Technical Analysis: THE WOUNDED BEAST

Market Strategist

THE WOUNDED BEAST

Oil markets yesterday have experienced what is

considered a technical correction, creating much expectation about a further

recovery. However, it would be hard to claim that it is objectively true.

Still, the market needs to deal with the Covid-19 and the disintegration of the

OPEC+ alliance.

The market remains under sellers pressure,

where investor and traders are still weighting the immediate impact in the

global economy with the spread in different latitudes of the virus, newly

affected countries are considering stronger lockdowns, that definitely will

create mayhem in the oil demand.

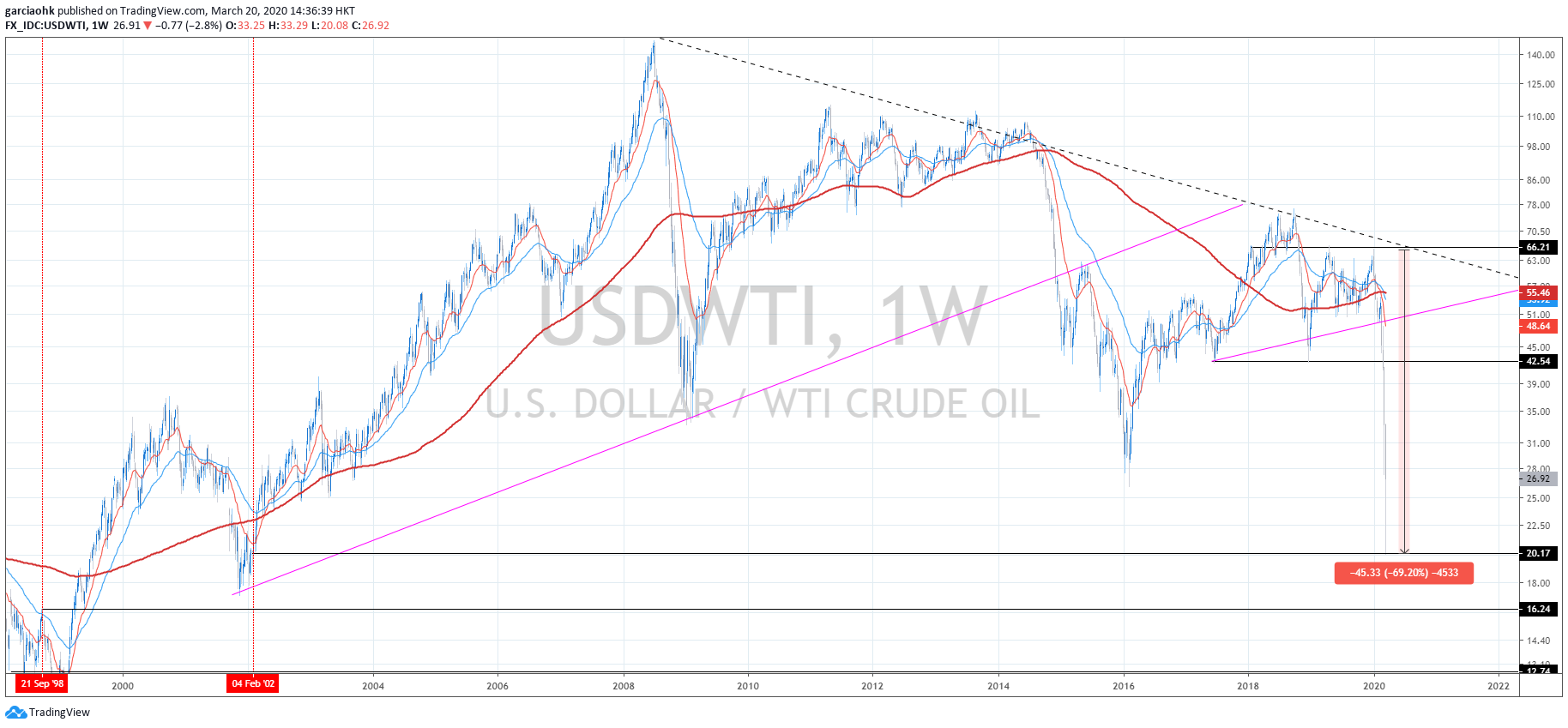

Today’s weekly report will have two charts to

explain and easily spot the bearish pressure in the weekly reign and the

technical correction in the H4 domain. In W1 (weekly charts) Oil has recorded a

69.20% plunge from its January high reaching levels last seen in Feb 2002, next

support level from 1998 at 16.24 could be achieved even with economic stimulus

announcements and the end of the price war between the Saudis and Russians. It

would take time for the oil market to cope with the intense never seen

disruption in the demand before finally correcting.

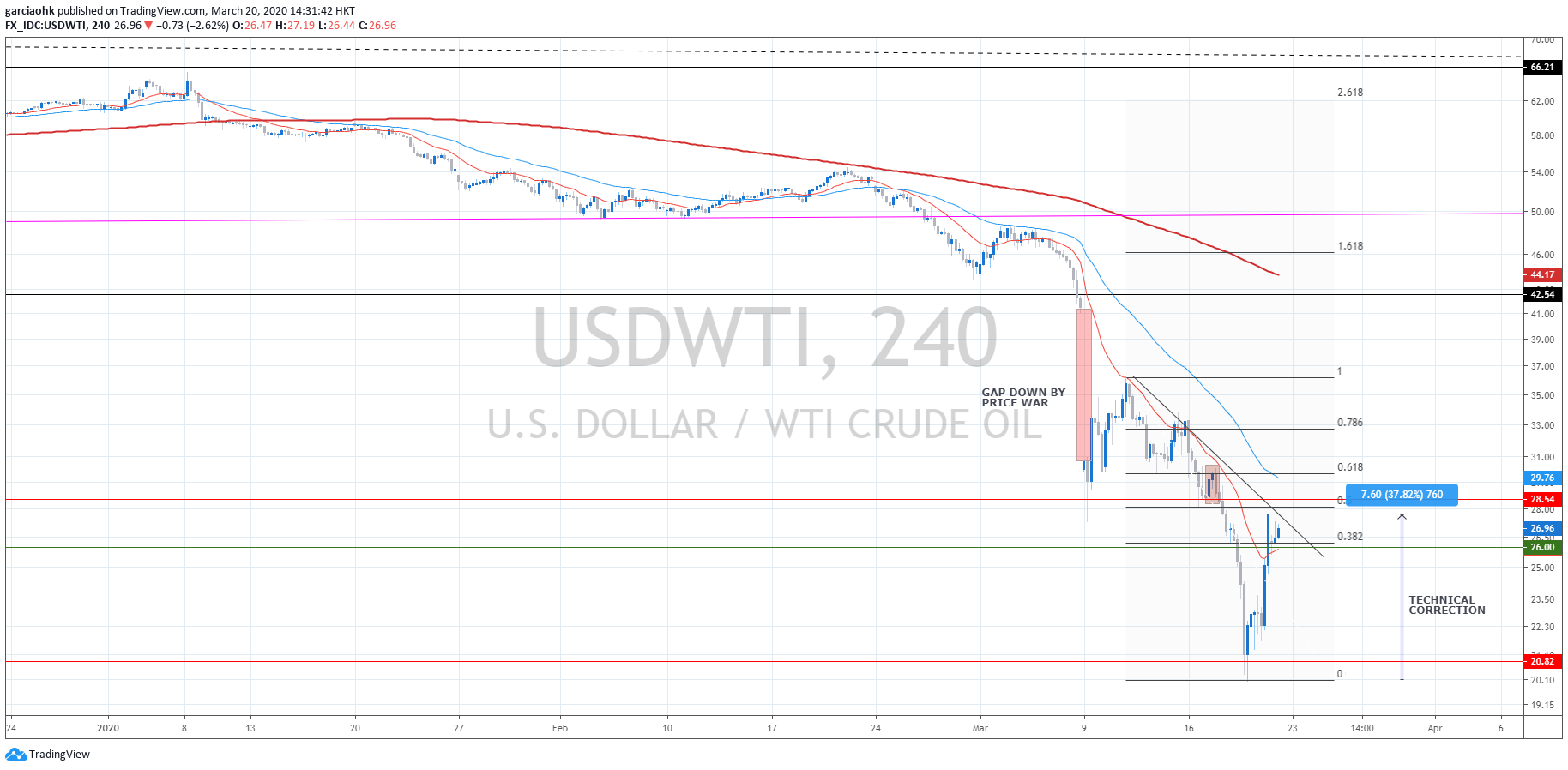

Now in the H4 domain (4 hours charts), the

price experienced a recovery of 38% from its lowest level, never seen before,

giving some enthusiasm to the market. Some experts said it was due to Trump’s

proposal on increasing the national oil reserves supporting the American drillers

hammered by the plunge in oil prices. However, personal opinion, this was a

more technical correction after reaching a critical demand zone of $20 per

barrel; bulls were sitting there expecting to fill up their orders, and

clearly, it just happens, pushing the price action back to the daily moving

averages. Finding resistance close to 50 Fibonacci level price action is still

under a clear bearish bias, where the last line of defense for the bears could

be the next Fibonacci level at around 61.8. Now, 50 EMA and 200 MA continue in

bright free fall. MACD (not displayed in the chart sorry) showed some bullish

divergence that confirmed this encountered correction. The market will continue to check on the

Bulls’ endurance for this short-term correction.

As a last note, this downturn in prices for

the oil producer dependent countries could vanish governments revenues by up to

85%, for instance, Venezuela, Ecuador, Iraq, Nigeria, Angola are at particular

risk, opening the door for the international financial institution to step in

and take extraordinary measures. Iraq’s oil minister had pledged the call for

an emergency meeting with the OPEC this week when price tested the $26 handle,

with no confirmation on that front yet, let’s get into the weekend and see what

next week will bring to the market.

Follow Regain capital

latest articles

-

- Jan 24,2022

-

- Jan 17,2022

-

- Jan 14,2022

-

- Jan 13,2022

-

- Jan 12,2022

-

- Jan 11,2022