Trade War Update: US-China Trade Deal In Place, However

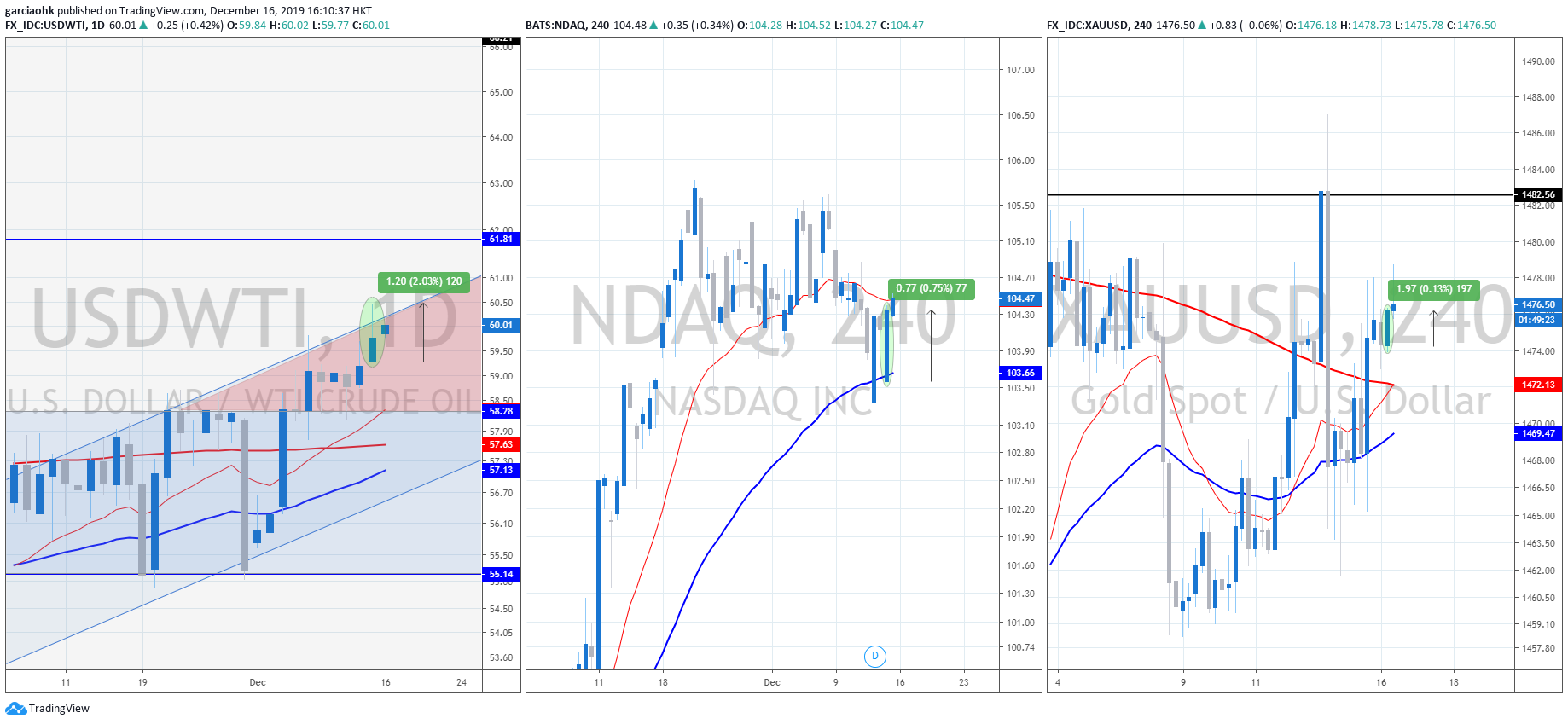

Market participants enjoyed their weekend while celebrating over the reaching of the Phase One trade deal between the US and China. Two significant parts of the agreement included; larger purchases of US goods and services by China and US December 15 tariffs to be eliminated. Stocks, commodities, and dollar market managed to close last Friday’s market with substantial gains following the trade deal announcement.

The long-awaited Phase One trade deal between the two economic powers is expected to be signed during the first week of January. The agreed-upon deal last week will boost US exports into China, with China agreeing to purchase billions of dollars of US agricultural products over the next two years. US Trade Representative, Robert Lighthizer stated that in two years, the US would be able to double their goods exports to China if the deal is signed.

Another crucial point in the trade deal is the halting of December 15 tariffs. US President Donald Trump vowed not to pursue additional duties, while also agreeing to lower taxes on $120 billion in other products to 7.5% from 15%. The tariff news boosted oil market sentiment while easing manufacturing sectors’ tensions and global demand for the commodity next year.

However, just like every other bullish news on trade war previously, market sentiment remains elusive after getting disappointed few times with unexpected escalation in tensions between the two economic powerhouses. Until further confirmation is in place, such as the signing of said ‘Phase One trade deal,’ market participants are still protecting their capital in the safe-haven markets, allowing precious gold to hold on its $1,475 handle.

Furthermore, Lighthizer stated that the outcome of the whole agreement would depend on those who are making the decisions in China, either the ‘hardliners’ or ‘reformers.’ One other issue remains, which is the previous intellectual property rights barrier, which was not included in the Phase One trade deal. Investors will wait for further firm confirmation before placing their bets against the safe-haven gold.

Based on past habits and patterns from both sides, it is suggested that optimism towards the trade deal will diminish until the agreement is signed next year, or at the very least, an update on further clarity of the signing such as the exact venue and time.

Photo Credit : medium.com

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020