Dollar Falls Despite Upbeat Jobs Report

The dollar index closed 0.12% lower last Friday despite the release of better than expected jobs report. However, the dollar is still up by nearly 0.1% over the week.

Last week’s move higher on the dollar was supported by a series of central bank meetings and the US jobs report. On Wednesday, the Fed announced a reduction of $15M each month off its overall asset purchase of $120M, in line with the market’s expectations. However, dollar failed to secure its gains after the Fed reassured the market that it is not in a rush to raise its interest rate anytime soon.

Despite a slight dovish stance from the Fed, market preference were still biased towards the dollar after the Bank of England and the Reserve Bank of Australia struck an even dovish stance during their policy meeting. The RBA reiterated on its loose monetary policy stance, commenting on its uncertainty towards the nation’s inflationary level while stating that the overall economic progress still requires support. On the other hand, the BOE missed expectations to raise its interest rate, judging that it will closely monitor on the overall inflation level before rushing to raise its rates.

Last Friday’s upbeat jobs report also failed to secure a position higher for the dollar. The US unemployment rate fell by 0.2% to 4.6%, whereas the Non-farm Payroll reported a total of 531K number of jobs created in October. The dollar gained initially after the release of the reports, before paring all its gains to close the market lower as investors assess an increased risk appetite towards the equity and stocks market.

Investors will shift their focus over to this week’s US inflation data to further access the Fed’s future policy stance, where a higher inflation could lead the Fed to raise its rates sooner than expected.

———————————————————————————————————————

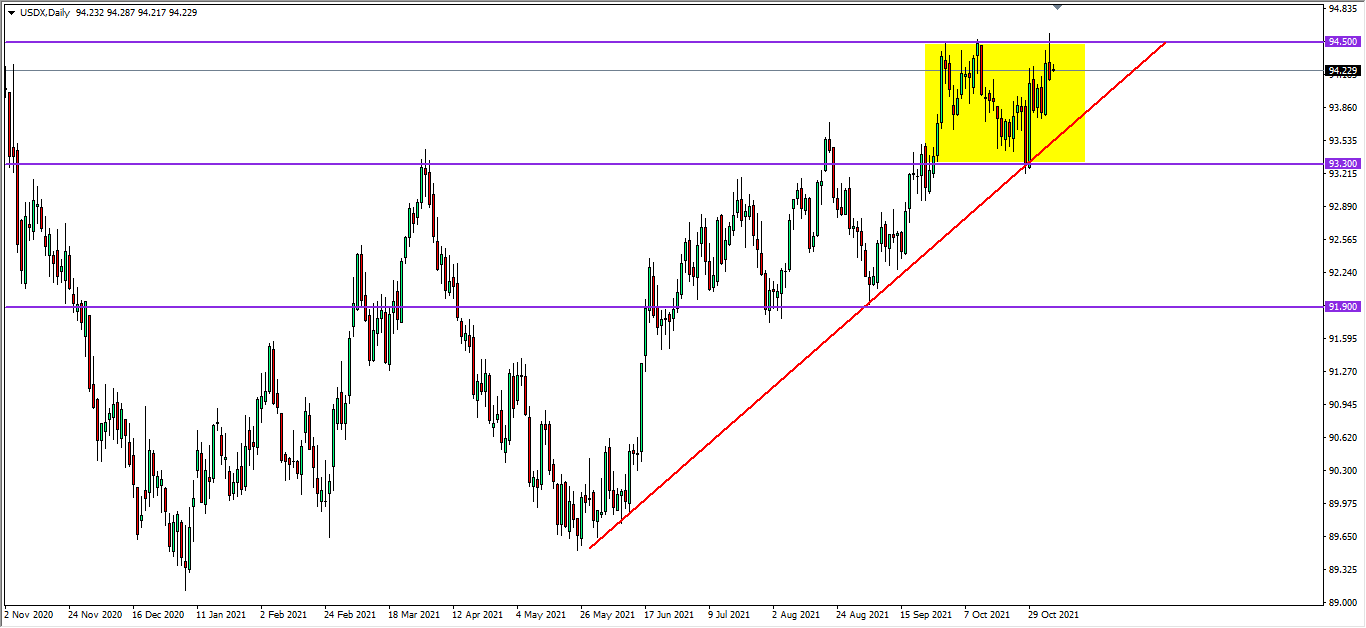

From the technical front, the dollar index in its D1 timeframe continues to be traded within a tight range between the 94.50 resistance and 93.30 support level, while also holding onto its upward trendline. A breakout above the resistance level would suggests further upward momentum for the dollar in the medium-term; whereas a breakout below the upward trendline could signal a possible bearish reversal.

Follow Regain capital

latest articles

-

- Mar 11,2022

-

- Jan 25,2022

-

- Jan 24,2022

-

- Dec 30,2021

-

- Dec 28,2021

-

- Dec 28,2021