Pound Extended Gains On BOE Rate Hike Optimism

The pound extended its rebound against the dollar for a third day in a row, after plunging to a 11-month low amid a strengthening dollar last week. The GBP/USD inched higher by 0.04% on Thursday, while set to record its first weekly gains in the past four weeks.

Recent preference towards the pound were encouraged by strong inflation data, where the UK CPI rose to a decade high near 4.2%, exceeding economists’ expectation of 3.9%. The strong inflation data had raised bets on a potential rate hike by the Bank of England (BOE) during its December policy meeting.

The pair fell from its 1.37 levels since the start of the month, after the BOE failed to meet the market expectations for a 25 basis point rate hike during its November meeting. The BOE had signaled its readiness in October to raise its base lending rate to prevent goods price from soaring too high.

As inflation continues to rise amid the global economic recovery from the pandemic, the BOE might be forced to take action sooner to prevent inflation from overheating and crippling the overall recovery pace in UK.

While the optimism for the Fed to raise its interest rate gave dollar a boost recently, the Fed is still one step behind compared to the BOE, where Chairman Jerome Powell had stated that a rate hike can only be expected as early as June next year.

Investors today will focus on the UK Retail Sales to further gauge the spending activity across the region, where an upbeat reading could allow the pound to extend its rebound further.

——————————————————————————————————————

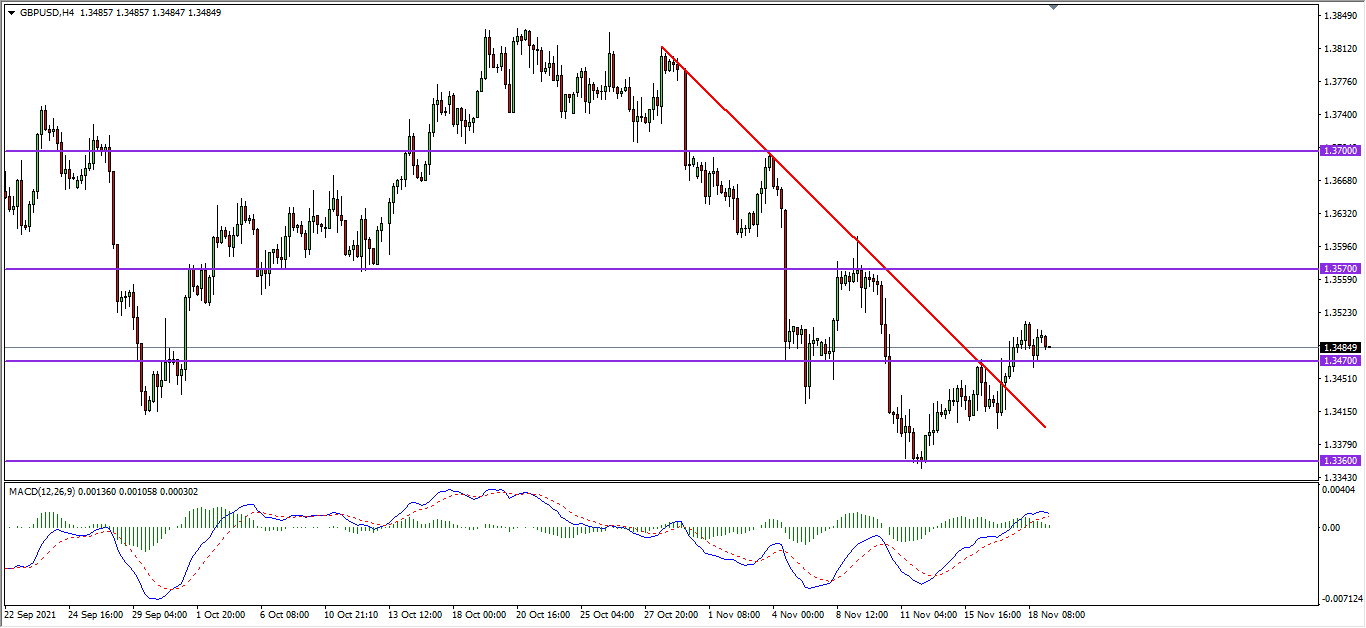

From the technical front, GBPUSD in its H4 timeframe succeeded in breaking above its previous downward trendline. MACD, showing bullish momentum, suggests the pair to extend higher towards the previous resistance level near 1.3570, whereby a further breakout above could send the pair back to its 1.3700 levels. However, should the pair breaks back below its support near 1.3470, the pair could continue its longer-term downtrend back to the 1.3360 support.

Follow Regain capital

latest articles

-

- Mar 11,2022

-

- Jan 25,2022

-

- Jan 24,2022

-

- Dec 30,2021

-

- Dec 28,2021

-

- Dec 28,2021