RBNZ Counter-Intuitive Decision Shocks The Market

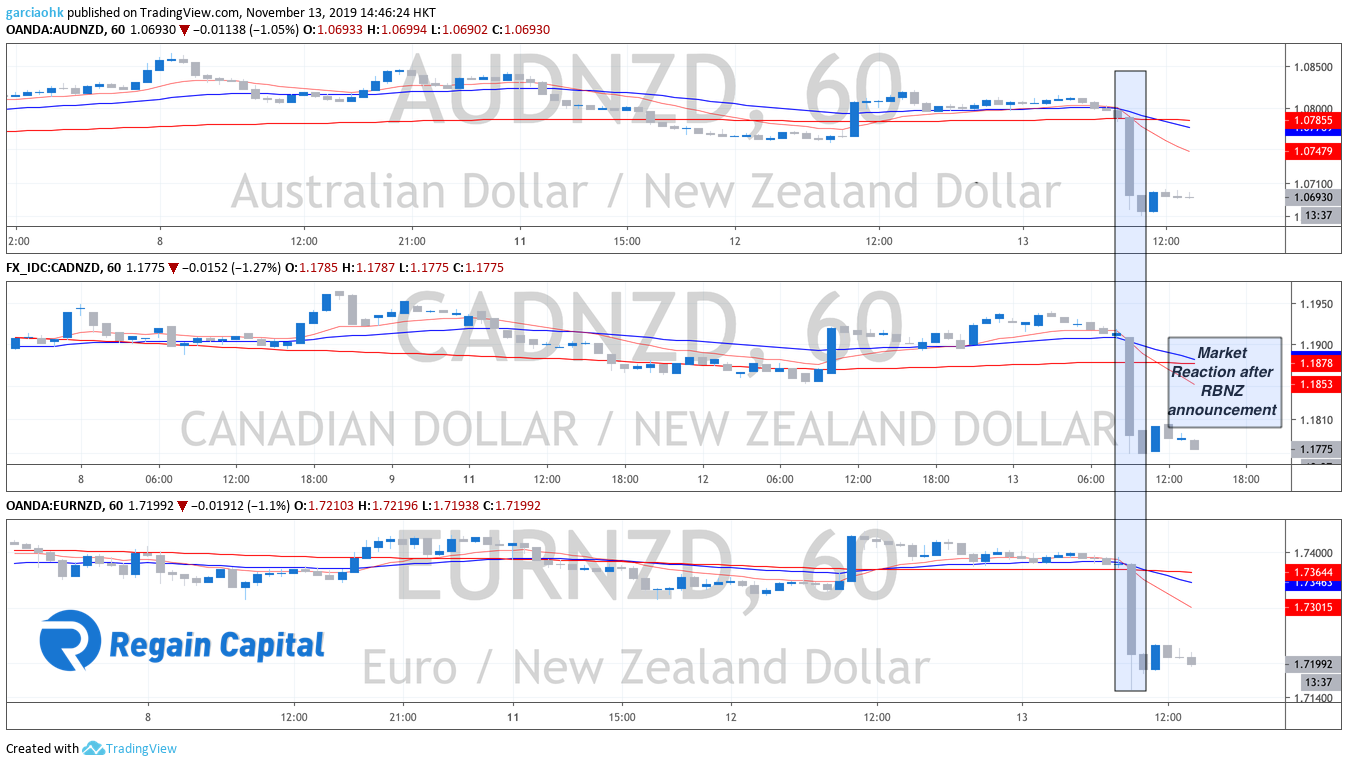

The Reserve Bank of New Zealand (RBNZ), which was previously widely expected to lower their interest rate decision by 25 basis-point, stunned the market with its decision to keep the rate unchanged at 1.00%. A counter-intuitive resolution that placed the Kiwi on fire, bringing a sluggish market into life.

In its rate statement, RBNZ stated that low-interest rates remain necessary for their employment and inflation status to meet its objectives. Job is close to its maximum sustainable level while inflation remains below the 2% target mid-point.

On the bearish side, global growth slowdown continues to pressure New Zealand’s trading activity, business confidence, and the financial sector. National GDP was also slowing down over the second half of 2019. RBNZ expects economic growth to recover during 2020, supported by its loose monetary policy. Lower lending rates over the past year are providing support for domestic consumption as well as encouraging broader investment.

Press Conference led by Governor Adrian Orr emphasized that economic risks are still tilted towards the downside, and low-interest-rate remains sensible. Orr also stated that further monetary stimulus would be added if circumstances worsen for the country.

Interest decision by central banks is crucial towards a country’s currency, whereby higher interest rate attracts investors; whereas lower interest rate reduces the appeal of that country’s currency. Today’s decision by RBNZ to maintain its interest rate unchanged provided bullish support as the market was expecting the interest rate to be lowered down.

Photo Credit: www.poundsterlinglive.com

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020