Yellow Metal Losing Its Shininess

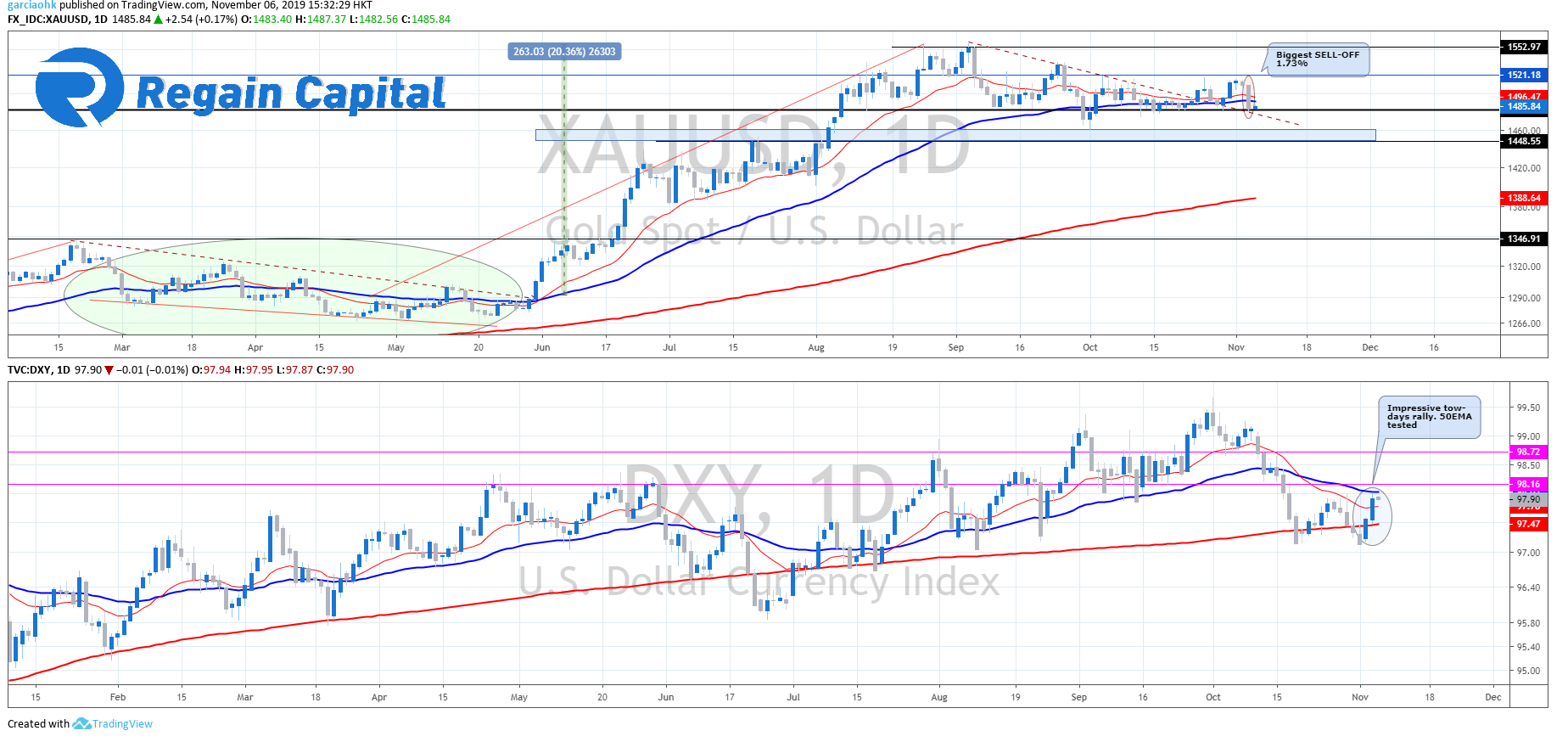

Safe-haven gold having a bad start of the week, recording two consecutive day losses with Tuesday losses as much as 1.73%, almost $30 a troy ounce, the most significant drop in six weeks. Market sentiment had a major turn, with investors’ previous risk aversion quickly shifted into a risk-on attitude as they sold-off the safe-haven assets and dive into the dollar market.

Previously, China voiced out their doubts about reaching a long-term trade deal with US counterparts. However, recent trade optimism shrugged off those concerns with both sides proving their determination to sign the phase one trade deal.

US President Donald Trump on Monday stated that he is considering to lift part of September tariffs on Chinese goods to smooth future trade negotiations. On the other side, China officials on Tuesday stated that Premier Xi Jinping said that he was willing to travel to the US to sign the trade deal. Efforts from both sides had since improved market sentiment on a possible truce to end the 16-month trade war.

In other news, yesterday’s release of upbeat US ‘ISM Non-Manufacturing PMI’ data signaled further expansion in the economic activity. The data led to a sharp rebound for the dollar index (DXY), also encouraging investors’ risk appetite and the demand for the greenback.

Photo Credit: www.express.co.uk

Follow Regain capital

latest articles

-

- Mar 11,2022

-

-

-

- Sep 09,2021

-

-

- Oct 22,2020