Market Stalled After US Jobs Report, Interesting Week Ahead

Last Friday, the dollar index (DXY) made a significant rebound from its 97.00 handle, supported by upbeat Non-Farm Payrolls (NFP) data. According to the reports, US NFP for the month of November showed a job creation up to 226K, beating economists’ expectations of 186K by a long shot. Furthermore, the Unemployment rate in the US also remained record low at 3.5%.

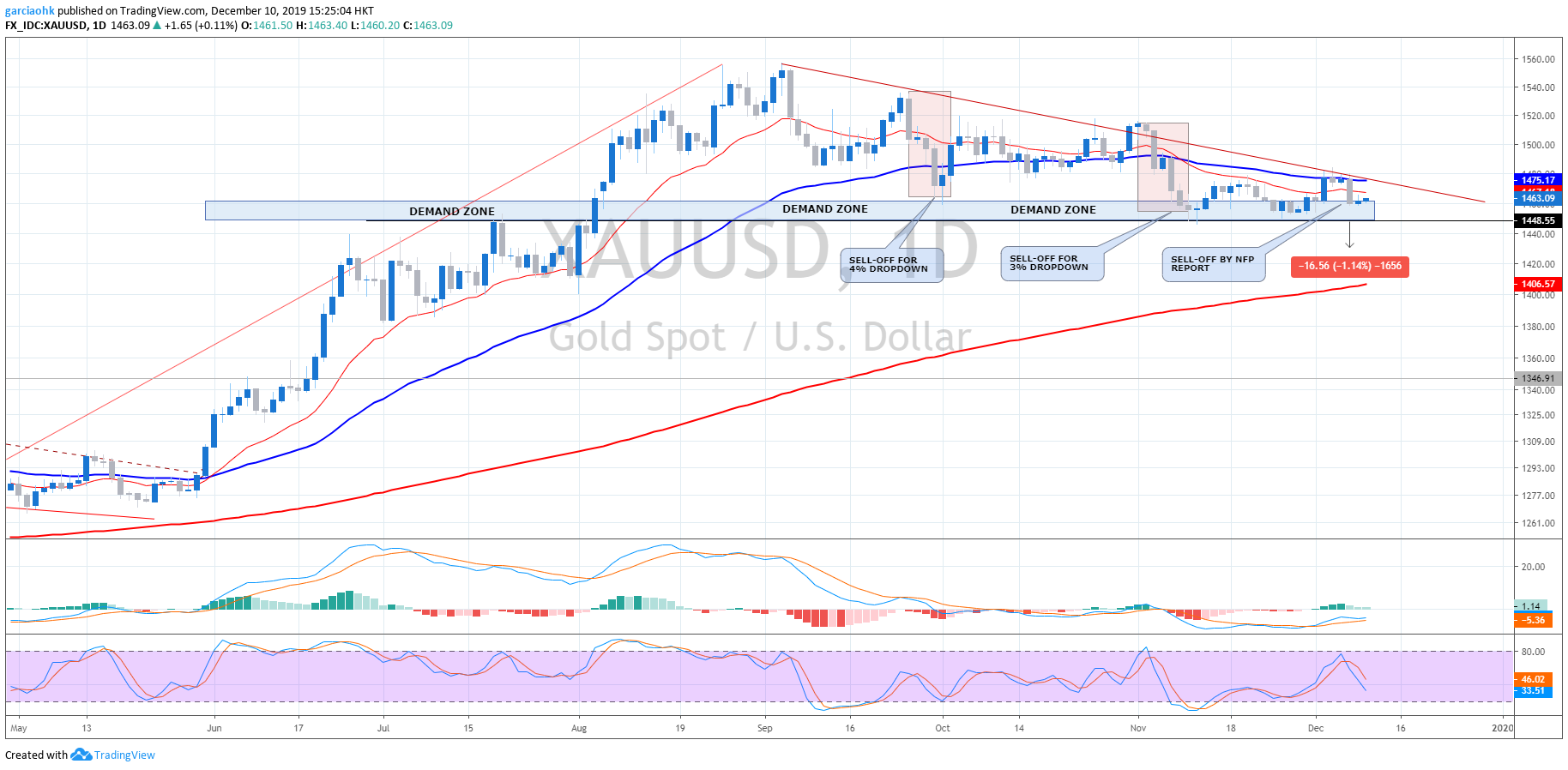

The positive outlook in the US job sector boosted investors’ confidence towards the greenback as they shifted their preference from safe-haven assets, mainly gold, into the US dollar market. The yellow metal suffered more than $15 while closing last week’s market near its demand zone at $1,460.

However, after the impact from last Friday’s job data, the FX market was traded thinly on Monday. Investors are waiting for further signals in the market from momentous events, such as UK general election on December 12; tariff implementation on December 15, as well as economic data such as US inflationary data and the final Federal Reserve (Fed) Policy Meeting for the year 2019.

Tomorrow Wednesday, the US will release its Consumer Price Index data, which acts as an inflationary measurement data. The data will be followed by the Fed’s interest rate decision and policy statement on early Thursday, where the central bank is expected to keep their cash rate unchanged. However, investors will be focusing on their speech to gain insight on the Fed’s future monetary policy stance.

Aside from the US, the UK will also be having its general election to see which party will be granted the majority to make history by delivering Brexit. Current majority polls are biased towards PM Boris Johnson’s Conservative Party winning the election. However, the possibility of the opposition Labour Party to make a comeback still kept market skepticism in place.

Furthermore, another major event in focus is the update on trade progress. Tensions still linger as the deadline for new rounds of US tariffs on Chinese goods is set to take effect on December 15. Market sentiment can change quickly depending on Trump’s final decision, whether or not to go along with additional tariffs or put that tariff on hold as both sides continue with their negotiations.

Overmuch events under the spotlight for a single calendar week would grasp the attention of investors, traders, and politicians in a susceptible, unusual market with a Christmas to come.

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020