our weekly report. Happy weekend ahead.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022