The top 6 traders of the world and their lessons

?Market Fun and Fact: The top 6 traders of the world and their lessons.

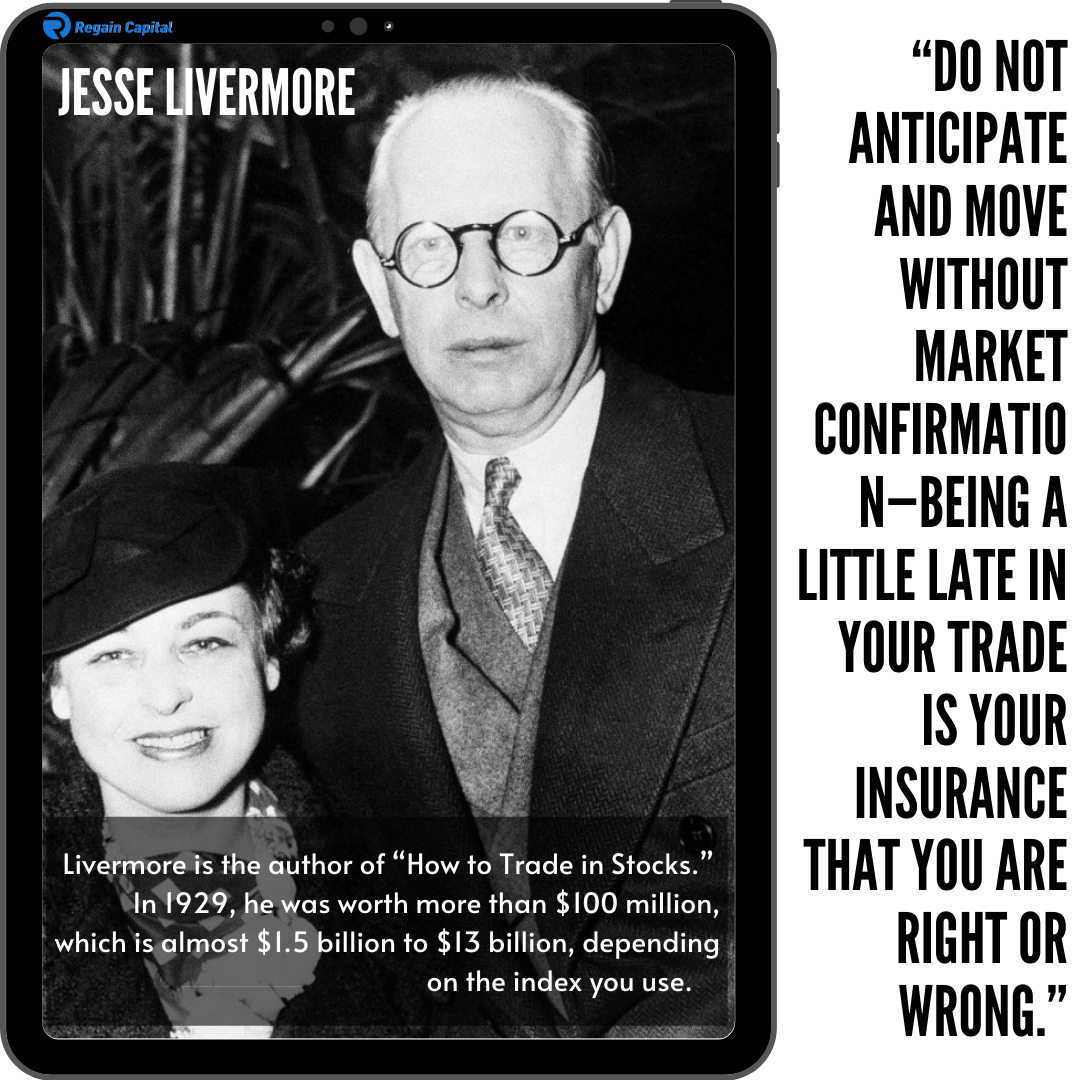

1. Jesse Livermore

“Do not anticipate and move without market confirmation—being a little

late in your trade is your insurance that you are right or wrong.”

Livermore is the author of “How to Trade in Stocks.” In 1929, he was

worth more than $100 million, which is almost $1.5 billion to $13

billion, depending on the index you use. He is still famous in the

trading chat rooms for making some of the best stock market trading

decisions in the history of US Stock Market. His fortune swelled to a

whopping $100 million after he sold the stocks right before the market

crashed in 1929. His mantra was to play the market only when the

factors were favorable. He was a low-frequency player, who studied and

truly understood the pulse of the market and other traders.

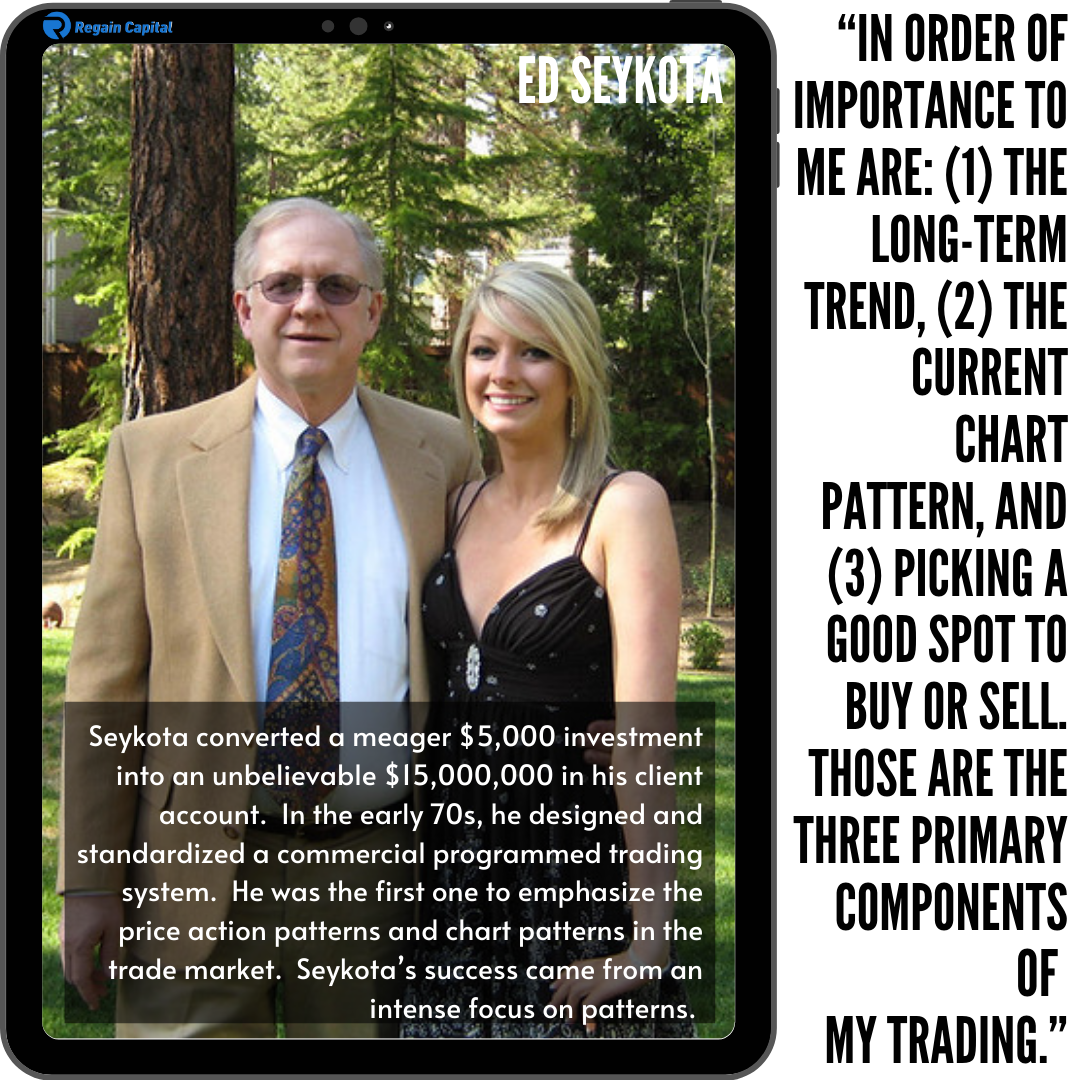

2. Ed Seykota

“In order of importance to me are: (1) the long-term trend, (2) the

current chart pattern, and (3) picking a good spot to buy or sell. Those

are the three primary components of my trading.”

Seykota

converted a meager $5,000 investment into an unbelievable $15,000,000 in

his client account. In the early 70s, he designed and standardized a

commercial programmed trading system. He was the first one to emphasize

the price action patterns and chart patterns in the trade market.

Seykota’s success came from an intense focus on patterns.

3. Richard Dennis

“Trading has taught me not to take the conventional wisdom for granted.

What money I made in trading is testimony to the fact that the majority

is wrong a lot of the time. The vast majority is wrong even more of the

time. I’ve learned that markets, which are often just mad crowds, are

often irrational; when emotionally overwrought, they’re almost always

wrong.”

Dennis was the “Prince of the Pit,” who made $200 million

from $1600 in a decade. He founded the Turtle Traders, a 21 member

group that went on to redefine the idea of traders. Richard Dennis and

William Eckhart appointed 21 average people and taught them the tricks

of the trade. They proved to everyone that success is not something you

are born with; anyone can succeed with the right training and mentors.

4. Paul Tudor Jones

“Don’t be a hero. Don’t have an ego. Always question yourself and

your ability. Don’t ever feel that you are very good. The second you

do, you are dead.”

In 1986, Jones predicted the cataclysmic crash

of the US stock market. As a result, he made as much as $100 million

from the 1987 Black Monday crash. It is one of the largest US stock

market decline in a single day. While hundreds of people suffered from

the crash of their fortunes, Tudor Jones walked away with millions in

his pockets. He offers a very realistic piece of advice to all

traders—to walk away from an account that is bleeding money. Sometimes,

you’ve just got to cut your losses.

5. George Soros

“Markets are constantly in a state of uncertainty and flux and money is

made by discounting the obvious and betting on the unexpected.”

Soros is the Oracle of the stock market. He invested $10 billion on

single currency trade in 1992. His profit on the transaction reached an

incredible $2 billion. He is still the “man, who broke the Bank of

England.” George Soros is a great example of market iconoclasts, who

are not afraid to play against the odds, even when the whole world says

otherwise. You’ve just gotta go with your gut.

6. Jim Rogers

“Acknowledge the complexity of the world and resist the impression that

you easily understand it. People are too quick to accept conventional

wisdom, because it sounds basically true and it tends to be reinforced

by both their peers and opinion leaders, many of whom have never looked

at whether the facts support the received wisdom.”

Jim Rogers

co-founded Quantum Fund with George Soros. He has made his

billion-dollar empire patience and calm decision making. His trading

principles are old school. He does not believe it is crucial for

traders to pay attention to the bulk they are trading. It is alright to

trade less than your competitors and wait for the one opportunity of a

lifetime.

Follow Regain capital

latest articles

-

-

- Sep 30,2020

-

- Sep 30,2020

-

-

- Sep 08,2020

-

- Aug 26,2020